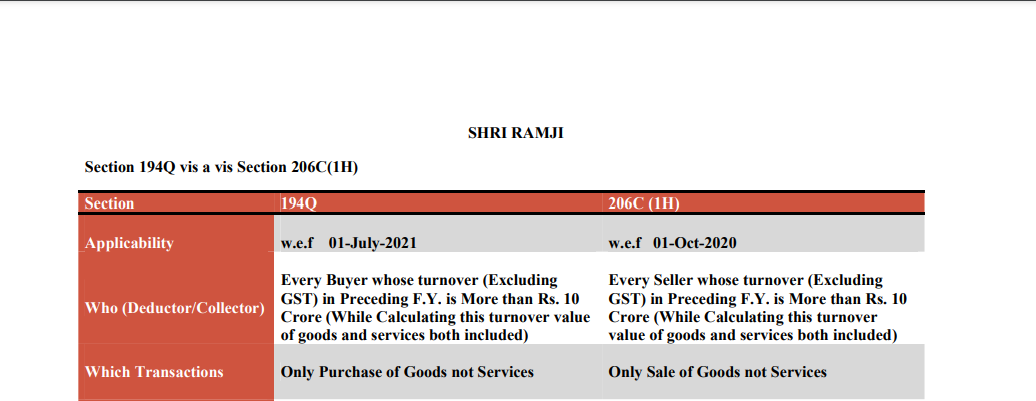

Section 194Q vis a vis Section 206C(1H)

| Section | 194Q | 206C (1H) |

| Applicability | w.e.f 01-July-2021 | w.e.f 01-Oct-2020 |

| Who (Deductor/Collector) | Every Buyer whose turnover (Excluding GST) in Preceding F.Y. is More than Rs. 10 Crore (While Calculating this turnover value of goods and services both included) | Every Seller whose turnover (Excluding GST) in Preceding F.Y. is More than Rs. 10 Crore (While Calculating this turnover value of goods and services both included) |

| Which Transactions | Only Purchase of Goods not Services | Only Sale of Goods not Services |

| Whom (Deductee/Collectee) | Every resident supplier from whom the value of purchases of goods exceeds Rs. 50 Lakh in a year | Every buyer from whom sum received against the sale of goods in India (export of goods excluded) (advance against the sale of goods also included) exceeding Rs. 50 Lakh in a year |

| Point of taxation | Credit or Payment whichever is earlier | At the time of receipt of sale consideration |

| Rate | If Pan Available – 0.10%

If Pan Not Available – 5% |

If Pan Available – 0.10%

If Pan Not Available – 1% |

| Due date of payment | 7th of next month in which tax deducted 30th April in case of March Month | 7th of next month in which tax collected |

| Return | Form 26Q | Form 27EQ |

| Exemptions | Provisions of section 194Q not applicable if –

|

Provisions of section 206C(1H) not applicable if –

|

| Consequences of Non-Compliances |

|

|

Related Topic:

Applicability Of Section 194Q

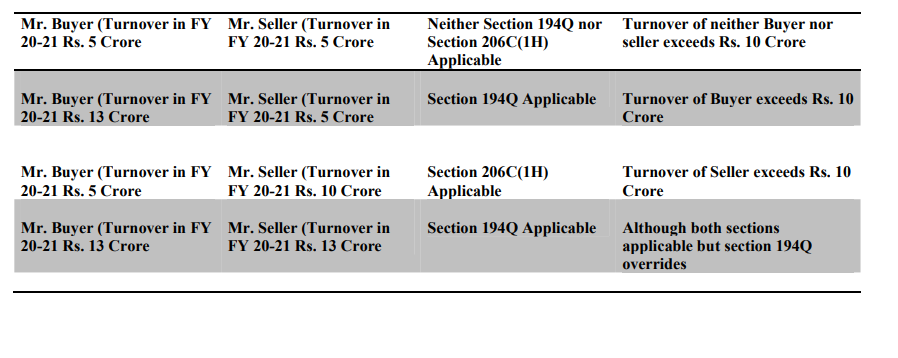

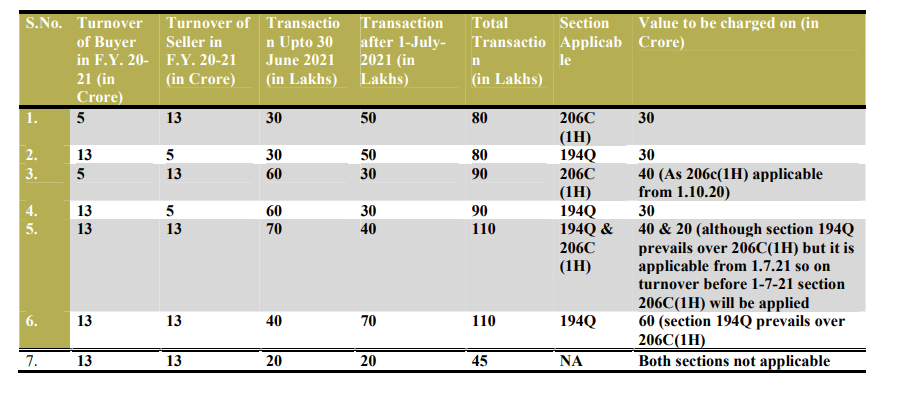

Analysis of 194Q and Section 206C (1H) with examples

Interplay Between 194Q and Section 206C (1H) with examples

Attention:

- Although tax is not required to be collected u/s 206C(1H) if the buyer is Central or State Govt or Local Authority or Embassy but transaction with these persons need to be disclosed while filing statements of TCS in form 27EQ otherwise we have to report these transactions in tax audit clause 34.

- As per section 206C(1H) Tax is required to be collected on receipt of sale consideration in relation to the sale of goods although the practice has been developed in the market to charge TCS at the time of Invoicing itself which is wrong in any manner.

- TCS is applicable to the automobiles sector for selling of a Motor vehicle above Rs. 10 lakhs to the customer but it is not applicable from the manufacturer to the distributor, dealer, or sub-dealer hence this sector is not free from this new TCS provision, and this provision of TCS is applicable to automobile sector also

Related Topic:

Detailed Analysis of Sec. 194Q and 206C(1H)

CA Yogesh Agarwal

CA Yogesh Agarwal