TCS on Sales & Overseas Tour Program to be Effective from 01.10.2020

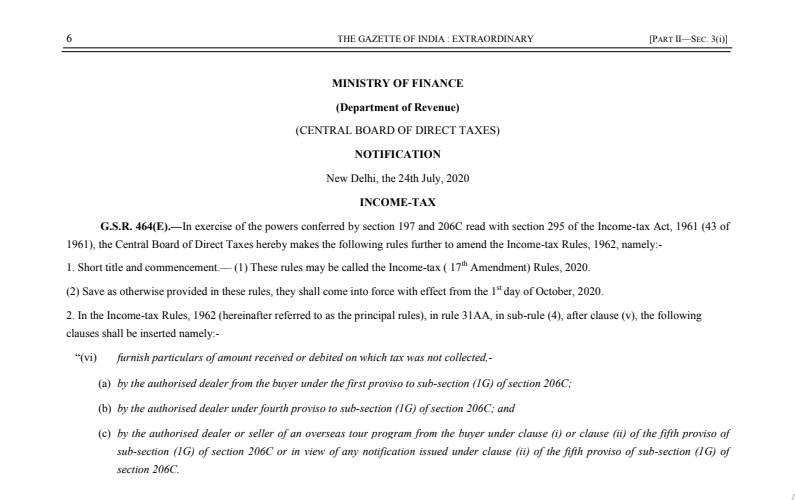

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 24th July 2020

INCOME-TAX

G.S.R. 464(E).—In exercise of the powers conferred by section 197 and 206C read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. Short title and commencement.–– (1) These rules may be called the Income-tax ( 17th Amendment) Rules, 2020.

(2) Save as otherwise provided in these rules, they shall come into force with effect from the 1st day of October 2020.

2. In the Income-tax Rules, 1962 (hereinafter referred to as the principal rules), in rule 31AA, in sub-rule (4), after clause (v), the following clauses shall be inserted namely:-

“(vi) furnish particulars of the amount received or debited on which tax was not collected,-

(a) by the authorized dealer from the buyer under the first proviso to sub-section (1G) of section 206C;

(b) by the authorized dealer under the fourth proviso to sub-section (1G) of section 206C; and

(c) by the authorized dealer or seller of an overseas tour program from the buyer under clause (i) or clause (ii) of the fifth proviso of sub-section (1G) of section 206C or in view of any notification issued under clause (ii) of the fifth proviso of sub-section (1G) of section 206C.

(vii) furnish particulars of the amount received or debited on which tax was not collected from the buyer,-

(a) under the second proviso to sub-section (1H) of section 206C; and

(b) under sub-clause (A) or sub-clause (B) or sub-clause (C), or in view of any notification issued under sub-clause (C), of clause (a) of the Explanation to sub-section (1H) of section 206C.”

3. In the principal rules, from the date of publication in the Official Gazette, in rule 37BC, in sub-rule (1), after the words “fees for technical services”, the words “, dividend” shall be inserted.

4. In the principal rules, in rule 37CA, the words, brackets, figures and letters ‘sub-section (1) or sub-section (1C)’, wherever they occur, shall be omitted.

5. In the principal rules, in rule 37-I, after sub-rule (2), the following sub-rule shall be inserted namely:-

“(2A) Notwithstanding anything contained in sub-rule (2), for the purposes of subsection (1F) or, sub-section (1G) or, sub-section (1H) of section 206C, credit for tax collected at source shall be given to the person from whose account tax is collected and paid to the Central Government account for the assessment year relevant to the previous year in which such tax collection is made”

Read & Download the Full Notification in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.