Supreme Court in the case of M/s Brindavan Beverages (P) Ltd.

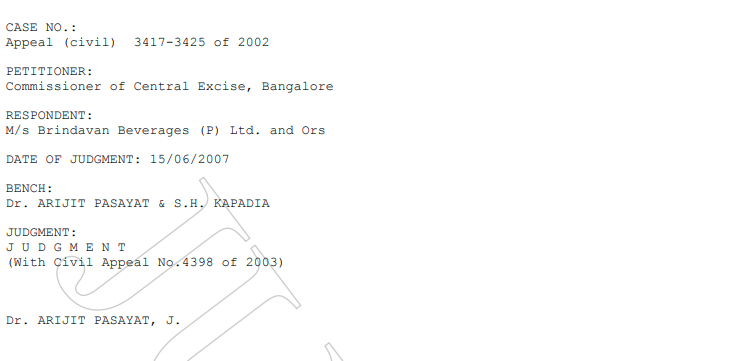

CASE NO.: Appeal (civil) 3417-3425 of 2002 PETITIONER: Commissioner of Central Excise, Bangalore RESPONDENT: M/s Brindavan Beverages (P) Ltd. and Ors DATE OF JUDGMENT: 15/06/2007 BENCH: Dr. ARIJIT PASAYAT & S.H. KAPADIA JUDGMENT: J U D G M E N T (With Civil Appeal No.4398 of 2003) Dr. ARIJIT PASAYAT, J. 1. Challenge in these appeals is to the judgment of the Customs, Excise and Gold (Control) Appellate Tribunal, Bangalore (in short the ’CEGAT’). By the impugned judgment appeals filed by the revenue against the common order of Commissioner of Central Excise, Bangalore (in short the ’Commissioner’) was dismissed. The Commissioner had dropped the proceedings initiated vide a show cause notice dated 4.5.1995 relating to availability of exemption under Notification Nos. 175/86 and 1/93. 2. Background facts, as projected by the appellant are as follows:- Vide the Show Cause notice, it was alleged that M/s Brindavan Beverages Pvt. Ltd., (hereinafter referred to as ’BBPL’) who were engaged in the manufacture of aerated water and were the franchise holders to M/s. Parley Exports Ltd. (hereinafter referred to as PEL) in whose brand names they had manufactured goods viz., Limca, Thums Up, Gold Spot, had also manufactured aerated water in the name and style of Citra which was said to be brand name of M/s. Limca Flavours and Fragrances Ltd., (hereinafter referred to as ’LFFL’), a holding Company of M/s. PEL. They had also manufactured goods under the brand name of "Bisleri Club Soda" with the permission of M/s. Acqua Minerale (P) Ltd. (hereinafter referred to ’AMPL’] and they had availed and paid duty under exemption notification 175/86 and 1/93, for the said Citra and Bisleri Club Soda bottles, claiming that the brand name owners, were registered with the Directorate of Industries as a Small Scale Unit and, therefore, they were also eligible for exemption under the said Notifications. On the basis of intelligence gathered that M/s Parley Exports Ltd., and Parley International Ltd., (hereinafter referred to as ’PEL and PIL’ respectively] were under-valuing the concentrate and thereby evading central excise duty, investigations were caused to be made by Officers of Directorate General of Anti-evasions and the Central Excise Jurisdictional Officers. Enquiries were caused and statements were recorded and pursuant to the said operations, according to Revenue, M/s BBPL availed the SSI exemption fraudulently in the conspiracy with AMPL and PEL by willfully making a misstatement and suppressing correct facts and central excise duty amounting to Rs.39,51,028/- for the period from July 1993 to January 1994 was demandable by invoking the longer period of limitation provided under the Central Excise Act, 1944 (in short the ’Act’). It was also found that the Assistant Collector had passed an order permitting BBPL, SSI exemption on "Bisleri Club Soda" and "Citra". However, it was noticed that the facts disclosed in the enquiries conducted were not placed before the Assistant Collector in as much as the investigations conducted revealed that PEL are the owners of brand name such as "Bisleri" for club soda and "Citra" and LFFL was under- evaluating the goods to keep the turn-over below the exemption limits. It was also alleged that LFFL who own "Citra" brand were engaged in the manufacture of flavours in their factory at Ahmedabad had availed exemption of the SSI Notifications as amended and had permitted franchise of small users the "Citra" brand name on terms and conditions and consequently the franchise also started availing the SSI benefit which was not eligible as the investigations revealed that "Citra" was developed and launched by the R & D efforts of PEL and was got registered as a brand name of LFFL. It was alleged that they have deliberately fragmented the manufacture of flavours to avail the benefit. The Parle Group Management, centrally and commonly, controlled the production including all aspects thereof were managed and controlled by the executives of PEL. If the shelter of corporate veil was lifted and removed, then it was seen that for purposes of other taxes it was one, but for notifications under Central Excise, they were shown as separate persons. Therefore, the value of clearance of all excisable goods removed from PEL, PIL and LFFL were to be taken together to determine the eligibility of LFFL. The benefits which LFFL were availing of the SSI claimed by them were not available to them and since there was a deliberate fragmentation of manufacture to avail SSI exemption, the benefit of exemption on "Citra" was not eligible. Therefore, excise duty amounting to Rs.79,48,115/- for the period October 1990 to January 1994 in respect of "Citra" was demandable by invoking the longer period of limitation in view of the deliberate suppression of facts. 