Time of supply of services under GST

Why we need to determine the time of supply of services in GST?

Levy of GST in derived from Section 8 of CGST/SGST Act(For intra states sales ) and section 5 of IGST Act (For inter-state and import and export supplies). These sections generates the levy of tax. But tax under GST will be payable at the time of supply. In case of services it will be the time of supply of services.Chapter IV of GST Act containing sections from 12 to 15 covers the provisions for the time and value of supply of goods/service. Here in This article we will cover the time of supply of services in five different scenarios.

- For services in forward charge

- For services in case of reverse charge

- Time of supply of services in case of Vouchers

- Other cases when the time is not determined in any of above cases.

- Time of supply in case of import of service from associated enterprises

- Common provisions

Time of supply of services for forward charge

In case of supply of services in forward charge earliest of the following will be the time of supply.

a) Date of issue of invoice by the supplier or the last date on which he was required to issue an invoice.

b) The date on which supplier has received the payment for such supply.

It is worth mentioning that section 28 contains the detail provisions for the time limit of issuance of Invoice. We can say that the time limit is not yet decided and it will be prescribed by the government.

Time of supply of services in reverse charge

In case of reverse charge the earliest of the following will be the time of supply

(a) the date on which the payment is made, or

(b) the date immediately following sixty days from the date of issue of invoice by the supplier in short issue of invoice +60 days

Whose books we need to check?

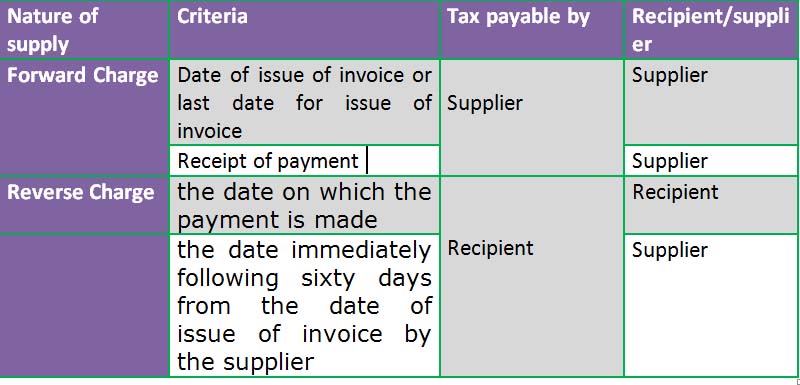

It is important to note here that in case of forward charge and reverse charge the person who is paying the tax will be different. In case of forward charge the supplier will be liable to pay GST. But in case of reverse charge the recipient of services will be responsible for the payment of GST. In both above cases we may get confuse for where we need to fit this criteria for time of supply. We have summarize it in the following table.

Time of supply of services in case of vouchers

In case of supply of vouchers, by whatever name called, by a supplier, the time of supply shall be-

(a) the date of issue of voucher, if the supply is identifiable at that point; or

(b) the date of redemption of voucher, in all other cases

Time of supply of services in other cases

In other case when it is not possible to determine the time of supply following should be considered.

(a) in a case where a periodical return has to be filed, be the date on which such return is to be filed; or

(b) in any other case, be the date on which the CGST/SGST is paid.

Time of supply of services in case of associated enterprises

In this para the time of supply for ‘associated enterprises’ will be covered. where the supplier of service is located outside India and recipient is in India.The time of supply shall be the earlier of :

a) Date of entry in the books of account of the recipient of supply,or

b)The date of payment

Common provisions:

There are the provisions which will apply equally to all above mentioned cases.

- where the supplier of taxable goods/services receives an amount up to one thousand rupees in excess of the amount indicated in the tax invoice, the time of supply to the extent of such excess shall, at the option of the said supplier, be the date of issue of invoice.

- For all above cases the supply shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment.

- For all above cases “the date on which the supplier receives the payment” shall be the date on which the payment is entered in his books of accounts or the date on which the payment is credited to his bank account, whichever is earlier.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.