Three important changes to remove RCM from importer implementing the Mohit Minerals Judgment

Table of Contents

- What was the Mohit Minerals Judgment?

- The amendments incorporated from 1-10-2023

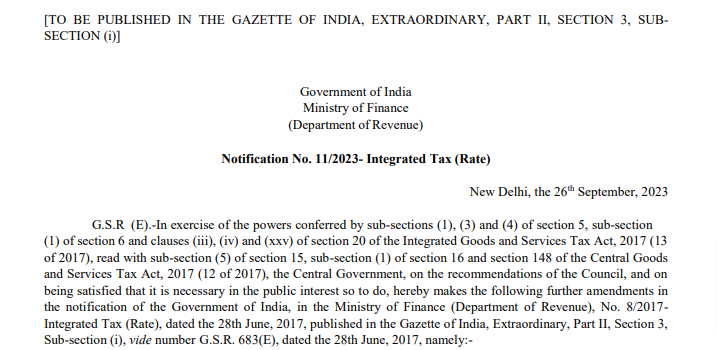

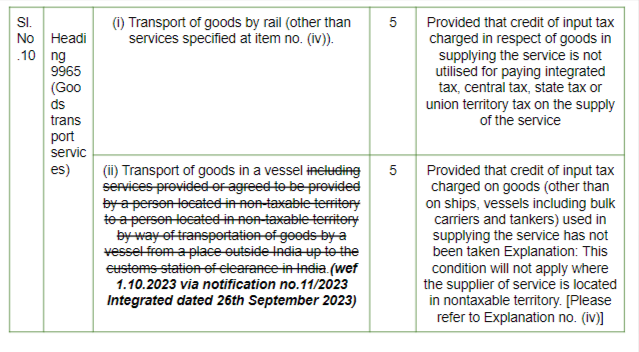

- Notification no. 11/2023 (Integrated) amending notification no. 8/2017 (Integrated)

- Read the PDF of Notification no. 11/2023

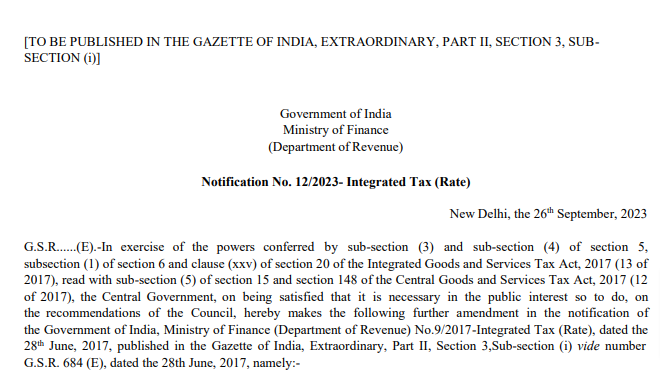

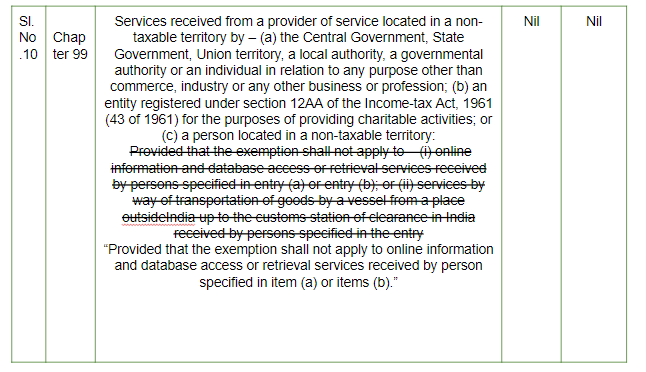

- Notification no. 12/2023 (Integrated) amending notification no. 9/2017(Integrated)

- Read the PDF of Notification no. 12/2023

- Notification no. 13/2023 (Integrated) amending notification no. 10/2017(Integrated)

- Read the PDF of Notification no. 13/2023 Pdf

What was the Mohit Minerals Judgment?

The judgment of Mohit Minerals is a famous one between Importers. The RCM liability on Ocean freight was made via notification no. 10/2017. It has been disputed since the beginning. Two important issues were raised by taxpayers, the first is of double taxation and the second is of Supply not taxable in India as both supplier and recipient of service are located outside India. After long litigation in the case of Mohit Minerals the Apex court decided in favour of the applicants. Now the related changes are incorporated by CBIC into the Act implementing the verdict of the honourable court. But an interesting point is they made it applicable from 1-10-2023 and not retrospective. So they still want to continue the litigation of the past period.

The Government issued Notification 11/2023- ITR, 12/2017-ITR and 13/2023- ITR all dated 26.9.2023 amending Notification No.8/2017- ITR, 9/2017-ITR and 10/2017-ITR respectively.

The purpose of the amending Notification No. 11/2023-ITR is not to levy 5% gst on ocean freight on shipping services provided from non-taxable territory to the receiver of the said services in non-taxable territory only. Accordingly no RCM liability arises under Notification 10/2017- ITR as amended by the Notification 13/2023- ITR on importer in case of CIF import contracts.

The amendment made to Sl.No 9(ii) of the Notification 8/2017- ITR through Notification 11/2023- ITR is not intended to exempt gst on shipping services.

Therefore gst at 5% is applicable on ocean freight in case of other than non- taxable territory to non-taxable territory shipping services as per Sl.No.9(ii) of Notification 8/2017- ITR even after amendment carried out to it through the Notification 11/2023-ITR dt 26.9.2023.

The amendment made to Notification 9/2017- ITR through the Notification 12/2023-ITR is only to be in line with not taxing shipping line services supplied from non-taxable territory to non-taxable territory and it doesn’t have any impact of gst on ocean freight in case of FOB import contracts by an importer in India.

Therefore, in case of Indian Importer paying ocean freight to foreign shipping services provider in case of FOB import contracts, gst on ocean freight is payable at 5% on RCM basis as per Sl.No 1 of Notification 10/2017- ITR read with Sl.No 9(ii) of the Notification 8/2017- ITR.

The amendments incorporated from 1-10-2023

Let us have a look at the changes made in notifications issued under the IGST Act.

Notification no. 11/2023 (Integrated) amending notification no. 8/2017 (Integrated)

8/2017 (Integrated) was the notification for tax rates of IGST transactions. In that notification, there was an entry to tax the relevant transportation of goods. Now the entry is removed as follows.

Read the PDF of Notification no. 11/2023

Notification no. 12/2023 (Integrated) amending notification no. 9/2017(Integrated)

This notification was for exemptions and it excluded the transportation by vessel service. Now the amendment is made to remove that exclusion.

Read the PDF of Notification no. 12/2023

Notification no. 13/2023 (Integrated) amending notification no. 10/2017(Integrated)

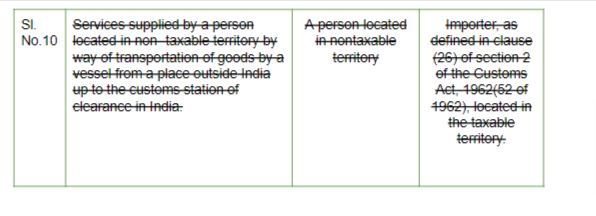

This was the notification of reverse charge services in IGST. This list included the liability of importer to pay RCM on services of Transportation done by a person sitting outside India. This entry is also removed. See the original entry and its treatment now.

Read the PDF of Notification no. 13/2023 Pdf

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.