The time of supply will be the Date of Invoice in case of continuous supply of service: AAR

The time of supply will be the Date of Invoice in case of continuous supply of service: AAR

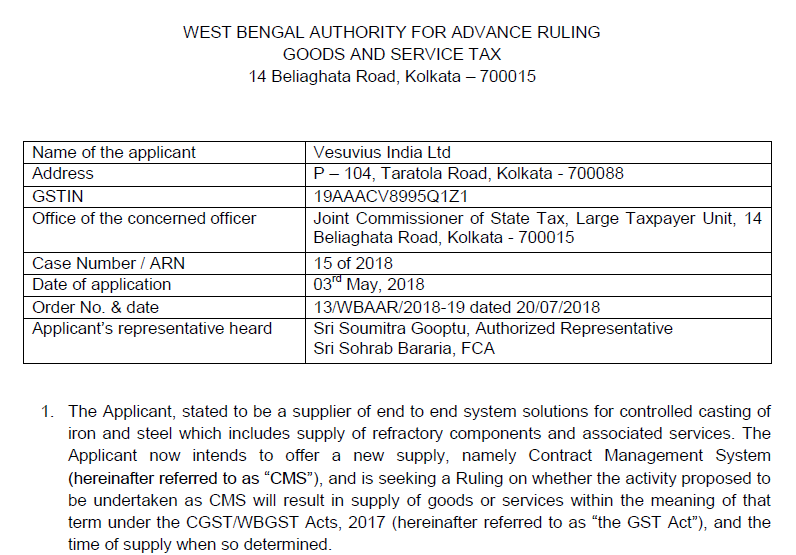

An advance ruling is given by the Authority of the advance ruling of West Bengal. The Applicant stated to be a supplier of the end to end system solutions for the controlled casting of iron and steel. Which includes the supply of refractory components and associated services. The Applicant now intends to offer a new supply, namely Contract Management System. The Contract Management System will be a continuous supply of service because it will continue for more than 3 months. The CMS, according to the Applicant, includes but not limited to application, installation, and fixation of various refractories. The Applicant will design the refractories required, monitor their usage and inventory, and supply the required refractory components and systems. This apart, the Applicant will monitor round-the-clock the flow of iron and steel.

Issue/Question raised in the Advance Ruling:

Whether the activity proposed to be undertaken as CMS(Contract Management System). Will it result in the supply of goods or services within the meaning of that the term under the CGST/WBGST Acts, 2017. (hereinafter referred to as “the GST Act”), and the time of supply when so determined.

Download the full facts and reasoning for the advance ruling. Regarding the time of supply will be the Date of Invoice in case of continuous supply of service:

Ruling:

Activities the Applicant proposes to undertake are services associated with the manufacturing of metal, and may be termed as “continuous supply of service” within the meaning of Section 2(33) of the GST Act, provided the service is agreed to be provisioned for a period exceeding three months.

The time of supply shall be the date of issue of the invoice in terms of Section 13(2) (a), read with Section 31(2) of the GST Act and Rule 47 of the GST Rules.

This Ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.