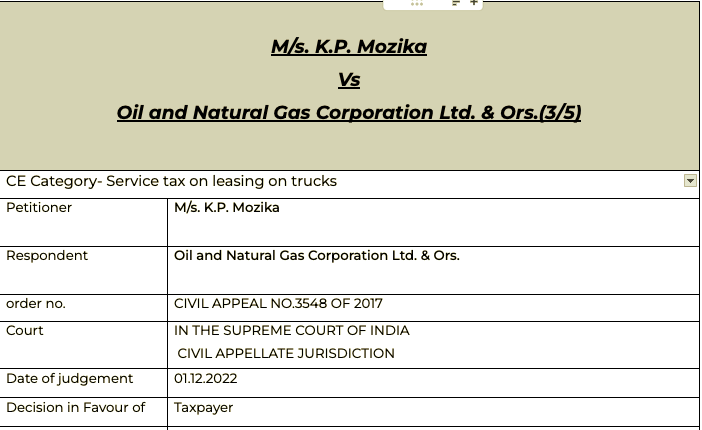

SC puts a end to old controversy of VAT on trucks leased to ONGC

The judgment of high court are reversed. In this case the honourable SC outs and end to the age old controversy. Cases like Gannon Drunkly came to picture again.

Around 50 petitions were bunched together. They had same issue.

Table of Contents

Citations-

Sales Tax Officer, Pilibhit v.Budh Prakash Jai Prakash

The State of Madras v. Gannon Dunkerley & Co

M/s. K.L. Johar & Co. v. The Deputy Commercial Tax Officer, Coimbatore III

- V. Meiyappan v. Commissioner of Commercial Taxes, Board of Revenue, Madras & Anr.4.

Bharat Sanchar Nigam Limited & Anr. v. Union of India & Ors

The State of A.P. & Anr. v. Rashtriya Ispat Nigam Limited.

Great Eastern Shipping Company Limited v. State of Karnataka & Ors.

Commissioner of Service Tax, Delhi v. QuickHeal Technologies Limited

Rashtriya Ispat Nigam Limited

Ahuja Goods Agency & Anr. v. State of Uttar Pradesh & Ors

Imagic Creative (P) Ltd. v.Commissioner of Commercial Taxes & Ors.

Gannon Dunkerley & Co

20th Century Finance Corporation Ltd. & Anr. v. State of Maharashtra

Aggarwal Brothers v. State of Haryana & Anr

Commissioner of Service Tax, Ahmedabad v. Adani Gas Limited

Pleading

In Civil Appeal no.3548 of 2017 and other connected matters, i.e. Civil Appeal no.7954 of 2012, Civil Appeal no.8715 of 2012, Civil Appeal no.9291 of 2012, Civil Appeal no.3549 of 2017, Civil Appeal no.3550 of 2017, Civil Appeal no.3551 of 2017, Civil Appeal no.3552 of 2017, Civil Appeal no.3553 of 2017, Civil Appeal no.3555 of 2017, Civil Appeal no.3558 of 2017, Civil Appeal no.3559 of 2017, Civil Appeal no.3564 of 2017, Civil Appeal no.3565 of 2017, Civil Appeal nos.35663569 of 2017, Civil Appeal no.3570 of 2017 and Civil Appeal no.3571 of 2017, the learned counsel appearing for the appellants pointed out that the taxes on sale of goods and advertisements were covered by Entry 48 in ListII of the Seventh Schedule to the Government of India Act, 1935. Under the Seventh Schedule to the Constitution of India, Entry 92A of ListI confers power on the Government of India to impose taxes on the sale of goods.

Facts

The agreement is of 13th April 2006, by which the appellant agreed to provide services of truck mounted hydraulic cranes with crew, etc., to ONGC for carrying out its various operations. The appellant had to approach the High Court on the threat given by ONGC to deduct tax at source under the VAT Act in respect of the services provided by the appellant. Similar petitions were filed before the learned Single Judge of the Gauhati High Court

The learned Additional Solicitor General appearing on behalf of the Union of India contended that the transactions subject matter of this group of appeals are essentially in the nature of rendering service, thereby attracting service tax. He submitted that the VAT Act and the Sales Tax Act will have no application, and the transactions will attract service tax. Therefore, the submission is that no interference is called for.

Observation

- To conclude, all the appeals preferred by the assessees will have to be allowed.

- Accordingly, we allow all the appeals of the assessees by holding that the contracts are not covered by the relevant provisions of the Sales Tax Act and of the VAT Act, as the contracts do not provide for the transfer of the right to use the goods made available to the person who is allowed to use the same. Civil Appeal no.3580 of 2017 preferred by the Union of India is disposed of in view of the earlier findings with the liberty to the Union of India to initiate proceedings, if any, for recovery of service tax in accordance with law.

Read/download the copy of M/s. K.P. Mozika Vs Oil and Natural Gas Corporation Ltd. & Ors

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.