SOP for Taxpayers-How to furnish a reply in ASMT-11 against a Notice in ASMT-10

SOP for Taxpayers-How to furnish a reply in ASMT-11 against a Notice in ASMT-10

In order to furnish a reply in FORM GST ASMT-11 against a notice u/s. 61 of the CGST/KSGST Act, 2017 in FORM GST ASMT-10, NOTICE FOR INTIMATING DISCREPANCIES IN THE RETURN AFTER SCRUTINY, the following steps have to be performed. 1. As and when a proper officer issues a notice in FORM GST ASMT-10 an SMS will be received in taxpayer’s Registered Mobile No. ↓

Notice vide Ref. No. ZJ3202200088011 dated 28/02/2020 has been issued. please furnish reply on or before 14/03/2020

2. If the taxpayer admits any amount and wishes to make payment of the admitted amount, pay accordingly in FORM GST DRC-03 (INTIMATION OF VOLUNTARY PAYMENT)

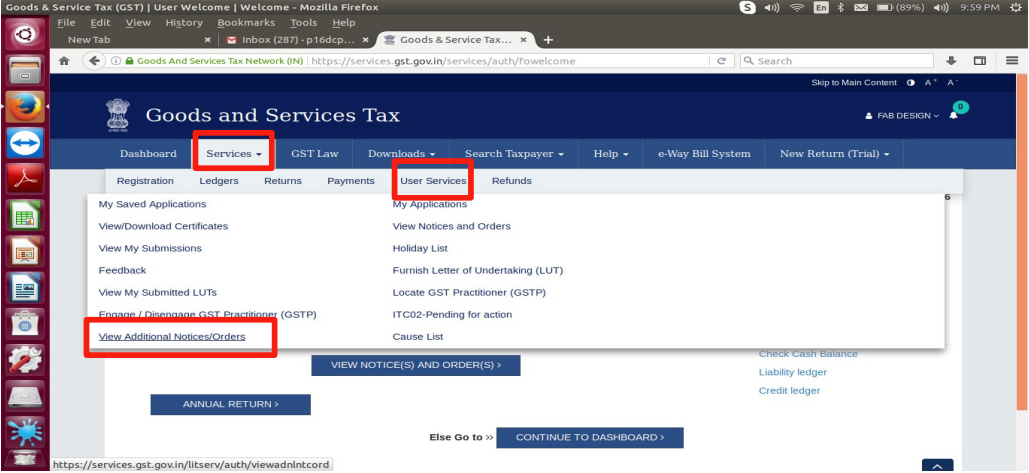

3. If the taxpayer wishes to furnish a detailed reply, prepare a reply in detail in .pdf format and scan all the necessary enclosures, if any.4. After login, go to SERVICES

