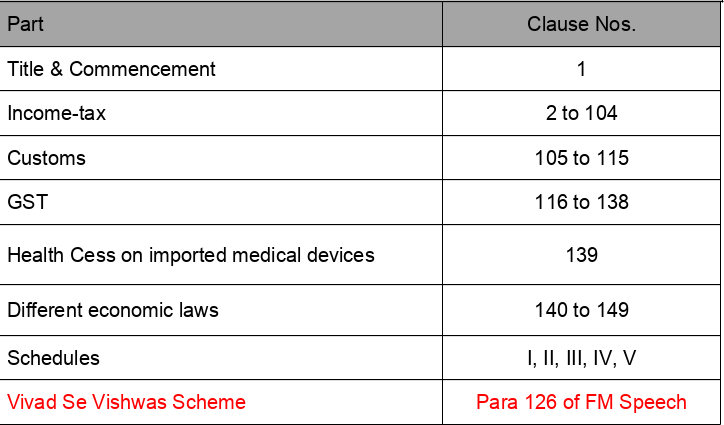

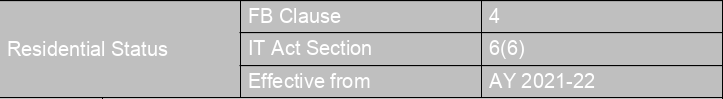

Best Analysis of Union Budget – 2020

Bird’s Eye View of Finance Bill, 2020

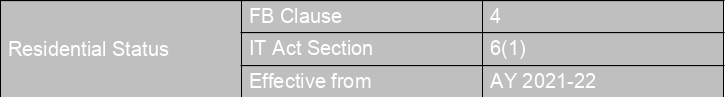

Old law: A citizen of India or PIO, who is outside India and comes to India on a visit is treated as resident in India if his stay during the PY is 182 days or more.

New law: Shall be treated as resident in India if:

(a) His stay in India during the PY is 182 days or more, or

(b) His stays in India during the PY is 120 days or more (+) Total stay in the preceding 4 years was 365 days or more

Comment: More chances of becoming a Resident in India. Hence more tax liability in India.

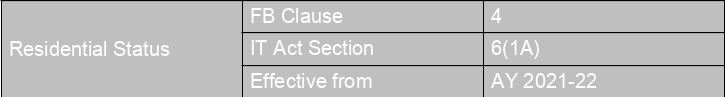

New law: A citizen of India shall be deemed to be Resident in any previous year if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criterion of similar nature.

Press release by Govt.: It is clarified that income earned outside India shall not be taxed in India unless it is derived from an Indian business or profession.

Old law: An Individual is treated as “Not Ordinary Resident” if:

(a) He was a Non-Resident in India in 9 out of 10 years preceding the Previous Year, or

(b) His stay in India during 7 years preceding the Previous Year was less than 730 days.

Earlier an Individual was “Ordinary Resident” if:

(a) He was a Resident in India in 2 out of 10 years preceding the Previous Year, and

(b) His stay in India during 7 years preceding the Previous Year was 730 days or more.

New law: An Individual shall be treated as “Not Ordinary Resident” if:

He was a Non-Resident in India in 7 out of 10 years preceding the Previous Year

Now an Individual shall be “Ordinary Resident” if he was a Resident in India in 4 out of 10 years preceding the Previous Year.

Download the copy: