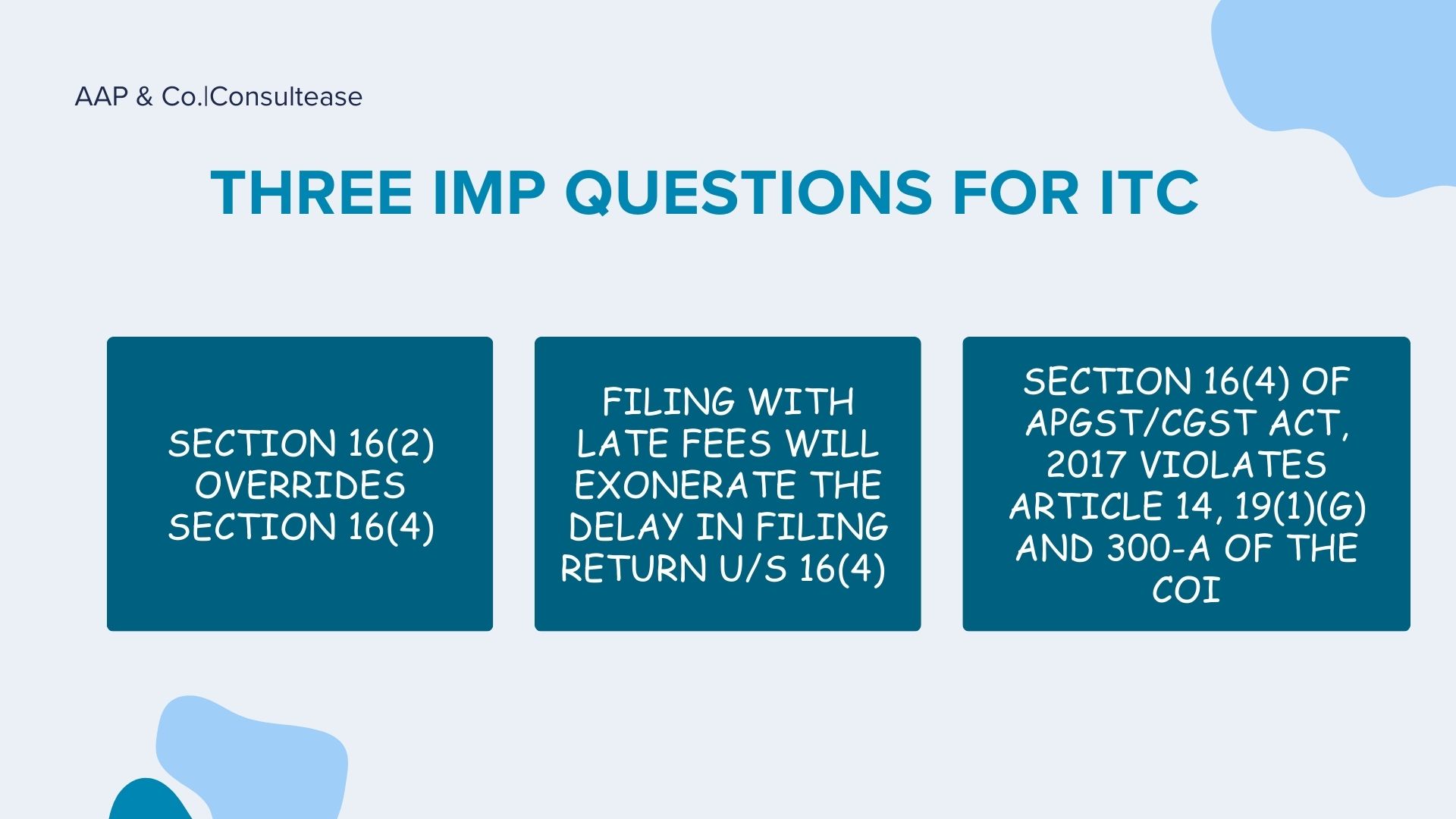

Three Most Important Issues in Time Barred ITC Resolved by Court in Thirumalakonda Plywoods Case

Appellant – Thirumalakonda Plywoods,

Respondent – The Assistant Commissioner – State Tax, Anantapur Circle – 1, Anantapuramu Division

Facts-

The petitioner prays for a writ of mandamus declaring

(a) Section 16(4) of APGST Act, 2017 and Section 16(4) of CGST Act, is violative of Article 14, 19(1)(g) and Section 300-A of Constitution of India.

