The department should issue tax intimation to the petitioner under Rule 142 (1A)

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

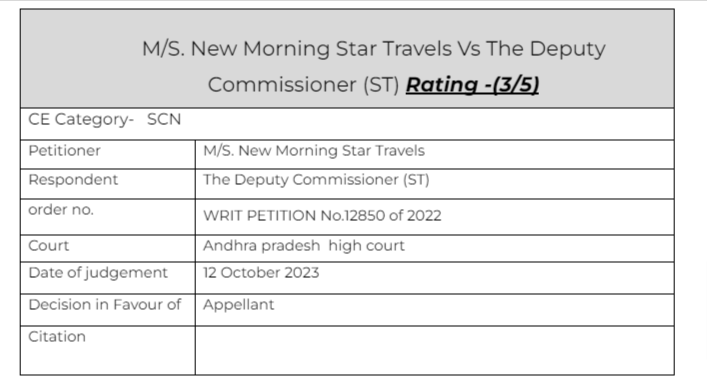

M/S. New Morning Star Travels Vs The Deputy Commissioner (ST)

Facts of the cases:

The challenge in the writ petition is to the order, dated 31.03.2022, which is a combined assessment order for tax, penalty and interest, passed by the 1st respondent for the assessment period from 01.07.2017 to 31.03.2020 for the financial year 2017-18, 2018-19, 2019-20 & 2020-21. Inter alia, the main thrust of argument of learned counsel for the petitioner is that no show cause notice was issued in terms of Rule 142 (1A) of the Central Goods and Services Tax (CGST) Rules, 2017, as per which, the proper officer shall, before service of notice to the person chargeable with tax, interest and penalty, under sub-Section (1) of Section 73 or sub-Section (1) of Section 74, as the case may be, communicate the details of any tax, interest and penalty as ascertained by the said officer, in Part A of Form GST DRC-01A. It is argued, in the said provision, which stood before amendment with effect from 15.10.2020, the word ‘shall’ is employed and therefore, issuance of communication before the service of notice under Section 74(1) is mandatory in terms of Rule 142 (1A) of the CGST Rules.

Observation & Judgement of the Court:

It is a trite law that whenever any ambiguity arises with regard to any provision, the benefit must go to the tax payer. In the instant case, since admittedly the tax period related to 01.07.2017 to 31.03.2021 which covers the pre and post amended period of Rule 142(1A), in our considered view, the 1st respondent ought to have issued tax intimation to the petitioner under Rule 142 (1A). Since it was not done, as rightly argued by the learned counsel for the petitioner, the assessment order, dated 31.03.2022, fell foul of law and is liable to be set aside.

Accordingly, the writ petition is allowed and the impugned assessment order, dated 31.03.2022, passed by the 1st respondent is set aside with a direction to the 1st respondent to issue a fresh tax intimation to the petitioner in terms of Rule 142(1A) (pre amended Rule 142 (1A)) within two weeks from the date of receipt of copy of this Order and take up further course of action as per law and pass appropriate orders. No costs.

Read & Download the Full M/S. New Morning Star Travels Vs The Deputy Commissioner (ST)

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.