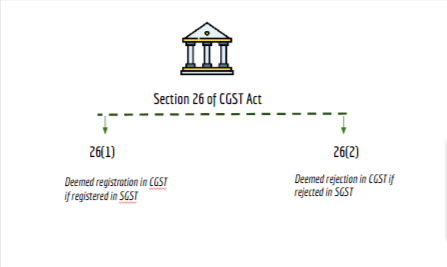

Section 26 of CGST Act: Deemed registration (updated till on July 2024)

Table of Contents

Section 26 of CGST Act as amended by the Finance Act 2023

Note: Section 26 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Text On Section:

“(1) The grant of registration or the Unique Identity Number under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act shall be deemed to be a grant of registration or the Unique Identity Number under this Act subject to the condition that the application for registration or the Unique Identity Number has not been rejected under this Act within the time specified in sub-section (10) of section 25.

(2) Notwithstanding anything contained in sub-section (10) of section 25, any rejection f application for registration or the Unique Identity Number under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act shall be deemed to be a rejection of application for registration under this Act.”

(As given in CGST Act)

Chart of the Section:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.