3. Noticees submitted their replies. On consideration of the submissions, proceedings initiated on the basis of the show cause notice dated 4.5.1995. Revenue preferred appeals before the CEGAT. 4. After considering the rival submissions, the CEGAT held that the order of the Commissioner dropping the proceedings did not suffer from any infirmity. 5. The CEGAT did not find any substance in this plea as there was no such brand name as "Bisleri Club Soda" which has been registered by the Trade Mark Authorities. What was registered for use under the Trade Marks Act is the word "Bisleri" for goods "soda" being aerated water and words "Bisleri for Bear and non-alcoholic beverages and syrups". The CEGAT found that no evidence was brought on record to indicate the words as used exist as a trade mark or any other marks belonging to another person who is not entitled to the benefits under the Notification. 6. In support of the appeals, learned counsel for the appellant submitted that the CEGAT has lost sight of the fact that there was necessity to lift the corporate veil and find out as to who was the real owner of the brand name. It was submitted that the supervision and the decision making power lay with somebody else and not the respondents. 7. Mr. A. Subba Rao, learned counsel for the appellant has submitted that respondent BBPL had the franchise of M/s Parley Exports Ltd. under whose brand name they had manufactured aerated water in the brand names of Limca, Thums Up and Gold Spot. Respondent had also manufactured aerated water in the name and style of Citra said to be the brand name of M/s. Limca Flavours and Fragrances Ltd., a holding company of PEL in which 50% shares are held each by Shri Ramesh J. Chauhan and Shri Prakash J Chauhan both of whom happened to be brothers. Additionally, the respondents also manufactured goods under the brand name of "Bisleri Club Soda" with the permission of M/s Acqua Minerals (P) Ltd., New Delhi. With reference to the various positions and as Directors in LFFL, PEL, AMPL, PIL, Apex Traders, M/s Coolade Beverages (P) Ltd. And M/s Delhi Bottling Co. Ltd. it is submitted that either Shri Ramesh J Chauhan or Prakash J Chauhan or persons related to him or being members of the Board of Directors of various companies had right to create facet to avail the benefits under the Notification in question. Since these concerns could not have availed the benefits they have created dummy concerns to avail the benefits. It is submitted that in the circumstances there was necessity to lift the corporate veil to find out the true owners. 8. Per contra, learned counsel for the respondents submitted that there is no material that the respondents had ever been parties to the so called arrangement, even if it is accepted for the sake of arguments but not conceded, that such arrangement was in reality made. There was no material brought on record to show that the respondents had any role to play in such matters as alleged. Even the show cause notice did not refer to any particular material to come to such a conclusion. Therefore, the Commissioner and the CEGAT were justified in holding that the respondents were entitled to the benefits. 9. We find that in the show cause notice there was nothing specific as to the role of the respondents, if any. The arrangements as alleged have not been shown to be within the knowledge or at the behest or with the connivance of the respondents. Independent arrangements were entered into by the respondents with the franchise holder. On a perusal of the show cause notice the stand of the respondents clearly gets established. 10. There is no allegation of the respondents being parties to any arrangement. In any event, no material in that regard was placed on record. The show cause notice is the foundation on which the department has to build up its case. If the allegations in the show cause notice are not specific and are on the contrary vague, lack details and/or unintelligible that is sufficient to hold that the noticee was not given proper opportunity to meet the allegations indicated in the show cause notice. In the instant case, what the appellant has tried to highlight is the alleged connection between the various concerns. That is not sufficient to proceed against the respondents unless it is shown that they were parties to the arrangements, if any. As no sufficient material much less any material has been placed on record to substantiate the stand of the appellant, the conclusions of the Commissioner as affirmed by the CEGAT cannot be faulted. 11. Therefore, on the facts noticed by the Commissioner and the CEGAT, there is no scope for interference in these appeals which are accordingly dismissed. There will be no order as to costs.

Download the copy:

Related Topic: Brief Note on Lifting the Corporate Veil

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.