>USER SERVICES>VIEW ADDITIONAL NOTICES/ORDERS

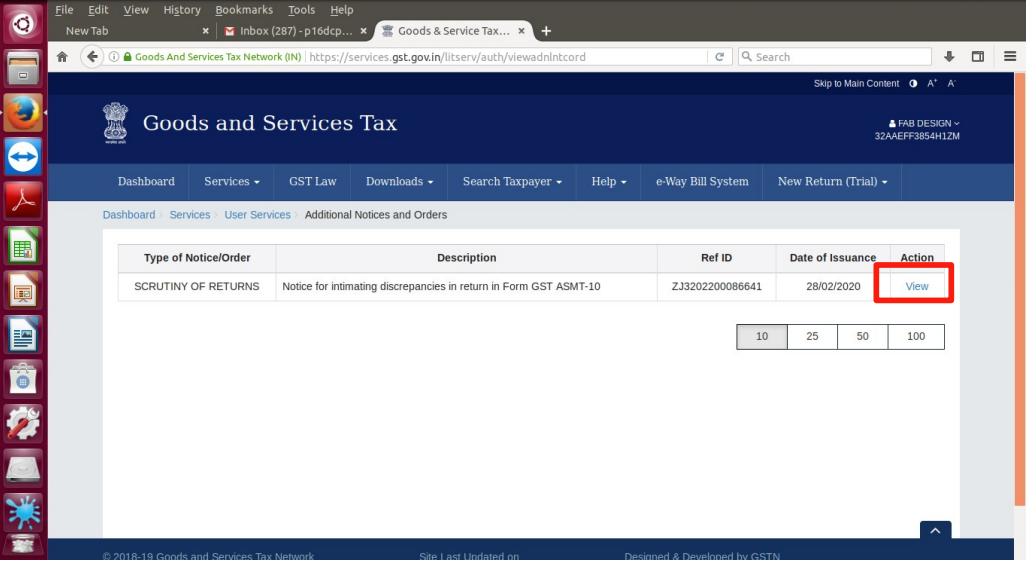

5. Click on View.

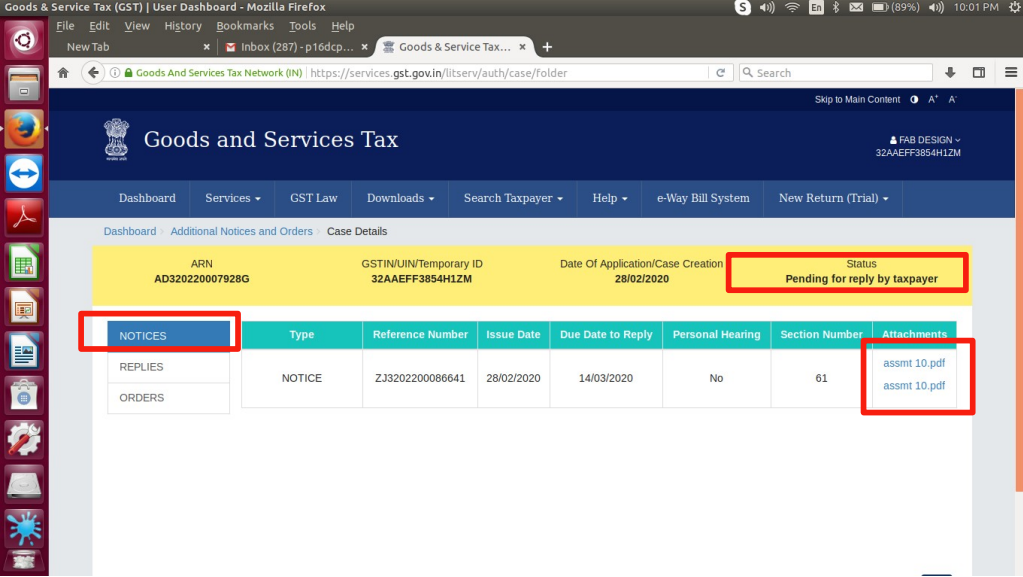

6. You can view the Notice by downloading the attachments and the status of the Notice will be Pending for reply by the taxpayer.

