What is UDIN for Chartered accountants

UDIN for Chartered accountants :

UDIN for chartered accountants will be mandatory. Although at this point of time it os only recommendatory. UDIN is unique code to be generated by Chartered accountants for signing a document. Every document signed by a chartered accountant will be having UDIN. This can be generated online for each document. This facility is started to curb the misuse of CA’s signatures. In the past there were cases when the CA’s signatures were misused by the unqualified people. It is important to mention that documents signed by a Chartered accountant is used at many places. Their signatures are accepted by government as a proof to correctness of a document.

How to generate UDIN:

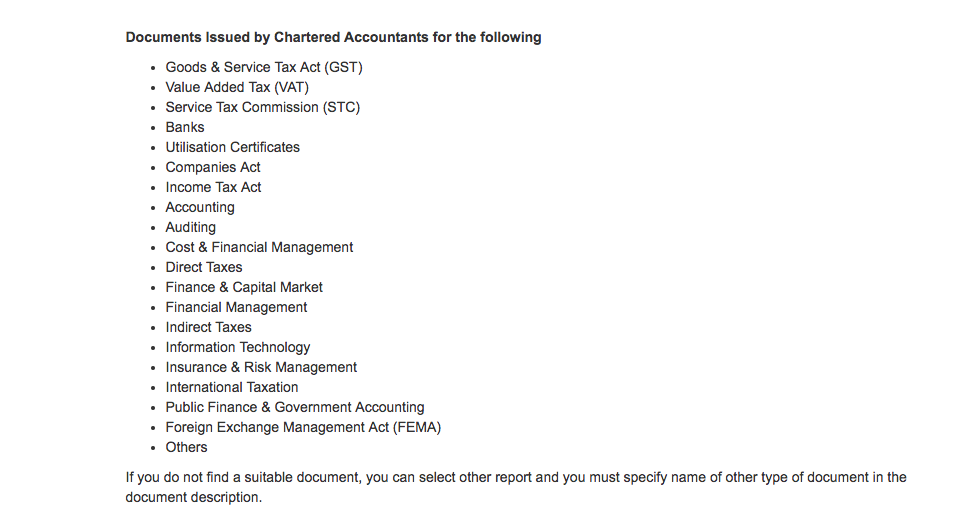

First of all you are required to create a login id on UDIN ICAI portal. Basic details like membership number, date of birth and date of enrolment is required. This facility is only for the CA’s in practice. Once the login is created, UDIN can be generated by entering the required details. The certificates can be issued for following categories.

UDIN for chartered accountants

Detailed procedure for login and creating the UDIN is explained in this article. It will be mandatory soon. Once it will be mandatory no fake documentation can be done. It will be a safeguard for Chartered accountants. Thus it is advisable to start its use from now.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.