Section 47 of CGST Act: Levy of late fees (updated till on July 2024)

Table of Contents

Section 47 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 47 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

TEXT on the Section 47 of CGST Act :

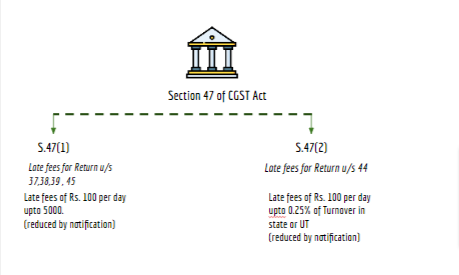

“(1) Any registered person who fails to furnish the details of outward or inward supplies required under section 37 or section 38 or returns required under section 39 or section 45 [or section 52] by the due date shall pay a late fee of one hundred rupees for every day during which such failure continues subject to a maximum amount of five thousand rupees.

(2) Any registered person who fails to furnish the return required under section 44 by the due date shall be liable to pay a late fee of one hundred rupees for every day during which such failure continues subject to a maximum of an amount calculated at a quarter per cent. of his turnover in the State or Union territory.”

Chart of the Section :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.