Tax Deducted at Source (TDS) Rates Applicable from 01st April 2020

Table of Contents

- Tax Deducted at Source (TDS) Rates Applicable from 01st April 2020

- Related Topic: Format of Declaration to be taken from Salaried Employee by Employer to deduct TDS in Old or New IT Slab Rates

- New Turnover limit for the purpose of Tax deducted at Source applicability as per Finance Act 2020

- Download the copy:

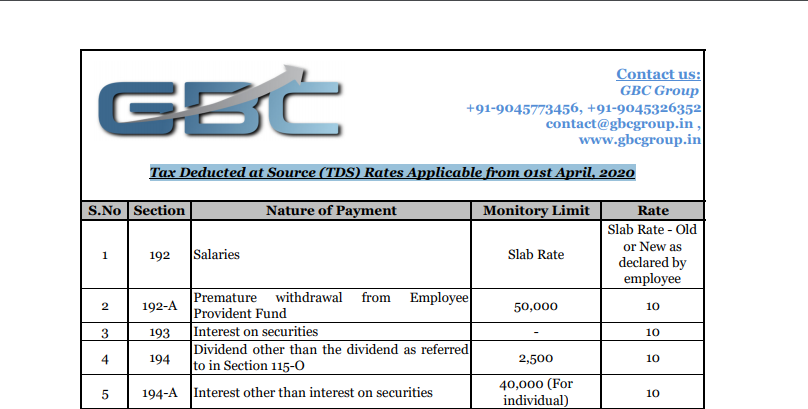

Tax Deducted at Source (TDS) Rates Applicable from 01st April 2020

| S.No | Section | Nature of Payment | Monetary Limit | Rate |

| 1 | 192 | Salaries | Slab Rate | Slab Rate – Old or New as declared by the employee |

| 2 | 192-A | Premature withdrawal from Employee Provident Fund | 50,000 | 10 |

| 3 | 193 | Interest on securities | _ | 10 |

| 4 | 194 | Dividend other than the dividend as referred to in Section 115-O | 2,500 | 10 |

| 5 | 194-A | Interest other than interest on securities | 40,000 (For individual)

50,000 (for Senior Citizens) |

10 |

| 6 | 194-A | Banks (Time deposits) | 40,000 (For individual)

50,000 (for Senior Citizens) |

10 |

| 7 | 194-A | Banks (Recurring deposit) | 40,000 (For individual)

50,000 (for Senior Citizens) |

10 |

| 8 | 194-A | Deposit in Co-operative Bank | 40,000 (For individual)

50,000 (for Senior Citizens) |

10 |

| 9 | 194-B | Winning from Lotteries | 10,000 | 30 |

| 10 | 194-BB | Winnings from Horse Race | 10,000 | 30 |

| 11 | 194-C | Payment to Contractor | 30,000 ( Single Transaction) 1,00,000 (Aggregate During the Financial year) | 1 (for Individual)

2 (for other than individual) |

| 12 | 194-C | Payment to Transporter not covered under 44AE | 30,000 ( Single Transaction) 75,000 (Aggregate During the Financial year) | 1 (for Individual)

2 (for other than individual) |

| 13 | 194-D | Insurance Commission | 15,000 | 5 |

| S.No | Section | Nature of Payment | Monetary Limit | Rate |

| 14 | 194-DA | Payment in respect of life insurance policy | 1,00,000 | 1 |

| 15 | 194-E | Payment to Non-resident Sportsmen or Sports Association | _ | 20 |

| 16 | 194-EE | Payments out of deposits under National Savings Scheme | 2,500 | 10 |

| 17 | 194-F | Repurchase Units by Mutual Funds | _ | 20 |

| 18 | 194-G | Commission – Lottery | 15,000 | 5 |

| 19 | 194-H | Commission / Brokerage | 15,000 | 5 |

| 20 | 194-I | Rent – Land and Building – furniture & fittings | 2,40,000 | 10 |

| 21 | 194-I | Rent – Plant / Machinery / equipment | 2,40,000 | 2 |

| 22 | 194-IA | Transfer of certain immovable property other than agriculture land | 50,00,000 | 1 |

| 23 | 194-IB | Rent – Land or building or both | 50,000 Per Month | 5 |

| 24 | 194-IC | Payment of Monetary consideration under Joint development agreement | _ | 10 |

| 25 | 194-J | Professional Fees for technical services (w.e.f. from 1.4.2020) | 30,000 | 2 |

| 26 | 194-J | Professional Fees – in all other cases | 30,000 | 10 |

| 27 | 194-K | Payment of any income in respect of Units of Mutual fund as per section 10(23D) or Units of administrator or from a specified company | _ | 10 |

| 28 | 194-LA | TDS on compensation for compulsory acquisition of immovable Property | 2,50,000 | 10 |

| 29 | 194- LBA(1) | Business trust shall deduct tax while distributing, any interest received or receivable by it from a SPV or any income received from renting or leasing or letting out any real estate asset owned directly by it, to its unit holders. | _ | 10 |

| 30 | 94- LBA(1) | Income by way of interest from infrastructure debt fund (non-resident) | _ | 10 |

| 31 | 194-LBB | Income in respect of investment in Securitisation trust. | _ | 10 (for Individual) 30 (for other than individual) |

| 32 | 194-LBC | Income in respect of investment made in a securitisation trust | _ | 25 (for Individual) 30 (for other than individual) |

| S.No | Section | Nature of Payment | Monetary Limit | Rate |

| 33 | 194-LC | Income by way of interest by an Indian specified company to a non-resident / foreign company on foreign currency approved loan / long term infrastructure bonds from outside India | _ | 5 |

| 34 | 194-LD | Interest on certain bonds and govt. Securities | _ | 5 |

| 35 | 194-M | Payment of Commission, brokerage, contractual fee, professional fee to a resident person by an Individual or a HUF who are not liable to deduct TDS under section 194C, 194H, or 194J. | 50,00,000 | 5 |

| 36 | 194-N | Cash withdrawal in excess of Rs. 1 crore during the previous year from one or more accounts maintained by a person with a banking company, co-operative society engaged in business of banking or a post office. | 1,00,00,000 | 2 |

| 37 | 194-O | Applicable for Ecommerce operator for sale of goods or provision of service facilitated by it through its digital or electronic facility or platform. | _ | 1 |

| 38 | 195 | Payment of any sum to Non resident | _ | |

| 39 | 196-B | Income from units | _ | 10 |

| 40 | 196-C | Income from foreign currency bonds or GDR (including long-term capital gains on transfer of such bonds) (not being dividend) | _ | 10 |

| 41 | 196-D | Income of FIIs from securities | _ | 10 |

Related Topic:

Format of Declaration to be taken from Salaried Employee by Employer to deduct TDS in Old or New IT Slab Rates

New Turnover limit for the purpose of Tax deducted at Source applicability as per Finance Act 2020

TDS was applicable to individuals and HUF if their accounts are liable to Audit in section 44AB in the previous year.

The Finance Act 2020, says All individuals & HUF will be liable to deduct TDS if the turnover had cross Rs. 1 Crore in case of business and Rs. 50 Lakhs in case of profession in previous year.

These amendments shall take effect from 1st April 2020.

Download the copy:

CA Mohit Bansal

CA Mohit Bansal

Extending Expertise

New Delhi, India