SC judgment on Taxability of export sale commission as intermediary

Summary of case

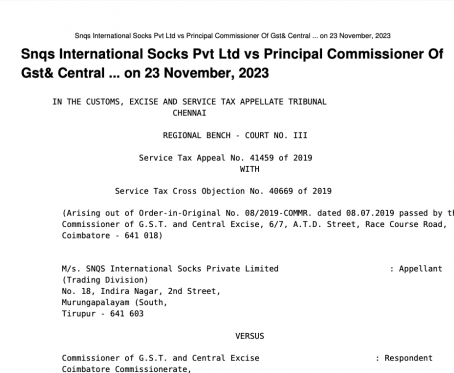

M/s. SNQS International Socks Private Limited (“the Respondent”) had received an export sales commission for procuring export orders from foreign buyers for the manufacturers who supplied garments.

Thereafter, a show cause notice (“SCN”) was issued alleging that these services were classifiable under ‘intermediary’ service as per Rule 2(f) of the Place of Provision of Services Rules, 2012, as amended with effect from October 1, 2014. Subsequently, an Order was passed raising the demand.

Let us read in detail-

Hon’ble Supreme Court, wherein the Hon’ble Court held that the Respondent does not fall within the scope and ambit of any of the definitions of ‘Business Auxiliary Service’, ‘Business Support Service’ as well as ‘Intermediary’. Hence, the appeal was dismissed.

Brief of the case-

M/s. SNQS International Socks Pvt. Ltd. submitted that they were engaged in procuring orders for supply of garments for exports. They directed the seller/manufacturer in India to send the garments to the overseas buyers and commission was received in foreign currency through banks. They stopped procuring orders from April 2016 onwards. During the period from October 2014 to March 2016, the appellant has provided the following: –

– Design and development of product

– Evaluation and development of vendors

– Quality assurance including testing of live production sample

– Logistical and operational support to vendors

observation of SC

- The adjudicating authority concluded that the services provided by M/s. SNQS International Socks Pvt. Ltd. were not on a principal-to-principal basis.

- However, this conclusion is deemed erroneous as the services were rendered directly to the foreign client and under the direction of the foreign client.

- The range of services provided by the appellant included procurement of goods, vendor selection, quality monitoring, sample design, live testing, and various other quality checks on garments until their final dispatch to the foreign client.

- These services extend beyond mere buying or selling of goods and are comprehensive in nature.

- The remuneration for these services was based on the FOB value of the exported garments, which does not categorize the appellant as an intermediary.

- All services were provided to the foreign client on a principal-to-principal basis.

- Vendor selection and garment production by these vendors were incidental services for goods procurement and were carried out under the direction of the foreign client.

- The appellant is the service provider, and the overseas buyer is the service recipient, with no agreement in place between the appellant and the vendors/exporters of garments.

- Additionally, the appellant did not receive any consideration for the services related to the export of goods from the vendors in India.

Read the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.