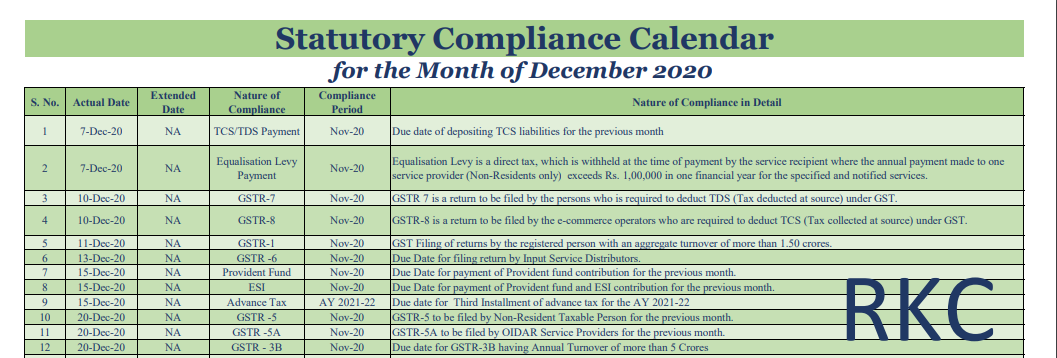

Statutory Compliance Calendar for the Month of December 2020

Statutory Compliance Calendar for the Month of December 2020

| S. No. | Actual Date | Extended Date | Nature of Compliance | Compliance Period | Nature of Compliance in Detail |

| 1 | 7-Dec-20 | NA | TCS/TDS Payment | Nov-20 | Due date of depositing TCS liabilities for the previous month |

| 2 | 7-Dec-20 | NA | Equalisation Levy Payment | Nov-20 | Equalisation Levy is a direct tax, which is withheld at the time of payment by the service recipient where the annual payment made to one service provider (Non-Residents only) exceeds Rs. 1,00,000 in one financial year for the specified and notified services. |

| 3 | 10-Dec-20 | NA | GSTR-7 | Nov-20 | GSTR 7 is a return to be filed by the persons who is required to deduct TDS (Tax deducted at source) under GST. |

| 4 | 10-Dec-20 | NA | GSTR-8 | Nov-20 | GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST. |

| 5 | 11-Dec-20 | NA | GSTR-1 | Nov-20 | GST Filing of returns by the registered person with an aggregate turnover of more than 1.50 crores. |

| 6 | 13-Dec-20 | NA | GSTR -6 | Nov-20 | Due Date for filing return by Input Service Distributors. |

| 7 | 15-Dec-20 | NA | Provident Fund | Nov-20 | Due Date for payment of Provident fund contribution for the previous month. |

| 8 | 15-Dec-20 | NA | ESI | Nov-20 | Due Date for payment of Provident fund and ESI contribution for the previous month. |

| 9 | 15-Dec-20 | NA | Advance Tax | AY 2021-22 | The due date for the Third Installment of advance tax for the AY 2021-22 |

| 10 | 20-Dec-20 | NA | GSTR -5 | Nov-20 | GSTR-5 to be filed by Non-Resident Taxable Person for the previous month. |

| 11 | 20-Dec-20 | NA | GSTR -5A | Nov-20 | GSTR-5A to be filed by OIDAR Service Providers for the previous month. |

| 12 | 20-Dec-20 | NA | GSTR – 3B | Nov-20 | The due date for GSTR-3B having an Annual Turnover of more than 5 Crores |

| 13 | 22-Dec-20 | NA | GSTR – 3B | Nov-20 | Due Date for filing GSTR – 3B which Annual Turnover up to 5 Crore State 1 Group (Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu, and Dadra & Nagar Haveli, Puducherry, Andaman, and Nicobar Islands, Lakshadweep) |

| 14 | 24-Dec-20 | NA | GSTR – 3B | Nov-20 | Due Date for filing GSTR – 3B which Annual Turnover up to 5 Crore State 2 Group (Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh, Delhi) |

| 15 | 30-Sep-20 | 31-Dec-20 | GSTR-9 | FY 2018-19 | Taxable Persons paying tax under Section 10 of the CGST Act, the composition scheme, are required to submit their annual returns in Form GSTR 9A. |

| 16 | 30-Sep-20 | 31-Dec-20 | GSTR 9A | FY 2018-19 | Taxable Persons paying tax under Section 10 of the CGST Act, the composition scheme, are required to submit their annual returns in Form GSTR 9A. |

| 17 | 30-Sep-20 | 31-Dec-21 | GSTR-9B | FY 2018-19 | Annual Return to be filed by e-commerce operators who have filed GSTR 8 during the financial year. |

| 18 | 30-Sep-20 | 31-Dec-20 | GSTR 9C | FY 2018-19 | Taxpayers whose annual turnover exceeds INR 5 crores in a Financial Year are required to get their accounts audited by a practicing Chartered Accountant or Cost Accountant before filing returns in Form GSTR 9C. |

| 19 | 31-Jul-20 | 31-Dec-20 | ITR | FY 2019-20 | Filing of income tax for individual and non-corporate [who are not subject to tax audit] |

| 20 | 30-Sep-20 | 31-Dec-20 | Form 3CA/3CB & 3CD | FY 2019-20 | Report to be furnished for Tax Audit under Income Tax Act, 1961 |

| 21 | 30-Nov-20 | 31-Dec-20 | Form 3CEB | FY 2019-20 | Report being furnished in respect of the international transaction and specified domestic transaction. |

| 22 | 30-Sep-20 | 31-Dec-20 | AGM due date | FY 2019-20 | Due date of AGM held by Company |

| 23 | 30-Sep-20 | 31-Dec-20 | DIR 3 (KYC) | FY 2019-20 | Form to ensure that correct particulars of an individual holding DIN are available with the Ministry of Corporate Affairs |

| 24 | 30-May-20 | 31-Dec-20 | Form LLP-11 | FY 2019-20 | Annual Return of Limited Liability Partnership (LLP) |

Related Topic:

Due Date Compliance Calendar JULY 2021

CA Rohit Kapoor

CA Rohit Kapoor

Delhi, India

CA Rohit Kapoor is a member of the Institute of Chartered Accountants of India (ICAI) and has vast experience in Direct Taxes with the working experience of 8+ Years. Rohit has also delivered Sessions in the Workshops, Training Session, etc. organized by RSMS, RAK, BCI, PSF, etc. He is also on the Board of Various Public Companies and National Level NGOs.