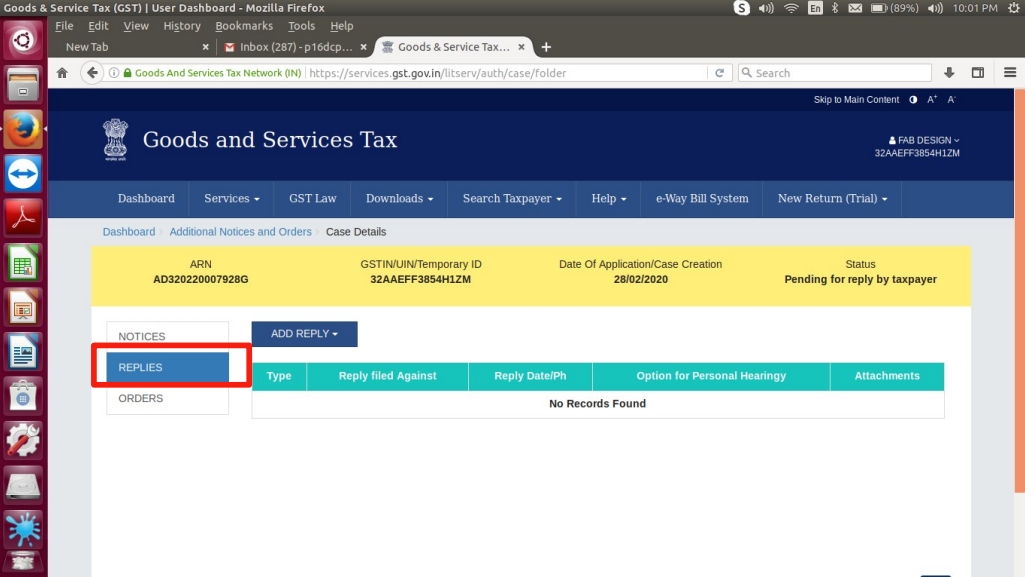

7. If the taxpayer likes to file a reply in FORM GST ASMT-11, click on REPLIES

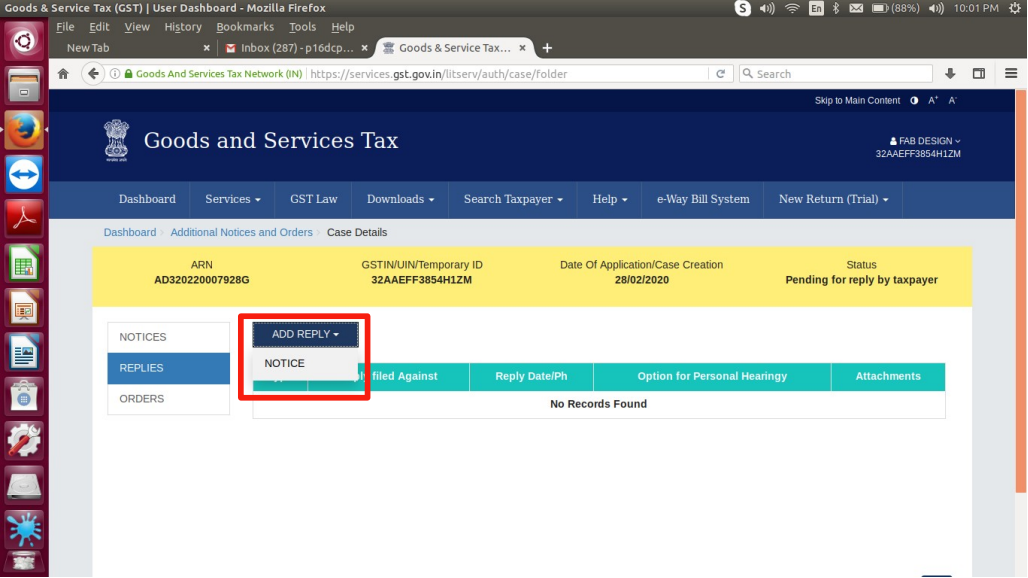

8. Click on ADD REPLY then click on NOTICE

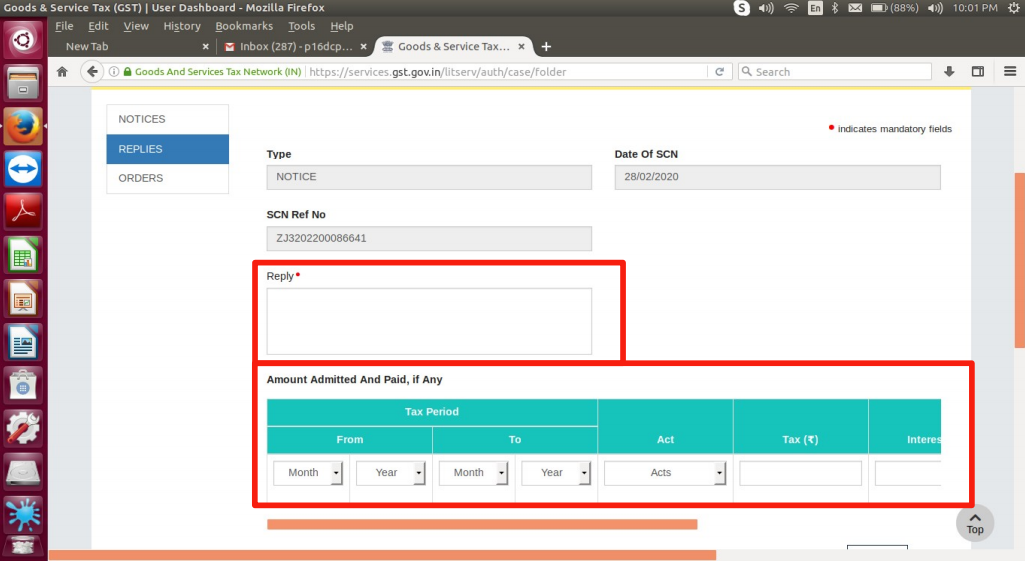

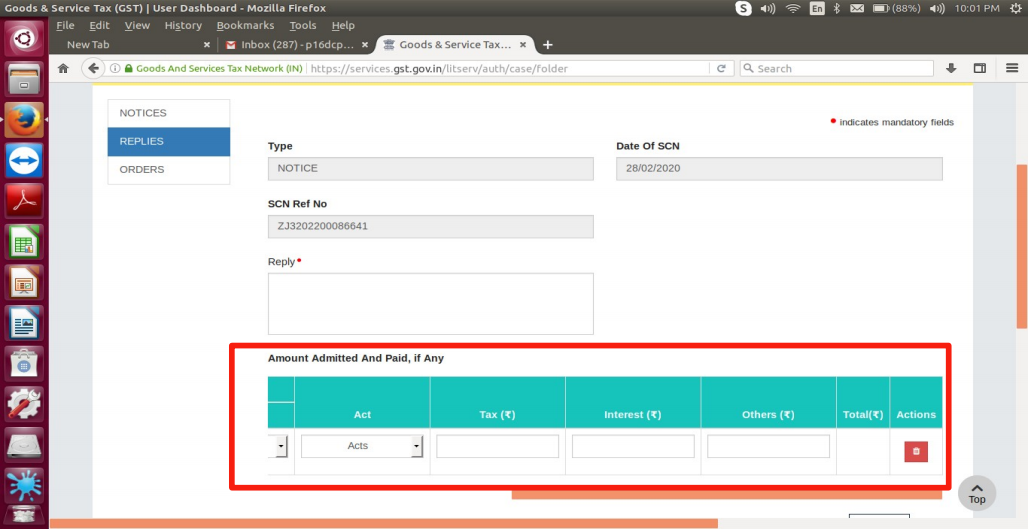

9. Enter Reply in the relevant field. It is mandatory. If a detailed reply has to be furnished, the taxpayer can upload the reply using the Browse