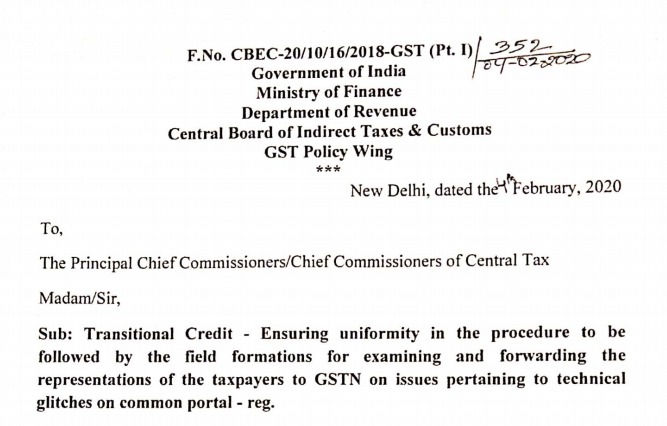

Transitional credit: SOP by Commissioner

To,

The Principal Chief Commissioners/Chief Commissioners of Central Tax

Madam/Sir,

Sub- Transitional Credit- Ensuring uniformity in the procedure to be followed by the field formations for examining and forwarding the representations of the taxpayers to GSTN on issues pertaining to technical glitches on the common portal.

As you are aware, an IT Grievance Redressal Mechanism was put in place on the recommendation of GST Council in its 26th Meeting held on 10th March 2018, to address difficulties faced by taxpayers on account of technical glitches on the common portal, including the cases pertaining to non-filing of TRAN-1 due to IT glitches.

2. Further Rule 117(1A) and Proviso to Rule 117(4)(b)(iii) were also introduced in CGST Rules 2017 to provide for an extension of the date of submitting the declaration electronically in TRAN-1 and TRAN-2 by 31.03.2019 and 30.04.2019 respectively, in respect of registered persons who could not submit the said declarations by due date on account of technical difficulties on common portal and in respect of which GST Council has made a recommendation for such extension. The said provisions have further been amended vide Notification No. 02/2020 dated 01.01.2020 to provide for the extension of date of submitting declarations in form TRAN-1 and TRAN-2 in such cases by 31.3.2020 and 30.4.2020 respectively.

3. In order to ensure uniformity in the procedure to be followed by the field formations for examining and forwarding the representations of taxpayers on issues pertaining to technical glitches on the common portal, GSTN issued a Standard Operating Procedure(SOP) dated 12.4.2018. The said SOP provides for the detailed modalities for the Nodal officers of the States/centre Tax while referring the technical glitches cases to the GSTN.

4. However, it has been brought to the notice by GSTN that the Nodal officers are not following the procedure prescribed by the above Standard Operating Procedure(SOP) while referring the technical glitches cases to GSTN. It has also been informed that the representations received from the taxpayers are being forwarded to GSTN without any proper scrutiny and verification of the representations and without requisite documents.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.