Tips for downloading return file from GST portal

Tips for downloading return file from GSTN portal and modifying /deleting earlier uploaded detail

1) User can download the saved invoices/details from online portal

2) To generate file for download GSTRI click PREPARE OFFLINE -> Download- >GENERATE FILE, If any previously downloaded request done it will show the download link to download file.

3) To generate latest GSTRI file click again on GENERATE FILE button and It will take 10-15 minutes to generate file.

4) To Download generate file, click on Click here to download link. Return file Is downloaded In the zip format.

5) In offline tool, OPEN button Is for view/modify/delete/add invoices/details in Downloaded GSTR1 file

6) After opening the downloaded file in offline tool, user can modify the invoices/details in any section.

7) To modify Click the EDIT ( Pencil Icon) button under Action column to edit the invoices and make the required corrections in the invoices/details uploaded/added earlier by you in GST Portal

8) To modify the details or records at rate level, click on the +’ button and navigate to the rate level records. Do the necessary corrections and click the UPDATE button. NOTE: If user encountered with slowness in offline tool, open the offline tool in Firefox or Google Chrome browser by typing localhost:3010 into browser’s address bar and press enter.

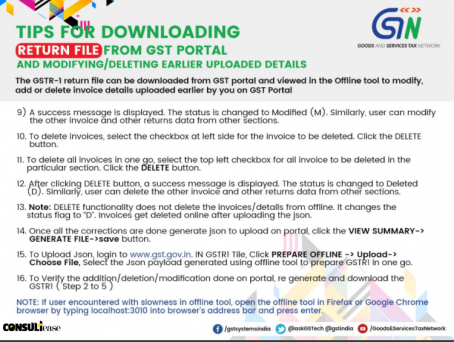

9) A success message is displayed. The status is changed to Modified (M). Similarly, user can modify the other invoice and other returns data from other sections.

10. To delete Invoices, select the checkbox at left side for the Invoice to be deleted. Click the DELETE button.

11. To delete all invoices In one go, select the top left checkbox for all invoice to be deleted in the particular section. Click the DELETE button.

12. After clicking DELETE button, a success message is displayed. The status is changed to Deleted (D). Similarly, user can delete the other invoice and other returns data from other sections.

13. Note: DELETE functionality does not delete the invoices/details from offline. It changes the status flag tot”. Invoices get deleted online after uploading the Json. 14. Once all the corrections are done generate Json to upload on portal, click the VIEW SUMMARY-> GENERATE FILE->save button.

15. To Upload Json, login to www.gst.gov.in. IN GSTRI Tile, Click PREPARE OFFLINE -> Upload-> Choose File, Select the Json payload generated using offline tool to prepare GSTRI in one go.

16. To Verify the additiqn/deletion/modification done on portal, re generate and download the GSTRI ( Step 2 to 5 )

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.