(b)That the non-obstante clause in Section 16 (2) of the APGST/CGST Act, 2017 would prevail over Section 16(4) of the APGST / CGST Act, 2017.

(c)That notification issued by the Government of Andhra Pradesh vide G.O.Ms.No.264, dated 11.09.2020 and providing an extension of time for filing returns only to the non-resident and not allowing such extension to the others and thereby distinguishing other taxpayers on account of COVID-19 pandemic is arbitrary, illegal and violative of Article 14 of Constitution of India.

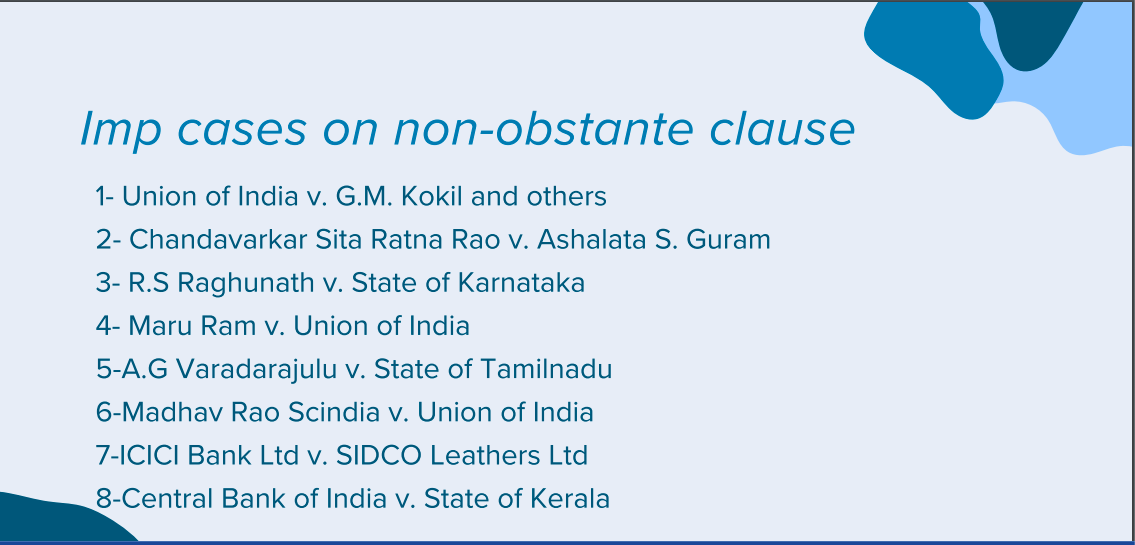

Cases cited –

Observation of Honourable High Court-

1) The time limit prescribed for claiming ITC U/s 16(4) of APGST Act/CGST Act, 2017 is not violative of Articles 14, 19(1)(g) and 300-A of the Constitution of India.

ii) Point No.2: Section 16(2) of APGST/CGST Act, 2017 has no overriding effect on Section 16(4) of the said Act as both are not contradictory with each other. They will operate independently.

iii) Point No.3: Mere acceptance of Form GSTR-3B returns with late fee will not exonerate the delay in claiming ITbeyond the period specified U/s 16(4) of APGST/CGST Act, 2017.

This is very important case as it tried to resolve the three most important questions related to ITC in GST.

Read & Download the Full Two Important Observations of Delhi Hc on Gst Refund pdf:

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.