Sanofi Advance ruling on ITC of free gifts

Table of Contents

Introduction:

Sanofi Advance ruling on ITC of free gifts given by Maharastra AAR is an important one. Here we will discuss Sanofi Advance ruling on ITC at length. This discussion is quite important for :

- Pharma sector companies

- FMCG companies

- Other companies using a lot of promotional schemes and items.

Promotional items provided free of cost to the customers. ITC on purchase of those products is restricted by CGST Act

Items are given free of cost to customers:

Various promotion schemes discussed in Sanofi Advance ruling on ITC

- Get a tour or freebie on sales of a prefixed quantity or number.

- Reward points scheme, these reward points can be converted into some items.

- Free small items bearing the name of the company.

There may be many permutations for this kind of schemes. They are an indispensable part of sales and promotion for any company. Every business want to use it but they don’t want to lose ITC on it’s purchase.

Why ITC of free items is not allowed in GST ?

An input tax credit of promotional items is barred by CGST Act. Section 17(5)(h) of CGST Act says.

This part of law disallows the ITC of items provided free of cost. The input tax credit of items given free will be reversed by the giver.

Guidance via an advance ruling of Sanofi India limited:

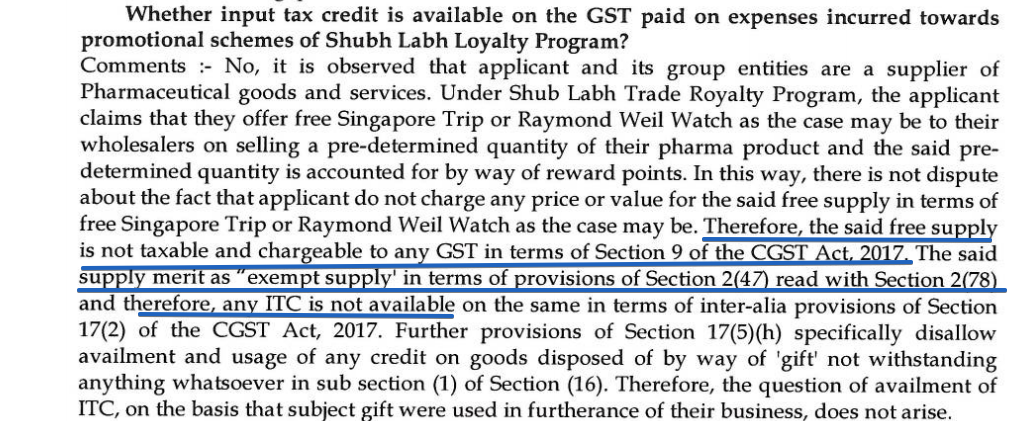

The advance ruling of Sanofi India limited clarified many issues related to ITC of items given free. This case was discussed around two questions. First was for the ITC on the items given free under Shubh Labh scheme. The facts of this issue are below.

Sanofi Advance ruling on ITC

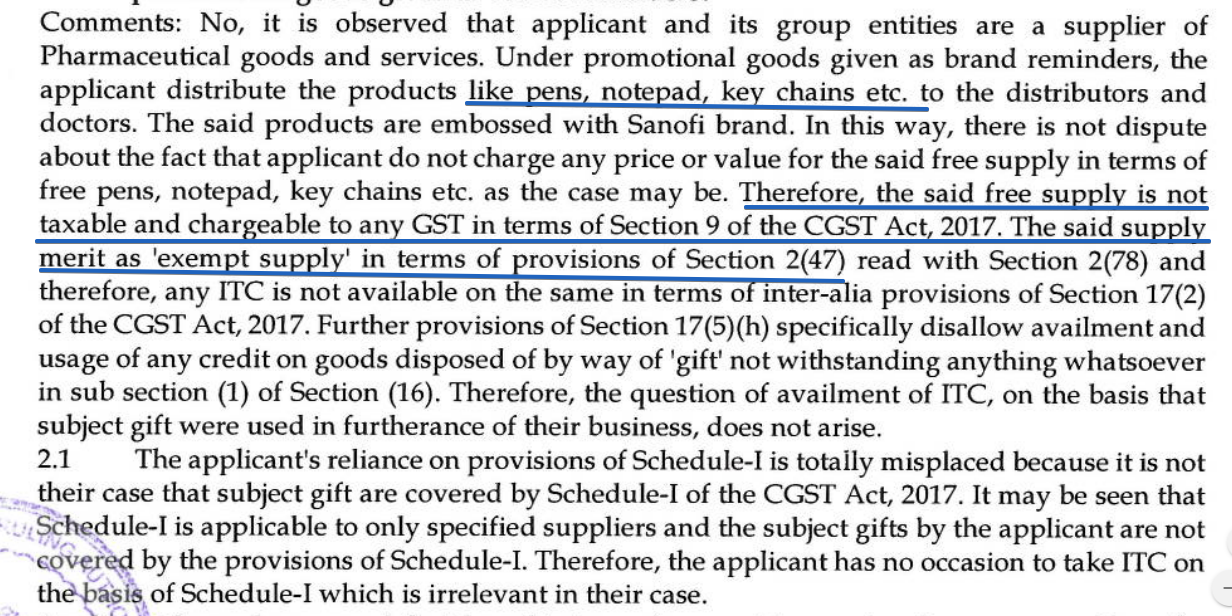

ITC of goods given free of cost as a brand reminder:

The second question was about the eligibility of ITC on goods given as brand reminder. What is a brand reminder? An item having the name of the company.

Even in this case, ITC was rejected due to the same reason. This particular transaction doesn’t have any commercial bearing. There is no consideration for this particular transaction. Interestingly it is assumed as an exempt supply. Authority said that no tax paid on this supply. Thus it is not a normal taxable supply. It is an exempt supply.

Hope you will enjoy reading it. PDF of this ruling is attached at the link above.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.