Selling online to Indian users? Register and pay GST

Table of Contents

- Are you selling online to Indian users?

- What is an OIDAR service?

- What do I need to do If I am making the OIDAR supply to a user in India?

- Registration as an OIDAR in India- Form, and documents-

- Whether a Person Selling online to Indian users or OIDAR services provider is eligible for the input tax credit?

- Which return a Person Selling online to Indian users or OIDAR service provided is required to file?

Are you selling online to Indian users?

Yes, you got it right. Selling online to Indian users attract some GST compliances. In this article, we will discuss it in detail. Online sellers are required to take registration in India and pay tax on their supplies. It is relevant for the sellers of games, videos, courses, online storage space, or anything covered in OIDAR. Don’t know what is OIDAR? I am going to explain it here.

What is an OIDAR service?

The term is defined in section 2(17) of the IGST Act. Let us have a look at the definition. Then I will explain it further for you.

“online information and database access or retrieval services” means services whose delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention and impossible to ensure in the absence of information technology and includes electronic services such as,–

(i) advertising on the internet;

(ii) providing cloud services;

(iii) provision of e-books, movie, music, software, and other intangibles through telecommunication networks or the internet;

(iv) providing data or information, retrievable or otherwise, to any person in electronic form through a computer network;

(v) online supplies of digital content (movies, television shows, music, and the like);

(vi) digital data storage; and

(vii) online gaming;

Yes, everything sold over the internet with a minimum of no human intervention is covered in OIDAR services. But if there is a considerable amount of human intervention it will not fall in OIDAR.

Example-

An online course of recorded videos will fall in OIDAR but a one to one live class will not fall in OIDAR. As it has a considerable amount of human intervention.

What do I need to do If I am making the OIDAR supply to a user in India?

Now that’s the most important part. If you are an OIDAR supplier. Supply to Indian unregistered person will require you to take registration as an OIDAR. If you cant take registration in India. You need to appoint a representative for this purpose. That person will take the registration and will pay the tax and file the requisite returns.

