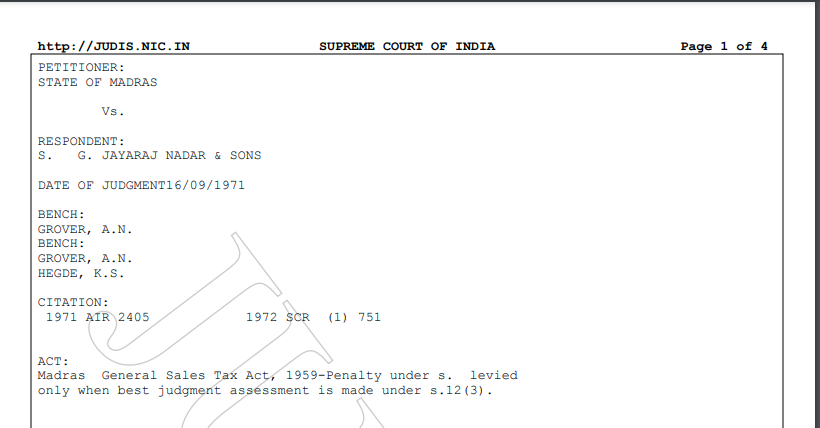

Supreme Court in the case of State of Madras V/s. S. G. Jayaraj Nadar & Sons

Table of Contents

Case Covered:

State of Madras

Versus

S. G. Jayaraj Nadar & Sons

Headnote:

The assessee was a dealer in motor vehicles and spare parts and certain other goods. During the assessment proceedings under the Madras General Sales Tax Act, 1959 it was found inter alia that the assessee had not included in the monthly return in Form A-2, three items of turnover, namely, delivery charges relating to motor vehicles purchased by the assessee from Calcutta dealers, sales of motor parts, and sales of firewood. The assessment was made overlooking the assessee’s objections in respect of the inclusion of these items in the turnover. The Commercial Tax Officer also imposed a penalty on the assessee. The Appellate Assistant Commissioner reduced the penalty to a nominal figure. The Board of Revenue set aside the appellate order holding that assessee did not deserve lenient treatment. The High Court in reference held that penalty was leviable only in respect of the second item in respect of which the best judgment assessment had been made but not in respect of the first and third items in respect of Which the figures in the books had been accepted. In appeal by the Revenue,

HELD: The High Court came to the correct conclusion because sub-ss. (2). and (3) of s. 12 have to be read together. Sub-section (2) empowers the assessing authority to assess the dealer to the best of its judgment in the events : (i) if no return has been submitted by the dealer under sub-s. (1) within the prescribed period and (ii) if the return submitted by him appears to be incomplete and incorrect. Subsection (3) empowers the assessing authority to levy the penalty only when it makes an assessment under sub-s. (2). In other words, when the assessing authority has made the assessment to the best of its judgment it can be a penalty. When account books are accepted along with other records there can be no ground for making the best judgment assessment. [753 C-G]

State of Kerala v. C. Velukutty, 17 S.T.C., referred to. In the present case, the High Court rightly found that the turnovers involved in the first and third items were not determined on the basis of any estimate of best judgment since the quantum of turnovers in respect of both these items were based on the assessee’s books. The penalty thus could not be levied in respect of these two items. [753 H754 B]

The appeal must accordingly fail.

Judgment:

CIVIL APPELLATE JURISDICTION: Civil Appeal No. 1404 of 1969.

Appeal by special leave from the judgment and order dated July 4, 1967, of the Madras High Court in Tax Case No. 210 of 1964.

S. T. Desai, A. V. Rangam, and A. Subashini, for the appellant.

T. A’. Ramachandran, for the respondent. The Judgment of the Court was delivered by Grover, J. This is an appeal from a judgment of the Madras High Court in a matter arising out of the Madras General Sales Tax Act 1959, hereinafter called the “Act”. The assessee is a dealer in motor cars, trucks, scooters, motor spare parts, and certain other goods. He returned a turn,.over of Rs. 42,09,912.12 for the assessment year 1961-

