Tax on online gaming big judgement and its after effects (Pdf Attach)

Latest update- GST council in it’s 50th Meeting changed the provisions related to the online gaming. New definition is inserted. The tax rate on online gaming will be 28%. This was to nullify the effect of the this judgement. The provisions are passed by the parliament and will be applicable from the notified date.

Table of Contents

Cases Covered:

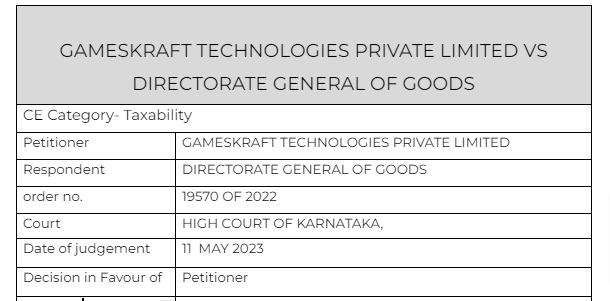

GAMESKRAFT TECHNOLOGIES PRIVATE LIMITED VS DIRECTORATE GENERAL OF GOODS

Citations:

- Whirlpool Corporation vs. Registrar General

- Linde Engineering Pvt. Ltd., vs. Union of India

- Calcutta Discount Co., Ltd., vs. Income Tax Officer

- Magadh Sugar and Energy Ltd., vs. State of Bihar

- Director General of Foreign Exports vs. Kanak Exports –(2016)

- Collector of Central Excise vs. ONGC – (1999) 1 SCC

- Narendra Udeshi vs. Union of India – (2002) SCC

- ORYX Fisheries vs. Union of India

- Spirotech Heat Exchangers vs. Union of India

- Topland Engines Pvt. Ltd., vs. Union of India –

- East India Commercial Co., Ltd., vs. Collector of Customs

- NKAS Services Pvt. Ltd., vs. State of Jharkhand

- Gurdeep Singh Sachar vs. Union of India – (2019)

- D.Krishna Kumar vs. State of A.P.

- Tamilnadu Housing Board vs. Collector of Central Excise

- Continental Foundation vs. Commissioner of Central Excise – (2007)

- Densons Pultretaknik vs. Commissioner of Central Excise

- Shreya Singhal vs. Union of India

- Shayara Bano vs. Union of India

- Twin Cities Cinema Cultural Centre vs. Commissioner of Police – 2002 SCC Online AP 691;

- Subramanyan Swamy vs. Union of India – (2016)

- Sunrise Associates vs. Government of NCT of Delhi

- Skill Loto Solutions Pvt. Ltd., vs. Union of India & Others – (2020) SCC Online SC 990;

- State of Rajasthan vs. Rajasthan Chemist Association – (2006) 6 SCC 773;

- Commissioner of Income Tax vs. Sun Engineering Works

- Kalabharathi Advertising vs. Hemanth Vimalnath Narichania – (2010) 9 SCC 437;

- Ratanlal Khare vs. State of M.P. – (1985)

- State of Rajasthan vs. Banwarlal Verma – 2001

- M/s. Filterco vs. Commissioner of Sales Tax

- Jitendra Kumar Singh vs. State of Uttar Pradesh

- Bombay Dyeing vs. Bombay Environmental Action Group – (2006)

- Continental Foundation vs. Commissioner of Central Excise

Facts of the case:

The Respondents have issued the Impugned SCN whereby it has been alleged that the Petitioner is involved in ‘betting/gambling’ and supplies ‘actionable claims’ and that the petitioner is guilty of evasion of GST by misclassifying their supply as services under SAC 998439 instead of actionable claims which are goods and mis-declaring their taxable value, though the – 18 – activities undertaken by the petitioner were in the form of betting/gambling which is an actionable claim and not a service.

His bank accounts were attached. Thus they filed this WRIT.

Observations & Judgement of the court

The honorable court ruled-

The subject Online/Electronic/Digital Rummy game and other Online/Electronic/Digital games played on the Petitioners’ platforms are not taxable as ‘Betting’ and ‘Gambling’ as contended by the respondents under the CGST Act and Rules or under the impugned show cause notice issued by the respondents;

Consequently, the impugned Show Cause Notice dated 23.09.2022 issued by the respondents to the petitioners is illegal, arbitrary and without jurisdiction or authority of law and deserves to be quashed.

Following was passed by the Court –

(i) W.P.No.19570/2022, W.P.No.19561/2022, W.P.No.20119/2022 and W.P.No.20120/2022 are hereby allowed;

(ii) The impugned Show Cause Notice dated 23.09.2022 issued by the respondents is hereby quashed;

(iii) W.P.No.22010/2021 and W.P.No.18304/2022 do not survive for consideration and the same are hereby disposed off;

(iv) All interim orders that were in force during the pendency of any of the petitions stand automatically dissolved.

Read & Download the Full GAMESKRAFT TECHNOLOGIES PRIVATE LIMITED VS DIRECTORATE GENERAL OF GOODS

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.