The order to freeze account was set aside by Court (Pdf Attach)

Table of Contents

Cases Covered:

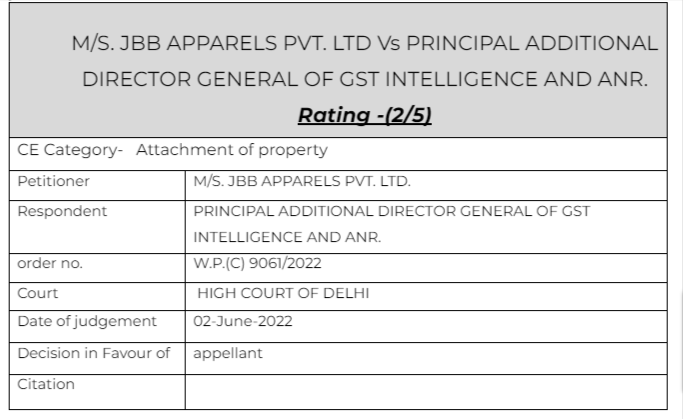

M/S. JBB APPARELS PVT. LTD Vs PRINCIPAL ADDITIONAL DIRECTOR GENERAL OF GST INTELLIGENCE AND ANR.

Facts of the cases:

The appellant’s bank accounts were freezed. They went to get it unfreezed

Observation & Judgement of the court:

There was a batch of petitions, in some cases, the bank accounts were already released by the banks. In other cases the court allowed it to unfreeze.

Read & Download the Full M/S. JBB APPARELS PVT. LTD Vs PRINCIPAL ADDITIONAL DIRECTOR GENERAL OF GST INTELLIGENCE AND ANR.

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.