Supply of diesel in O&M contract is not chargeable to ST- CESTAT

Brief of the case-

The appellant is providing operation and maintenance service to mobile tower companies. It pays service tax on such activity. It is also engaged in filling diesel in power generators. A demand of service tax of over Rs.5 crores was raised on the cost of diesel supplied by the appellant, along with interest and equivalent penalty. Hence, appeal.

Hon’ble CESTAT, Allahabad set aside the order and allowed the appeal. It held that: (i) supply of diesel is an independent supply and not part of operation and maintenance; (ii) supply of diesel is supply of goods and section 67 applies to gross amount charged for provision of “such service”; (iii) it is a reimbursement of cost of diesel; (iv) follows decision in Gangapti Associates, though holding that the said decision is for period prior to amendment to section 67 in 2015, the principles there would apply.

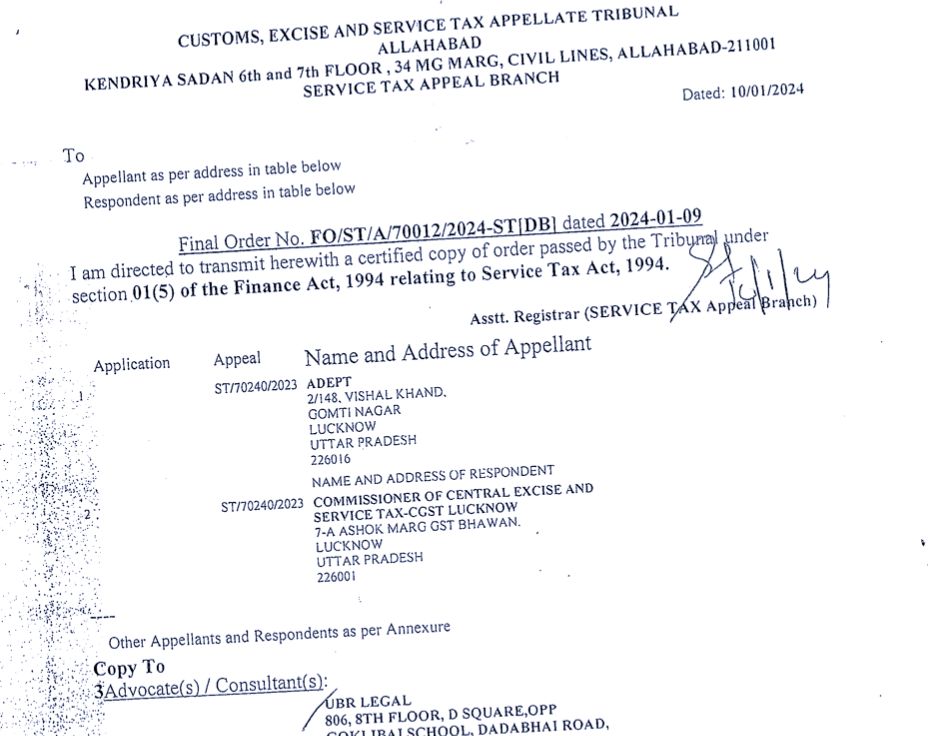

Argued by Adv. Bharat Raichandani along with Adv. Dileep Kumar Srivastava i/b UBR Legal

Read/download the judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.