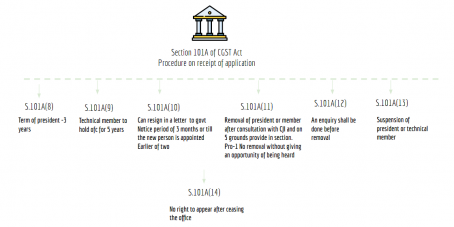

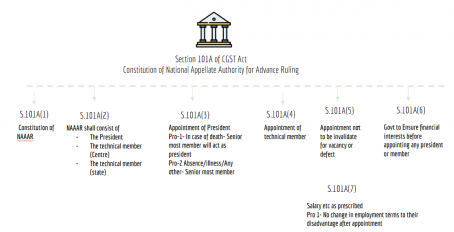

Section 101A of CGST Act : Constitution of National Appellate Authority for Advance Ruling (Updated till on July 2024)

Section 101A Summary Chart :

1[Section 101A of CGST Act : Constitution of National Appellate Authority for Advance Ruling

(1) The Government shall, on the recommendations of the Council, by notification, constitute, with effect from such date as may be specified therein, an Authority known as the National Appellate Authority for Advance Ruling for hearing appeals made under section 101B.

(2) The National Appellate Authority shall consist of—

(i) the President, who has been a Judge of the Supreme Court or is or has been the Chief Justice of a High Court, or is or has been a Judge of a High Court for a period not less than five years;

(ii) a Technical Member (Centre) who is or has been a member of Indian Revenue (Customs and Central Excise) Service, Group A, and has completed at least fifteen years of service in Group A;

(iii) a Technical Member (State) who is or has been an officer of the State Government not below the rank of Additional Commissioner of Value Added Tax or the Additional Commissioner of State tax with at least three years of experience in the administration of an existing law or the State Goods and Services Tax Act or in the field of finance and taxation.

(3) The President of the National Appellate Authority shall be appointed by the Government after consultation with the Chief Justice of India or his nominee:

Provided that in the event of the occurrence of any vacancy in the office of the President by reason of his death, resignation or otherwise, senior most Member of the National Appellate Authority shall act as the President until the date on which a new President, appointed in accordance with the provisions of this Act to fill such vacancy, enters upon his office:

Provided further that where the President is unable to discharge his functions owing to absence, illness or any other cause, the senior most Member of the National Appellate Authority shall discharge the functions of the President until the date on which the President resumes his duties.

(4) The Technical Member (Centre) and Technical Member (State) of the National Appellate Authority shall be appointed by the Government on the recommendations of a Selection Committee consisting of such persons and in such manner as may be prescribed.

(5) No appointment of the Members of the National Appellate Authority shall be invalid merely by the reason of any vacancy or defect in the constitution of the Selection Committee.

(6) Before appointing any person as the President or Members of the National Appellate Authority, the Government shall satisfy itself that such person does not have any financial or other interests which are likely to prejudicially affect his functions as such President or Member.

(7) The salary, allowances and other terms and conditions of service of the President and the Members of the National Appellate Authority shall be such as may be prescribed:

Provided that neither salary and allowances nor other terms and conditions of service of the President or Members of the National Appellate Authority shall be varied to their disadvantage after their appointment.

(8) The President of the National Appellate Authority shall hold office for a term of three years from the date on which he enters upon his office, or until he attains the age of seventy years, whichever is earlier and shall also be eligible for reappointment.

(9) The Technical Member (Centre) or Technical Member (State) of the National Appellate Authority shall hold office for a term of five years from the date on which he enters upon his office, or until he attains the age of sixty-five years, whichever is earlier and shall also be eligible for reappointment.

(10) The President or any Member may, by notice in writing under his hand addressed to the Government, resign from his office:

Provided that the President or Member shall continue to hold office until the expiry of three months from the date of receipt of such notice by the Government, or until a person duly appointed as his successor enters upon his office or until the expiry of his term of office, whichever is the earliest.

(11) The Government may, after consultation with the Chief Justice of India, remove from the office such President or Member, who—

(a) has been adjudged an insolvent; or

(b) has been convicted of an offence which, in the opinion of such Government involves moral turpitude; or

(c) has become physically or mentally incapable of acting as such President or Member; or

(d) has acquired such financial or other interest as is likely to affect prejudicially his functions as such President or Member; or

(e) has so abused his position as to render his continuance in office prejudicial to the public interest:

Provided that the President or the Member shall not be removed on any of the grounds specified in clauses (d) and (e), unless he has been informed of the charges against him and has been given an opportunity of being heard.

(12) Without prejudice to the provisions of sub-section (11), the President and Technical Members of the National Appellate Authority shall not be removed from their office except by an order made by the Government on the ground of proven misbehaviour or incapacity after an inquiry made by a Judge of the Supreme Court nominated by the Chief Justice of India on a reference made to him by the Government and such President or Member had been given an opportunity of being heard.

(13) The Government, with the concurrence of the Chief Justice of India, may suspend from office, the President or Technical Members of the National Appellate Authority in respect of whom a reference has been made to the Judge of the Supreme Court under sub-section (12).

(14) Subject to the provisions of article 220 of the Constitution, the President or Members of the National Appellate Authority, on ceasing to hold their office, shall not be eligible to appear, act or plead before the National Appellate Authority where he was the President or, as the case may be, a Member.]

1. Inserted vide sec 105 of the Finance (No. 2) Act, 2019 (23 of 2019). This amendment shall be effective from a date to be notified.

Prem

Prem

designer

Adilabad, India

gst taxation