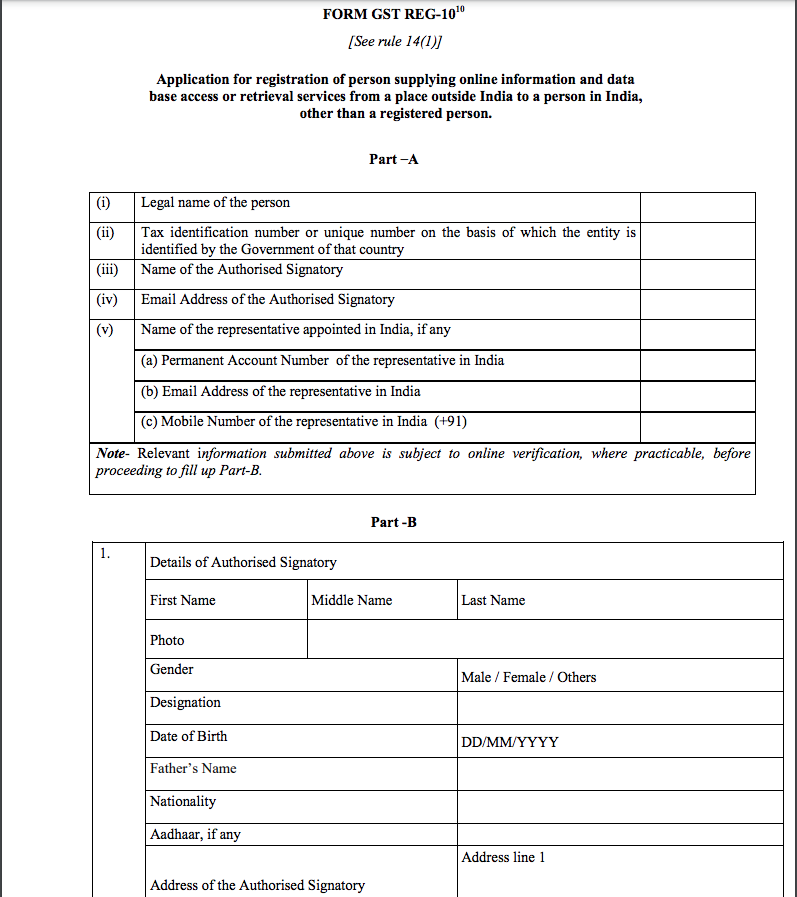

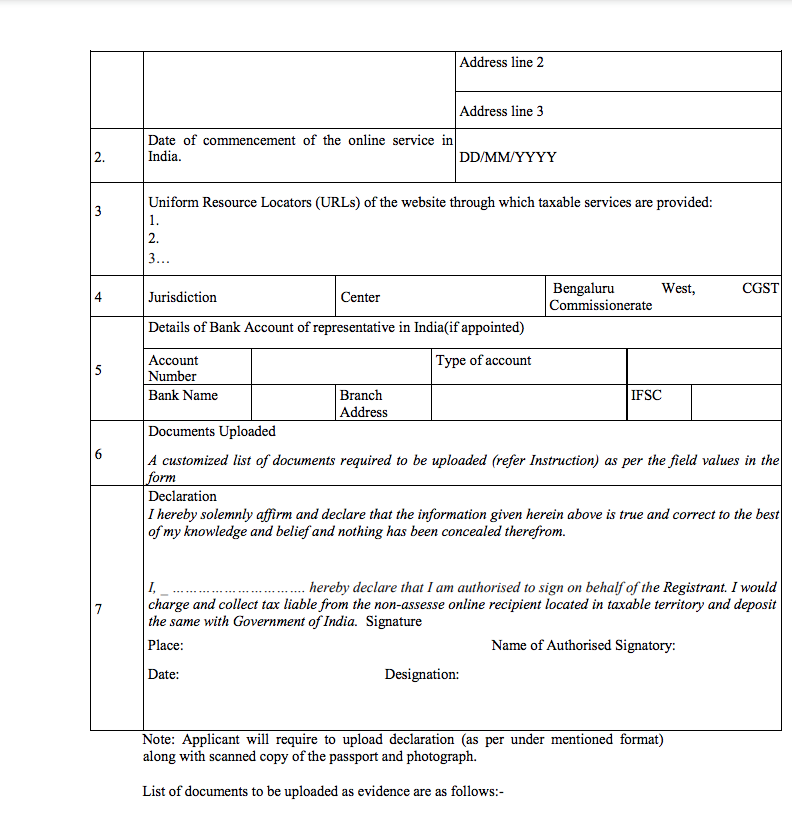

Registration as an OIDAR in India- Form, and documents-

A separate form is prescribed for registration of OIDAR. GST Reg 10 is the form for an OIDAR person. Following is the format of GST Reg 10. You can register online.

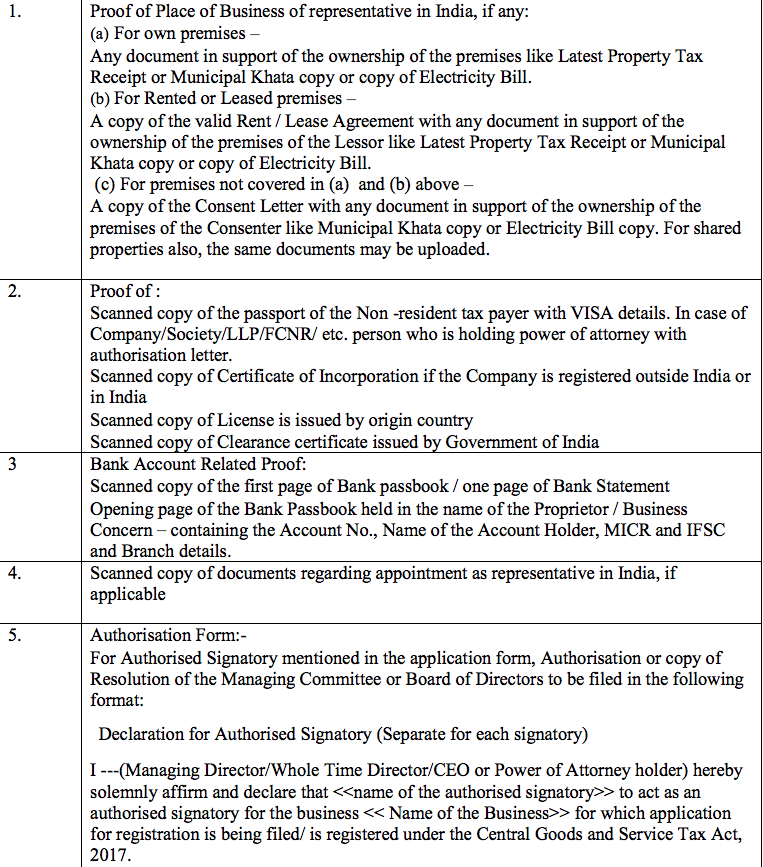

following documents are required for online registration of an OIDAR-

- Tax identification number or unique number on the basis of which the entity is identified by the Government of that country

- Legal name

- Details of authorized representative in India

- Authorized signatory

The following details of an authorized signatory are also required.

You can apply online on the Indian GSTN portal.

Whether a Person Selling online to Indian users or OIDAR services provider is eligible for the input tax credit?

It is not possible for an OIDAR services provider to make purchases form the Indian market. But if there are any purchases, there is no restriction on the eligibility of ITC to an OIDAR.

