New tax rate list for composition dealers

New tax rate list for Composition dealers:

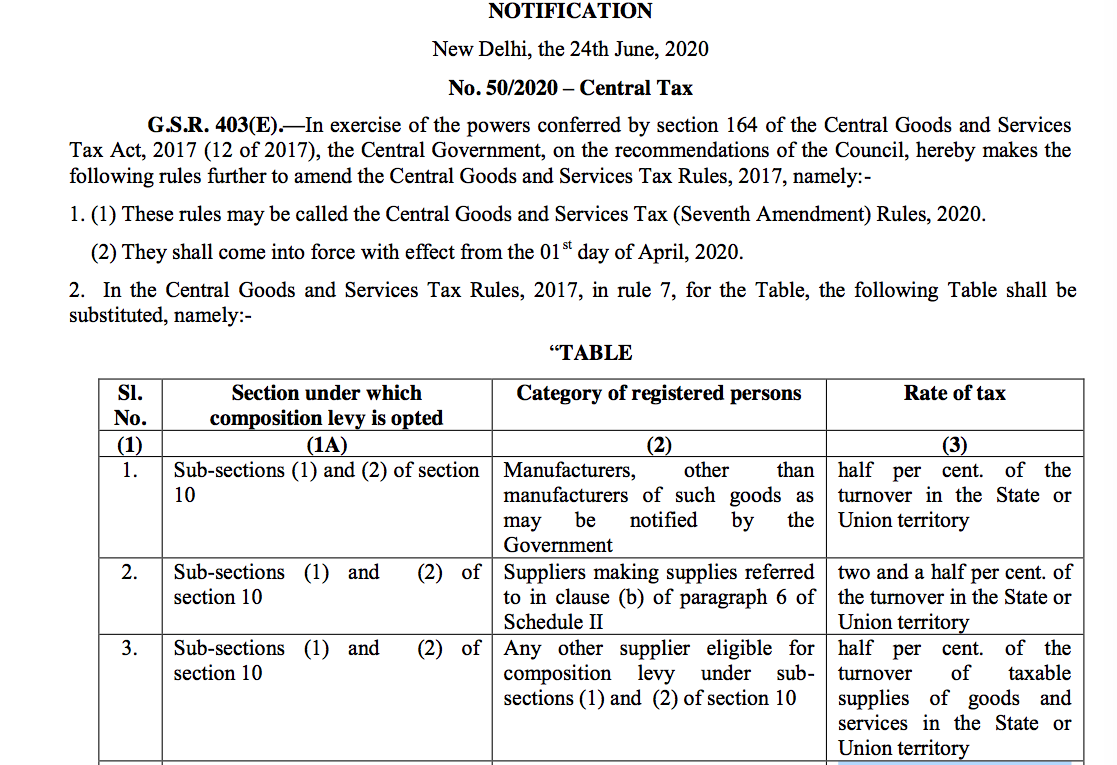

Rule 7 of CGST rules as amended. The new tax rate list is inserted into rules. Let us have a look at it.

| Type of Taxpayer | Tax rate |

|

Manufacturers, other than manufacturers of such goods as may be notified by the Government |

half percent. of the turnover in the State or Union territory |

|

Suppliers making supplies referred to in clause (b) of paragraph 6 of Schedule II |

two and a half percent. of the turnover in the State or Union territory |

|

Any other supplier eligible for composition levy under sub- sections (1) and (2) of section 10 |

half percent. of the turnover of taxable supplies of goods and services in the State or Union territory |

|

Registered persons not eligible under the composition levy under sub-sections (1) and (2), but eligible to opt to pay tax under sub-section (2A), of section 10 |

three percent. of the turnover of taxable supplies of goods and services in the State or Union territory. |

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.