SCN Quashed in Case of Nikas Services Pvt Ltd as Vague

In this judgement a SCN was sent to the taxpayer. Instead of going to the appeal the appellant went to the court. A writ under article 226 of Constitution of India was filed. The contention of taxpayer was that the SCN in vague. No details are given in the SCN. Here the principle of natural justice were quoted. Many past judgements of Apex court were also quoted.

The appellant also said that the SCN under section 74 is filed without issuance of ASMT 10. Thus it is not valid. On the other hand the contention of respondent was that writ jurisdiction is not to be ordinarily invoked in matters concerning imposition of tax. He has

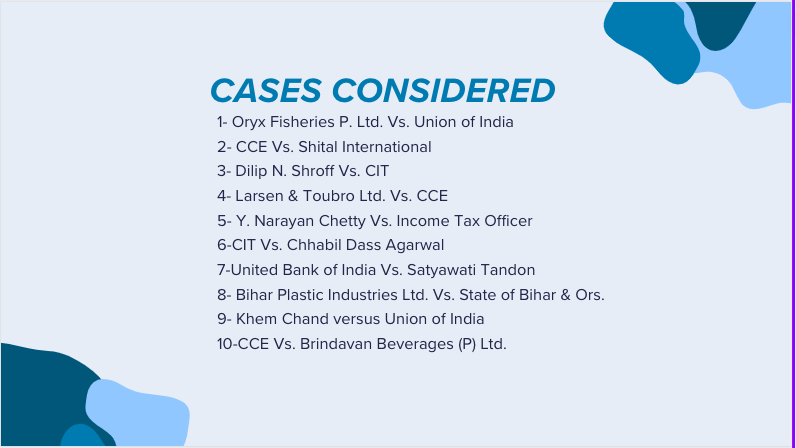

placed reliance on the case of CIT Vs. Chhabil Dass Agarwal reported in (2014) 1 SCC 603 para 11 and 16 as also in the case of United Bank of India Vs. Satyawati Tandon reported in (2010) 8 SCC 110 para-43 to 45.

It is submitted that the petitioner has an efficacious alternative remedy of appeal after the proceedings are concluded and the order in original is passed. The list of all cases cited is below:

The court had look at the judgement and said that it was made on a fix format without even properly editing.The court said “As observed herein above, the impugned notice completely lacks in fulfilling the ingredients of a proper show-cause notice under Section 74 of the Act. Proceedings under Section 74 of the Act have to be preceded by a proper show-cause notice.

A summary of show-cause notice as issued in Form GST DRC-01 in terms of Rule 142(1) of the JGST Rules, 2017 (Annexure-2

impugned herein) cannot substitute the requirement of a proper show-cause notice.”

Although they didnt commented on the part of appeal that SCN cant be issues without ASMT 10. Because the court quashed the notice.

JUDGEMENT- The notice was Quashed.

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.