To the extent the Circular dated 11.11.2019 is contrary to the first proviso to Rule 36(4) of the Rules, it would remain unenforceable in law.

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

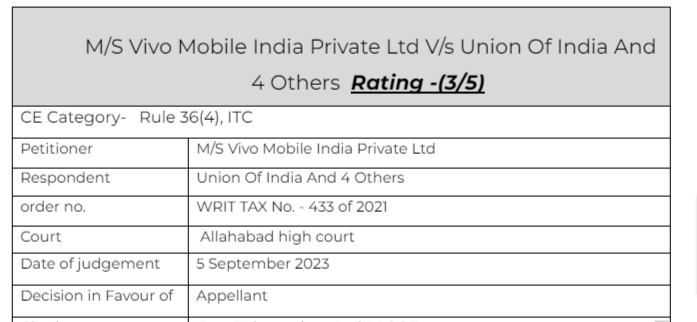

M/S Vivo Mobile India Private Ltd V/s Union Of India And 4 Others

citations:

Tata Teleservices Ltd. V CCE

Suncraft Energy Private Limited and Anr. Vs The Assistant Commissioner,

Union of India Vs Bharti Airtel Ltd

Eicher Motors Ltd. Vs. Union of India

Sandur Micro Circuits ltd. Vs. Commissioner of Central Excise

Tata Teleservices Vs. Commissioner of Customs

Alfa Laval (India) Ltd. Vs. Union of India

Facts of the cases:

The authority has opined that the petitioner had availed/utilised excess Input Tax Credit (ITC in short), Rs. 110,06,90,100.31, for the months of February 2020 to August 2020. Construing the same to be a violation of Rule 36(4) of the CGST Rules, 2017, it has been directed to be reversed and added to the output tax liability of the petitioner, with consequent interest obligation. Also, an equal amount of penalty referable to Section 74 of the Central Goods and Service Tax Rules, 2017 has been imposed. Thus, total demand of Rs. 235.52 crores had been created – inclusive of interest @ Rs. 15,40,00,000/-. Against that demand, the petitioner had self-deposited Rs. 11,00,69,010/- (provisionally, pending this writ petition) being 10% of the disputed demand of tax. However, it has disputed the entire liability.

Observation & Judgement of the Court:

Insofar as the conduct of the revenue authorities in recovering the amount during pendency of the writ petition is concerned, the established principle being there is no implied stay of recovery unless granted by the Court, principally, we see no error on part of the revenue in recovering the disputed amount during pendency of the writ petition. The fact that the assessee had pre-deposited 10% of the disputed amount during the pendency of the writ petition may not work in its favour. That principle being a statutory principle enacted in the context of the statutory appeal, it may never stand extended to a writ proceeding that arose under Article 226 of the Constitution of India. While it may have been open to the petitioner to rely on that provision and to bring to the knowledge of this Court that it had predeposited 10% of the disputed tax at the time of filing the writ petition, no automatic benefit accrued to the petitioner upon that deposit, in the absence of any interim order granted by this Court.

At the same time, it is wholly unacceptable that the revenue authorities chose to thereafter recover the entire disputed amount leading to recovery of 110% of the disputed amount. While effecting the recovery, the revenue authorities ought to have accounted for any amount that may have been pre-deposited by the petitioner against the disputed demand of tax and penalty

Accordingly, the impugned order is quashed. The entire amount recovered may be returned to the petitioner within a period of six weeks from the date a copy of this order is served on the proper officer, by the petitioner. At the same time, the petitioner would remain entitled to interest that we provide @ 6% on the amount of excess recovery of Rs. 11,00,69,010/-, from the date of that excess recovery to the date of its actual refund. It is left open to the respondent State to recover up to 10% of that interest amount from the erring field officers and all superior/supervisory officers (who may have allowed such grossly illegal excess recovery to be made and withheld), in proportion to their complicity or negligence in allowing that excess recovery to arise and be withheld.

Read & Download the Full M/S Vivo Mobile India Private Ltd V/s Union Of India And 4 Others

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.