Timeline – Payment of Interest on Net Cash Liability – GST

Table of Contents

- Timeline – Payment of Interest on Net Cash Liability – GST

- 1. 31st GST Council Meeting held on 22nd December 2018 –

- 2. 31st GST Council Meeting held on 22nd December 2018

- 3. Press Release – 22.12.2018

- 4. THE FINANCE (NO. 2) ACT, 2019

- 5. PRESS RELEASE – 14.03.2020

- 6. 40th GST Council Meeting

- 7. Notification 63 dated 25.08.2020 –

- Read the Copy:

Timeline – Payment of Interest on Net Cash Liability – GST

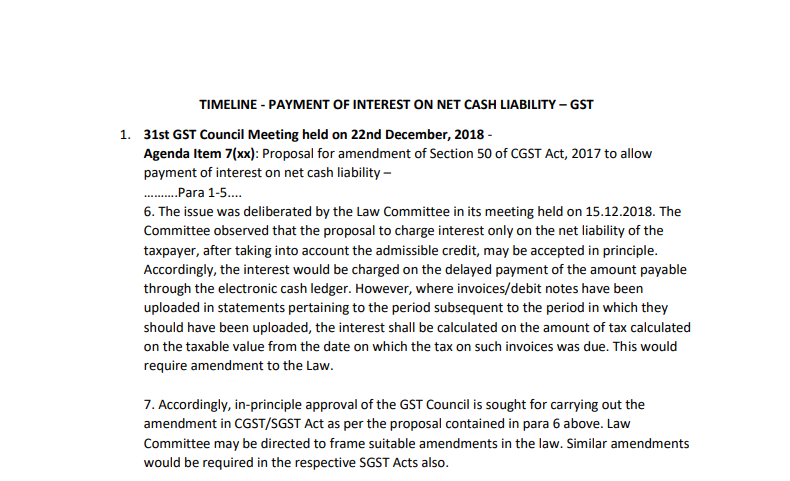

1. 31st GST Council Meeting held on 22nd December 2018 –

Agenda Item 7(xx): Proposal for amendment of Section 50 of CGST Act, 2017 to allow payment of interest on net cash liability –

……….Para 1-5…

6. The issue was deliberated by the Law Committee in its meeting held on 15.12.2018. The Committee observed that the proposal to charge interest only on the net liability of the taxpayer, after taking into account the admissible credit, may be accepted in principle. Accordingly, the interest would be charged on the delayed payment of the amount payable through the electronic cash ledger. However, where invoices/debit notes have been uploaded in statements pertaining to the period subsequent to the period in which they should have been uploaded, the interest shall be calculated on the amount of tax calculated on the taxable value from the date on which the tax on such invoices was due. This would require an amendment to the Law.

7. Accordingly, in-principle approval of the GST Council is sought for carrying out the amendment in the CGST/SGST Act as per the proposal contained in para 6 above. Law Committee may be directed to frame suitable amendments in the law. Similar amendments would be required in the respective SGST Acts also.

2. 31st GST Council Meeting held on 22nd December 2018

Minutes of Meeting –

Agenda Item 7: Issues recommended by the Law Committee for the consideration of the GST Council –

16. Introducing this Agenda item, the Secretary informed that the issues under this Agenda item were discussed in detail in the Officers meeting held on 21 51 December 2018, and a presentation was also made (attached as Annexure 4). He informed that except for six issues, the officers were in agreement with the other proposals under this Agenda item. He stated that if the Council agreed then except the six issues, the Council may approve the rest of the proposals. The Council agreed to this proposal. He invited Commissioner (GST Policy Wing), CBIC to present five issues and Joint Secretary, DoR, to present one issue for the consideration of the Council.

[Agenda item 7(xx) was one of the issues where the officers were in agreement and Council agreed to approve such agreed issues]

Annexure 4 (of the Minutes) –

Agenda No. 7 (xx) (1/2) Proposal for amendment of Section 50 of CGST Act to allow payment of interest on net cash liability

• Law permits furnishing of a return without payment of full tax as self-assessed as per the said return but the said return would be regarded as an invalid return

• No such facility has been yet made available on the common portal. This inflexibility of the system Increases the interest burden

• GST only on value addition

Agenda No. 7 (xx) (2/2) Proposal for amendment of Section 50 of CGST Act, 2017 to allow payment of interest on net cash liability – Accordingly, in-principle approval for amendment in law (as the proposed changes require an amendment to CGST as well as SGST Acts) is sought so as to provide that:

– interest should be charged only on the net liability of the taxpayer, after taking into account the admissible credit, i.e. the amount payable through electronic cash ledger

– interest would be charged on tax calculated on taxable value where invoices or debit notes are uploaded late

3. Press Release – 22.12.2018

In-Principle approval given for Law Amendments during 31st Meeting of the GST Council December 22, 2018,

The GST Council in its 31st meeting held today at New Delhi gave in-principle approval to the following amendments in the GST Acts:

1. Creation of a Centralised Appellate Authority for Advance Ruling (AAAR) to deal with cases of conflicting decisions by two or more State Appellate Advance Ruling Authorities on the same issue.

2. Amendment of section 50 of the CGST Act to provide that interest should be charged only on the net tax liability of the taxpayer, after taking into account the admissible input tax credit, i.e. interest would be leviable only on the amount payable through the electronic cash ledger.

The above recommendations of the Council will be made effective only after the necessary amendments in the GST Acts are carried out.

4. THE FINANCE (NO. 2) ACT, 2019

NO. 23 OF 2019 published on [1st August, 2019.] Section 100. In section 50 of the Central Goods and Services Tax Act, in sub-section (1), the following proviso shall be inserted, namely:––

“Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after the commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger.”.

5. PRESS RELEASE – 14.03.2020

(Law and Procedure related changes) The GST Council, in its 39th meeting held on 14.03.2020, has made the following recommendations:

1. Measures for Trade facilitation:

a. Interest for delay in payment of GST to be charged on the net cash tax liability w.e.f. 01.07.2017 (Law to be amended retrospectively).

6. 40th GST Council Meeting

held on 12th June 2020. And 41st GST Council Meeting to be held on August 27, 2020. However Agenda and Minutes of 39th Council meeting, wherein it was recommended that interest be charged on net liability (law to be amended retrospectively) not made available on the GST Council website so far.

7. Notification 63 dated 25.08.2020 –

Sec 50 amendment of FA, 2019 made effective from 01.09.2020

Read the Copy:

CA Gurjit Singh Bhullar

CA Gurjit Singh Bhullar