TDS provision under GST

TDS provision under GST

The concept of TDS is a simple concept incorporated under GST with the intent to tap the possible chances of revenue leakage and Prevent Tax Evasion. Under the Scheme, the recipient deducts tax at the notified rate from the payment due to the supplier and deposits the tax into the government treasury on behalf of the supplier. When the supplier files return, he can claim the credit of the tax paid by the recipient on his behalf. Section 51 of the CGST Act deals with the issue of TDS. Let us discuss in this article detailed analysis of TDS provisions. Let us discuss the TDS provision under GST.

Governing Provisions of TDS under GST

Section 51 of CGST Act, 2017

Rule 60(60) of CGST rules, 2017

Rule 66 of CGST Rules, 2017

With the Notification 50/2018 (Central Tax) Dated 13.09.2018, TDS under section 51 of the CGST Act is coming into force from 01.10.2018. Further Circular No. 65/39/2018-DOR, Dated the 14th September 2018 issued regarding procedural aspects.

Who will deduct the TDS :

As per Sec 51. (1) of CGST Act & Notification No. 50/2018 – Central Tax; 13th September 2018, following persons, are required to deduct TDS w.e.f 1st October 2018.

Download the full pdf on TDS provision under GST by clicking the below image:

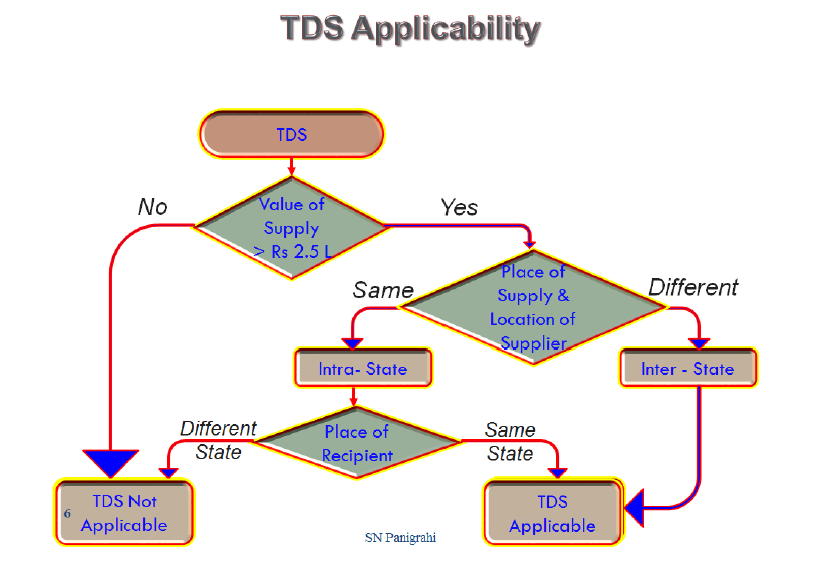

TDS Applicability:

As per Sec 51 of CGST Act TDS shall be deducted where the total value of supply of taxable goods or services or both under a contract, exceeds two lakh and fifty thousand rupees. Provided that no deduction shall be made if the location of the supplier and the place of supply is in a State or Union territory which is different from the State or as the case may be, Union territory of registration of the recipient.

For the purpose of deduction of tax specified above, the value of supply shall be taken as the amount excluding the central tax, State tax, Union territory tax, integrated tax, and cess indicated in the invoice.

Value of Supply on Which TDS shall be Deducted & Rate of TDS

As Explanation in Sec 51(1) of CGST Act, For purpose of deduction of TDS, the value of supply is to be taken as the amount excluding the tax indicated on the invoice. This means TDS shall not be deducted on the CGST, SGST or IGST component of invoice.

Rate of TDS

As per Sec 51(1) of CGST Act, CGST of 1% plus SGST of 1% or IGST of 2% will be deducted from the payment made or credited to the deductee.