option. If any amount is admitted and paid to enter the tax period and values in the relevant fields.

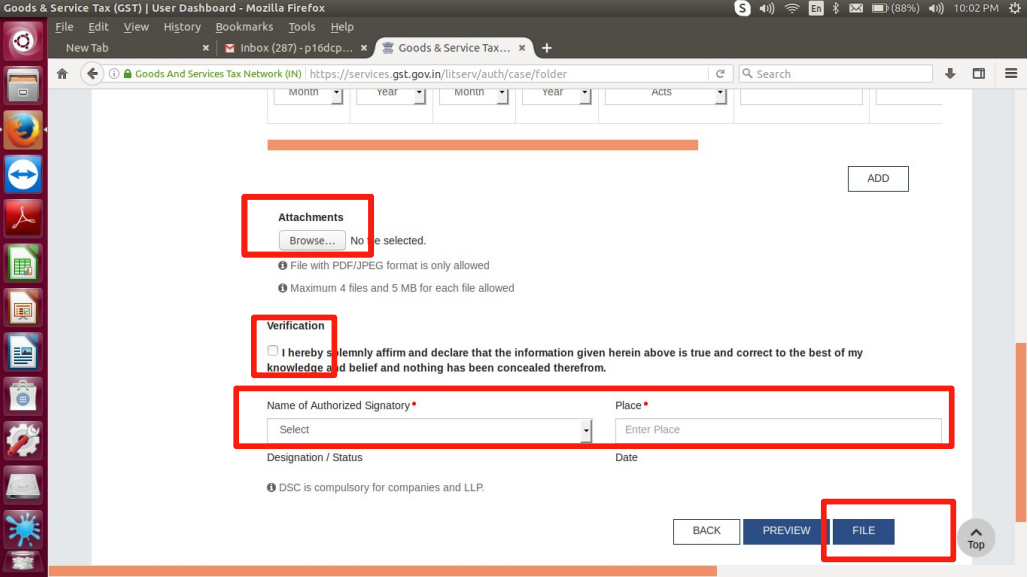

10. Upload the documents such as FORM GST DRC-03(if any amount paid on the basis of notice), Detailed Reply(if required), Enclosures(if any). The taxpayer can upload in .pdf/.jpeg format up to 4 attachments of 5Mb each. Click on Verification, Select Authorized Signatory, Enter Place then Click on FILE