62. The Commercial Tax Officer on scrutiny of accounts determined the turnover at Rs. 68,06,331.49. During the assessment proceedings, it was found that the assessee had not included in the monthly return in Form A-2, three items of turnover. The first was a sum of Rs. 1,95,311.21 relating to delivery charges which the assessee had paid to certain Calcutta dealers from whom he had made purchases of cars, trucks, scooters, etc. The second item was Rs. 2,21,247.97 which related to the sales of motor parts. The third item was Rs. 1,56,539.25 being the aggregate of the sale proceeds of firewood. The assessing authority served a notice on the assessee to show cause why these items should not be brought to tax. The assessee filed objections that were rejected. The assessing authority found that the delivery charges paid by the assessee were included in the cost price when the cars, trucks, scooters, etc. were sold by it and sales tax at 7% had been collected by the assessee on the delivery charges. As regards the second item it was held that the assessee had failed to maintain separate accounts contrary to the rules in respect of the first sales of parts and as it was not possible to separate the first sales from the general entries in the account books it was necessary to make an assessment on last judgment. The assessment was completed but a certain penalty was levied On the assessee. The assessee appealed to the Appellate Assistant Commissioner who took the view that the failure of the assessee to disclose the taxable turnover in the monthly returns was due to a bona fide impression on the assessee’s part that it would be sufficient if correct figures were furnished at the time of the final assessment. He, therefore, imposed a nominal penalty. The Board of Revenue in the exercise of its power under S. 34 of the Act set aside the order of the Appellate Assistant Commissioner. According to the Board’s findings, the failure of the assessee to disclose the turnover in question was deliberate and called for no lenient treatment. An appeal was filed against the order of the Board of Revenue to the Madras High Court. The High Court allowed the appeal so far as the first and third items were concerned. As regards the second item it decided against the assessee.

Section 12(2) of the Act is in the following terms “If no return is submitted by the dealer under subsection (1) within the prescribed period, or if the return, submitted by him appears to the assessing authority to be incomplete or incorrect, the assessing authority shall, after making such inquiry as it may consider necessary, assess the dealer to the best of its judgment :

Provided that before taking action under this subsection the dealer shall be given a reasonable opportunity of proving the correctness or completeness of any return submitted by him”.

The question is whether a penalty can be levied while making the assessment under sub-s. (2) of the above section merely because an incorrect return has been filed. The High Court was of the view that it is only if the assessment has to be made, to the best of the judgment of the assessing authority that penalty can be levied. It seems to us that the High Court came to the correct conclusion because sub-ss. (2) and (3) have to be read together. Subsection (2) empowers the assessing authority to assess the dealer to the best of its judgment in two events; (i) if no return has been submitted by the dealer under sub-s. (1) within the prescribed period and (ii) if the return submitted by him appears to be incomplete or incorrect. Sub-section (3) empowers the assessing authority to levy the penalty only when it makes an assessment under sub-s. (2). In other words, when the assessing authority has made the assessment to the best of its judgment, it can levy a penalty. It is well known that the best judgment assessment has to be on an estimate which the assessing authority has to make not capriciously but on settled and recognized principles of justice. An element of guesswork is bound to be present in best judgment assessment but it must have a reasonable nexus, to the available material and the circumstances of each case. (See The State of Kerala v. C. Velukutty) (1) Where account books are accepted along with other records there can be no ground for making the best judgment assessment. In the present case, the High Court found that the turnovers involved in the first and the third items were not determined on the basis of any estimate of best judgment. The quantum of turnovers in respect of both these items was based on the assessee’s account books. It has almost been conceded on behalf of the Revenue before us that the determination of the turnovers relating to the aforesaid two items was made from the entries in the books (1) 17 S.T.C.

14-L3SupCI/72, of account of the assessee. The true position, therefore, was that certain items which had not been included in the turnover shown in the returns filed by the assessee were discovered from his own account books and the assessing authority included those items in his total turnover. For these reasons the High Court was justified in holding that the assessment of the first and the third items could not be regarded as based on best judgment. The penalty thus, could not be levied in respect of those two items. As a result, the appeal fails and it is dismissed with costs. G.C. Appeal dismissed.

Related Topic:

Supreme Court in the case of Jayant Versus The State of Madhya Pradesh

Read & Download the Copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.