Section 16 of the CGST Act: Eligibility and conditions for taking input tax credit (Updated till on July 2024)

Section 16 of the CGST Act: Eligibility and conditions for taking input tax credit

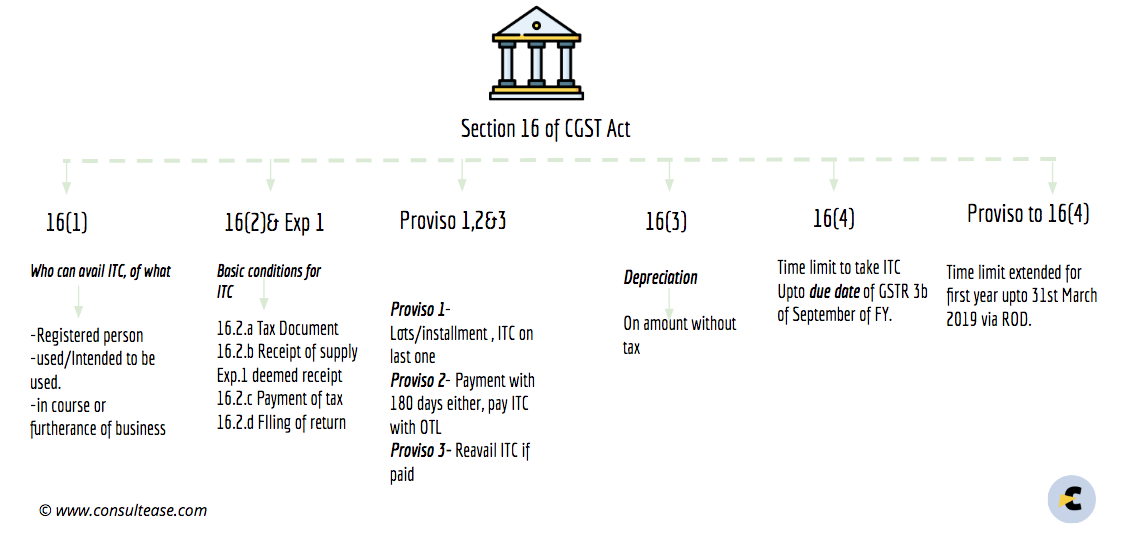

Section 16 of the CGST Act provides for the basic eligibility of ITC. Some conditions are laid down in the section. It is divided into four subsections. Section 16(1) provides for the person eligible for ITC.

- Registered person.

- Inward supply used /Intended to be used

- In the course or furtherance of business

Thus the use of supply is not mandatory to claim the credit. Although if it is removed without a use, ITC is reversible. Because use of inward supply is mandatory but not for availing the ITC.

Related Topic:

Input Tax Credit under Section 16 (2) – The Etymology of Double/Triple Jeopardy (???)

Subsection 2 supersedes the entire section. It starts with “Notwithstanding anything contained in this section”. It provides for 4 basic conditions to claim ITC.

- Invoice or tax document

- Receipt of goods/ services

- Payment of tax by the supplier

- Filing of returns by the recipient

Related Topic:

Section 16(4) challenged in Calcutta high court in Rainbow infrastructure

Summary of section 16 of the CGST Act

Section 16 of the CGST Act as given in the Bare Act

16. (1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

(2) Notwithstanding anything contained in this section, no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless,––

(a) he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other tax paying documents as may be prescribed;

(b) he has received the goods or services or both.

Explanation.—For the purposes of this clause, it shall be deemed that the registered person has received the goods where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

Explanation.—For the purposes of this clause, it shall be deemed that the registered person has received the goods or, as the case may be, services–– (i) where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise; (ii) where the services are provided by the supplier to any person on the direction of and on account of such registered person.” (Amended via CGST Amendment Act 2018 from 1st Feb 2019)

(c) subject to the provisions of section 41,or section 43A,the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilisation of input tax credit admissible in respect of the said supply; and

(d) he has furnished the return under section 39.

First proviso:

Provided that where the goods against an invoice are received in lots or instalments, the registered person shall be entitled to take credit upon receipt of the last lot or instalment:

Second proviso

Provided further that where a recipient fails to pay to the supplier of goods or services or both,other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon, in such manner as may be prescribed.

Third Proviso

Provided also that the recipient shall be entitled to avail of the credit of input tax on payment made by him of the amount towards the value of supply of goods or services or both along with tax payable thereon.

(3) Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income-tax Act, 1961, the input tax credit on the said tax component shall not be allowed.

(4) A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertains or furnishing of the relevant annual return, whichever is earlier.

“Provided that the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September, 2018 till the due date of furnishing of the return under the said section for the month of March, 2019 in respect of any invoice or invoice relating to such debit note for supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub-section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March, 2019.”. {inserted via: Removal of difficulty Order No. 02/2018-Central Tax}

(As given in CGST Act)

Rules relevant to section 16 of the CGST Act

| 1. | Rule 36 | Documentary requirements and conditions for claiming input tax credit |

| 2. | Rule 37 | Reversal of input tax credit in the case of non-payment of consideration |

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.