Section 62 doesn’t give power to impose penalty(Pdf Attach)

Table of Contents

Cases Covered:

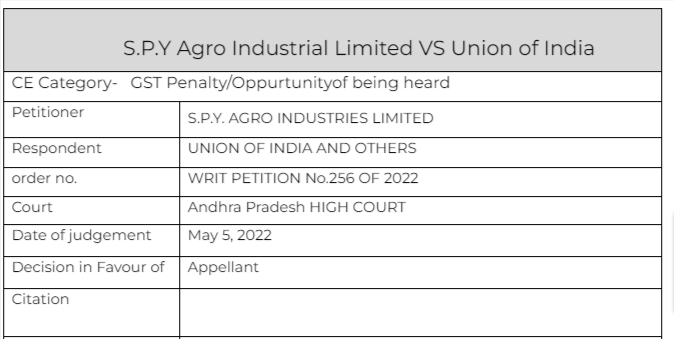

S.P.Y Agro Industrial Limited VS Union of India

Facts of the cases:

The petitioner failed to submit its returns in GSTR-3B for the months of January 2020 to June 2020 and as such, the petitioner was directed to file fresh returns within 15 days. In view of the non-response on the part of the petitioner in furnishing returns, an assessment order came to be passed by the 3rd respondent on 13.08.2020 determining the liability at Rs.1,85,17,721/- towards IGST and Rs.1,39,39,656/- each towards CGST and APGST apart from a sum of Rs.3,36,798/- as cess payable by the petitioner for the tax period January 2020 to June, 2020.

Then the order was amended to add a penalty to it. The entire procedure followed by the authorities in imposing a penalty without hearing the petitioner is illegal and incorrect. He further submits that this is a fit case, where the authority should issue a fresh show cause notice and then deal with the same afresh in accordance with the law. He further submits that reviewing the order of the self-same authority imposing additional liability, without hearing the petitioner or without giving an opportunity of hearing the petitioner is illegal and against all cannons of law.

Observation & Judgement of the Court:

Section 62 of the Act does not anywhere speak about imposing a penalty. It only speaks about liability for payment of interest subsection (1) of Section 50 or for payment of late fees under Section 47 of the Act. Further, if the penalty is to be imposed in cases, that are not covered under Section 62 or Section 63 or Section 64 or Section 73 or Section 74 or Section 129, or Section 130, the authority can impose a penalty after giving reasonable opportunity of hearing such person. Further as observed earlier, under Section 161 of the Act any rectification, which adversely affects any person is possible only after following the principles of natural justice. Since the order impugned substantially affects the assessee as the penalty is sought to be imposed, which demand did not form part of the notice dated 13.08.2020, without giving an opportunity of hearing, the orders under challenge are set aside. However, the respondents are permitted to proceed further by issuing a fresh notice and passing orders in accordance with law.

Comment:

The order imposing the penalty was dropped by the court.

Read & Download the Full S.P.Y Agro Industrial Limited VS Union of India

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.