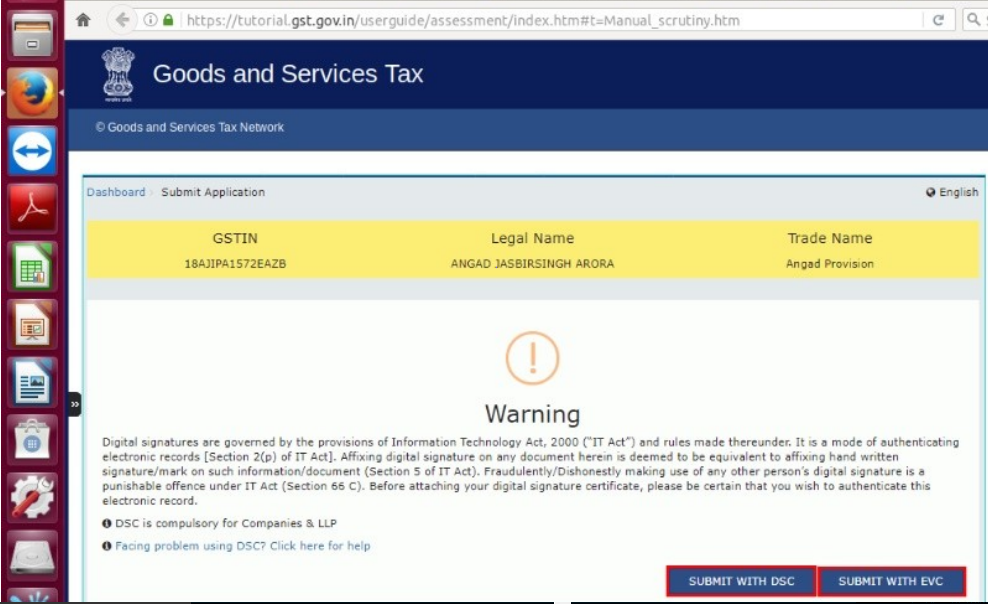

11. Click on SUBMIT WITH EVC or SUBMIT WITH DSC, as the case may be.

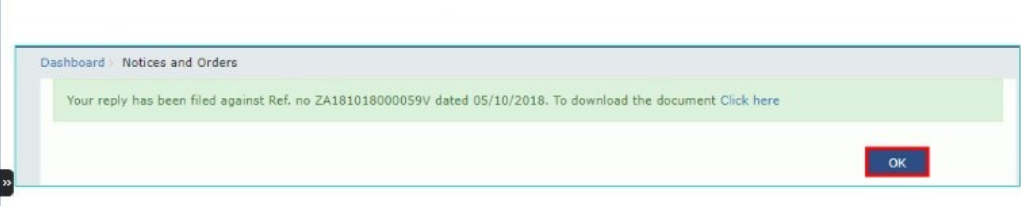

12. The taxpayer will receive a message like ↓

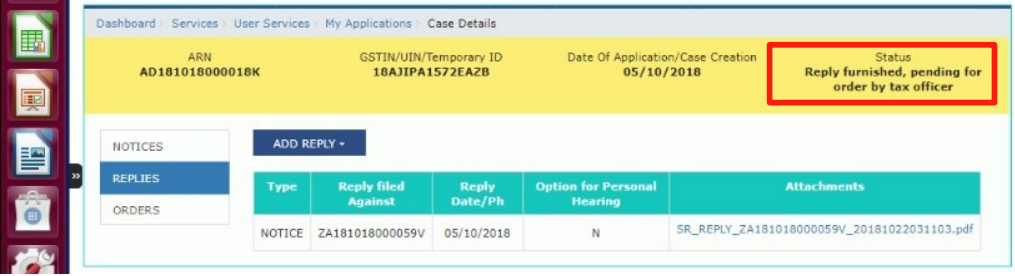

13. The status will be changed to Reply furnished, pending for order by the tax officer

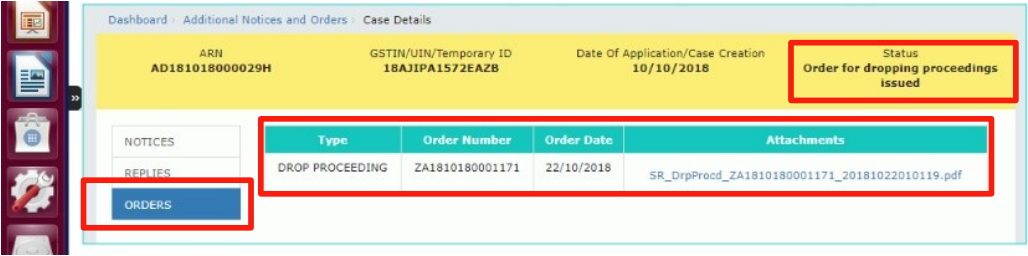

14. If proper officer accepts the reply, he will issue Order of acceptance of reply against the notice issued under section 61 in FORM GST ASMT-12. The order will be available under ORDERS and the status will be changed to Order for dropping proceedings issued.

15. If the reply is not accepted, the proper officer will recommend the case to proceed with Sec. 65 or 66 or 67 or 73 or 74. The said action of the proper officer will not be reflected in the common portal for the time being.

Related Topic:

How to file a reply in form GST ASMT-11?

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.