SEBI Report on Related Party Transaction Open For Public Comments

Table of Contents

Background

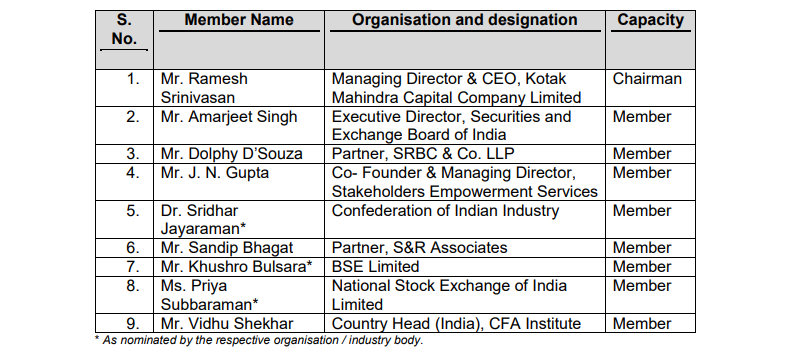

SEBI constituted a Working Group in November 2019 to review the policy space pertaining to related party transactions under the Chairmanship of Mr. Ramesh Srinivasan, Managing Director & CEO, Kotak Mahindra Capital Company Limited. The Working Group comprised of members from PMAC including persons from the Industry, Intermediaries, Proxy Advisors, Stock Exchanges, Lawyers, Professional bodies, etc.

The terms of reference of the Working Group were to make recommendations to SEBI on the following issues:

1. Review the policy space relating to related party transactions, including the following:

(a) Definition of “related party” and “related party transactions”;

(b) Thresholds for classification of “related party transactions” as material; and

(c) Process followed by the Audit Committee for approval of related party transactions.

2. Review the provisions relating to related party transactions in the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 vis-à-vis the Indian Accounting Standards and the Companies Act, 2013.

3. Specify a format for periodic disclosure of related party transactions by listed entities.

4. Recommendations for strengthening the monitoring and enforcement of regulatory norms related to related party transactions.

5. Any other matter, as the Working Group deems fit pertaining to related party transactions.

The Working group has submitted its report on January 22, 2020.

Chapter 1: Introduction

A. The Working Group on Related Party Transactions

I. Composition of the Working Group

The Working Group to discuss related party transactions (“Working Group”) was constituted on November 4, 2019, with the following members:

II. Terms of Reference of the Working Group

With the aim of strengthening regulatory norms in relation to related party transactions undertaken by listed entities in India, the Working Group was requested to make recommendations on the following issues:

6. Review the policy space relating to related party transactions, including the following:

(d) Definition of “related party” and “related party transactions”;

(e) Thresholds for classification of “related party transactions” as material; and

(f) The process followed by the Audit Committee for approval of related party transactions.

7. Review the provisions relating to related party transactions in the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 vis-à-vis the Indian Accounting Standards and the Companies Act, 2013.

8. Specify a format for periodic disclosure of related party transactions by listed entities.

9. Recommendations for strengthening the monitoring and enforcement of regulatory norms related to related party transactions.

10. Any other matter, as the Working Group deems fit pertaining to related party transactions.

The Working Group was requested to provide its recommendations in the context of equity listed entities.

III. Approach

The Working Group had five meetings over a period of one month with the first meeting held on November 14, 2019, and the last on December 11, 2019. The Working Group deliberated on each of the terms of reference in detail.

The Working Group reviewed case studies and empirical evidence wherever possible, including international practices and feedback from stakeholders to reach a conclusion on the various issues considered by it. The Working Group also conducted two meetings with company secretaries and institutional investors to solicit views and different perspectives from persons and organizations who deal with issues pertaining to related party transactions. The Report of the Working Group was placed before the Primary Market Advisory Committee (“PMAC”) of SEBI in its meeting held on January 17, 2020, and the suggestions made by the PMAC have been incorporated in this Report.

This report (“Report”) sets out recommendations of the Working Group which include, inter alia, amendments to certain provisions of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR”). The Working Group kept in mind the objectives of investor protection as well as ease of doing business while setting out these recommendations. The consolidated draft of the proposed amendments to the LODR recommended by the Working Group is set out in Appendix-l to this Report.

B. Related Party Transactions- Regulatory Framework

A related party transaction (“RPT”) is a transfer of resources, services or obligations between two parties, irrespective of whether a price is charged or not. With respect to a corporate entity, related parties would broadly consist of its executives, directors or promoters, who are responsible for making decisions for the corporate entity. RPTs are prone to abuse by persons in control of the decision making of the corporate entity for personal gains and are, therefore, strictly regulated under most regimes. RPTs, if misused, will cause significant loss of value of the corporate entity entering into the RPT. In India, where the existence of promoter-driven and closely held companies is prevalent, the risk of abuse by way of RPTs is relatively high.

RPTs have always been prevalent and have also contributed to the growth of business for entities around the world. Hence, in spite of the possibility of misuse, most jurisdictions have permitted RPTs, albeit with certain safeguards. Therefore, the Working Group also recognized that there is no need to prohibit RPTs, although the regulatory framework should be fortified to mitigate the possibility of abuse.

An ideal regulatory framework for RPTs should encourage value-enhancing RPTs while penalizing undesirable RPTs. In his article on ‘RPTs and Intragroup Transactions’, Jens Damman discusses1 three strategies that legal systems may adopt to deal with RPTs within corporate groups. First, legal systems may use tax and other incentives to induce ownership structures which reduce the costs of intragroup self-dealing. Secondly, legal systems may provide various protective rights to minority shareholders in order to ensure that they avoid being subject to an exploitative controlling shareholder or promoter in the first place. And thirdly, “once a corporate group has emerged, individual transactions can be policed to ensure that they do not enrich controlling shareholders at the expense of the minority.” The last two suggestions are within this Working Group’s scope and therefore the discussions of the Working Group and this Report are focused around the same.

RPTs can be regulated either by way of a substantive review or a procedural review. Substantive review of RPTs would involve examining the terms of the transaction and evaluating the fairness of the transaction. Procedural review of RPTs would involve judging the fairness of the transaction on the basis of the procedure through which the RPT was executed. For this purpose, the regulator would have to specify the procedure for obtaining approvals of persons considered to be best placed to objectively judge the RPT. The Working Group recognized that ideally, a review of RPTs would need to be a combination of both, substantive and procedural review.

I. Legislative History

The legal regime in India relating to RPTs has evolved over the years after taking into consideration recommendations made by a number of committees such as the Narayana Murthy Committee on Corporate Governance (2003), J.J. Irani Committee on Company Law (2005), the Company Law Committee (2016) and the Kotak Committee on Corporate Governance (2017).

Requirements in relation to RPTs under the erstwhile listing agreement:

Several disclosure requirements with respect to RPTs were mandated under Clause 49 of the erstwhile listing agreement. This listing agreement referred to Accounting Standard 18 for the definition of the term ‘related party transactions’.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.