Section 48 of CGST Act: GST practitioners (updated till on July 2024)

Table of Contents

Section 48 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 48 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

TEXT on the section :

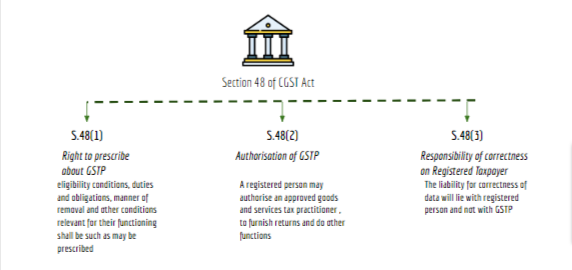

Section 48 of CGST Act provide for the GST practitioners.

“(1) The manner of approval of goods and services tax practitioners, their eligibility conditions, duties and obligations, manner of removal and other conditions relevant for their functioning shall be such as may be prescribed.

(2) A registered person may authorise an approved goods and services tax practitioner to furnish the details of outward supplies under section 37, the details of inward supplies under section 38 and the return under section 39 or section 44 or section 45 in such manner as may be prescribed.

(3) Notwithstanding anything contained in sub-section (2), the responsibility for correctness of any particulars furnished in the return or other details filed by the goods and services tax practitioners shall continue to rest with the registered person on whose behalf such return and details are furnished.”

Chart of the Section :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.