TDS(tedious) and TCS Overall Analysis

Analysis of TDS provisions as per Income Tax Act (“the Act” or “IT Act”)

Salary Related – 192 AND 192A

| Section | Nature of payment | Payer | Payee | Rate | Remarks |

| 192 | Salary | Any person | Employee (R or NR) | Slab rate | Note 1 |

| 192A | Accumulated balance of a provident fund | Any person | Employee | 10% | 1. No TDS if amount < 5000

2. TDS applicable only if taxable in hands of the employee |

Liable to deducted @ time of payment

Note 1: a) Employees shall provide details of other income and loss if any from House property

b) Employees shall share income details from other employer, if any in Form 12B

c) Employees shall provide details of investments, deductions, and allowance along with documentary evidence

a) Rebate u/s 87A shall be claimed if the income does not exceed Rs 500,000/-

b) Employer is under no obligation to verify the documents submitted with respect to a declaration submitted

Related Topic:

Format of Declaration to be taken from Salaried Employee by Employer to deduct TDS in Old or New IT Slab Rates

a) Fees paid to consultant doctor covered u/s 192 or u/s 194J (BHC Grant Medical Foundation (Ruby Hall Clinic)). Contract for Service or Contract of Service

a) Salary paid to MP, MLA, Ministers & chief Ministers shall attract u/s 192 or not

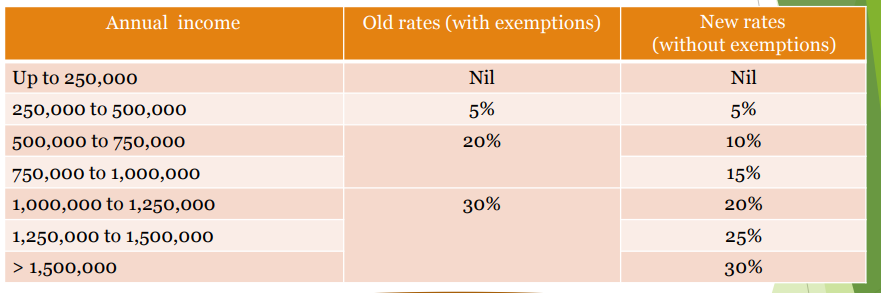

b) W.e.f April 1, 2021 employee can opt for concessional rates of taxes u/s 115BAC of IT Act

Salary Related – 115BAC

- Effective from April 1, 2021,

- concessional rate of income tax

- Conditions for opting 115BAC provisions

-Without any exemptions/deductions under provisions of the Income Tax Act

-Without any set-off of any loss

-Without any additional depreciation

- Assessee having business or professional income

-The option is exercised before due date u/s 139(1) of the Act

-From April 1, 2021, and for all subsequent assessment years

-Can be withdrawn only once in any other subsequent assessment years (except for the year opted)

-Once withdrawn shall never be eligible again for the same

- Assessee having income other than business or profession – can opt at the time of filing of ROI u/s 139(1)

Comparison Of Slab Rates

The assessee shall conduct comparable analysis to arrive at the best option for a tax deduction

Salary Related – LTC Cash Voucher Scheme

- An employee can purchase goods and services in lieu of the tax exempted portion of the Leave travel concession /allowance

- Employee need not take leave for this purpose nor undertake any travel

- This scheme is applicable to the LTC fare left unutilized during the block year

- Any goods or services with GST of 12% or higher rate would qualify

- The payment should have been made through digital mode

- The Purchase should been affects after 12.10.2020 and up to 31.03.2021

Read & Download the Full Copy in pdf:

CA Sangam Kumar Aggarwal

CA Sangam Kumar Aggarwal

Sangam Aggarwal is a seasoned Tax Practitioner, a Fellow member of ICAI and He has done his LLB in 2014 and has also qualified DISA along with Certificate Course in Concurrent Audit from ICAI. He has also acted as a Co-opted member of the Corporate & Allied Laws and Corporate Governance Committee of NIRC of ICAI (2019-20). He has 12+ years of rich and profound experience in the field of Taxation (Direct & Indirect) and Advisory. He makes Representations for a widely diversified cross-section of industries before Authority for Advance Rulings, CIT (A), ITAT, and other appropriate forums. Sangam Aggarwal has previously worked with IFFCO Tokio General Insurance Co. Ltd. as Manager in Finance & Accounts. He is currently the managing partner of in Chartered Accountants Firm. Sangam Aggarwal is visiting faculty of ICAI and have spoken on different forums of ICAI.