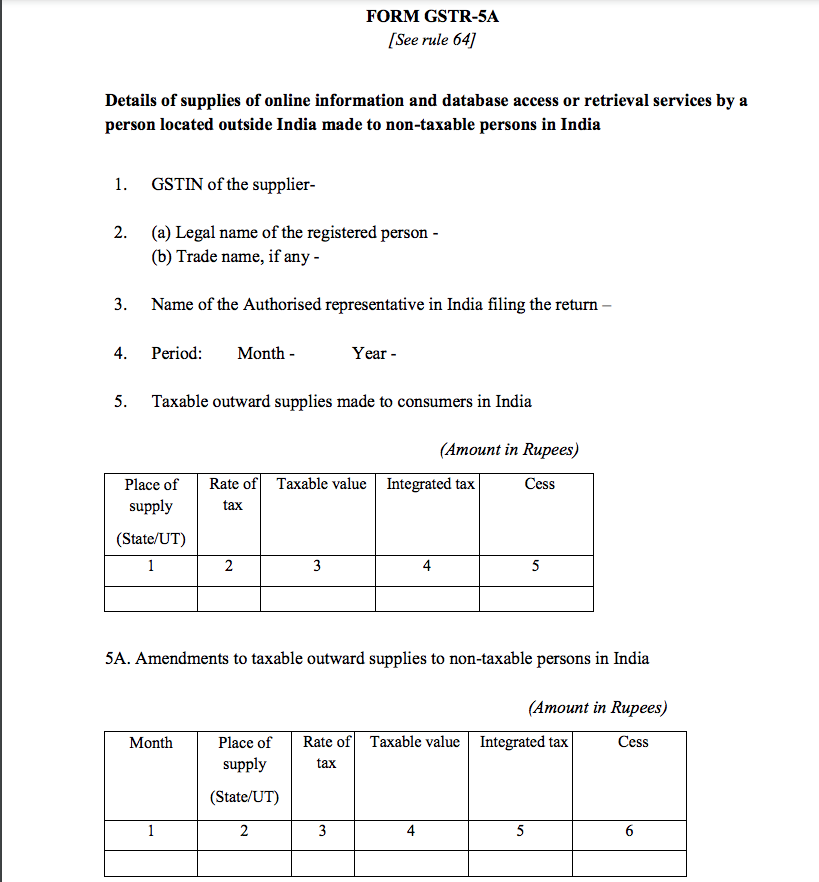

Which return a Person Selling online to Indian users or OIDAR service provided is required to file?

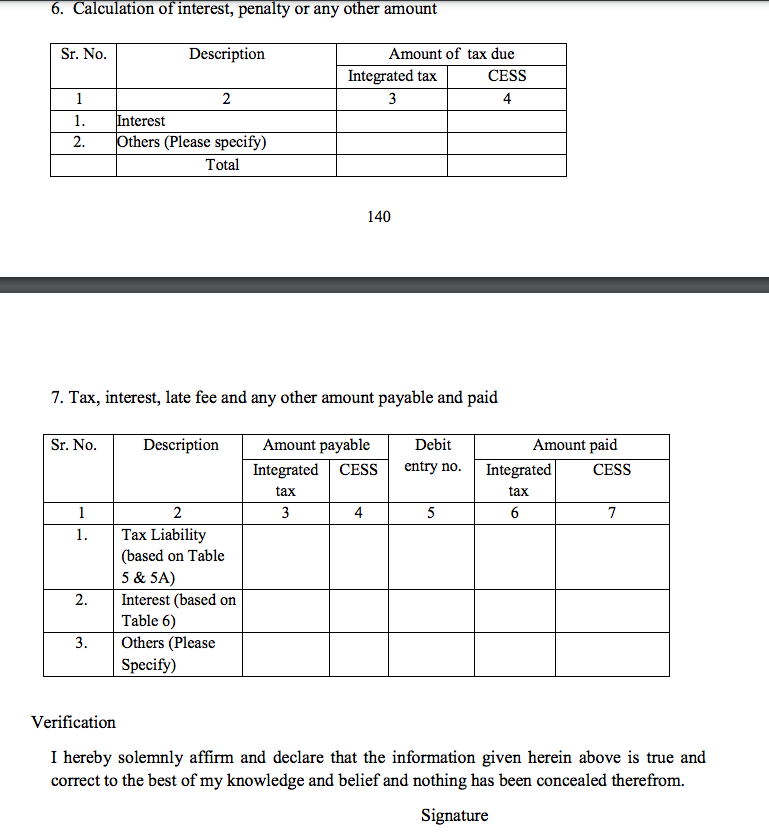

There is a specific return for OIDAR service providers. As we know that they operate in India through a representative. The return is also filed by the representative. The form for the return of an OIDAR service provider is GSTR 5A. The format of the form is given below-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.