Udyam Registration – Eligibility, Process, Documents Required, and Certificate

The MSME sector is the soul and blood of the Indian economy. It provides the raw material for the bigger industries, maximum employment, and also spearheads innovation, design, and technology in the fast-changing industry. Most of the Start UPs are in this sector only. It is a steady but silent worker. It has been hit the most because of Demonetisation, the introduction of GST, and now Corona. Now is the high time, when the government has to look after their woes and provide them succor so that they can continue to serve the country.

According to the notification of MSME dated 26.06.2020, erstwhile MSME/UDYOG AADHAAR Registration has been replaced by UDYAM Registration, launched by the Ministry of MSME, effective from July 1, 2020. The enterprise for this process will be known as Adam. Udyam registration is a single-window, paperless process, no additional documents or certificates are required in order to register under MSME.

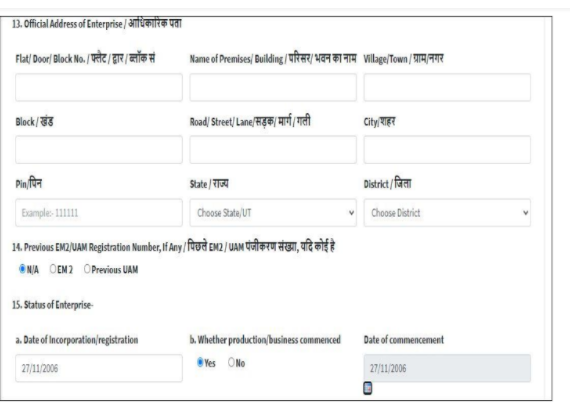

All existing enterprises registered under EM–Part-II (Entrepreneurs Memorandum) or UAM (Udyog Aadhar Memorandum Portal) shall have to register again on the Udyam Registration portal on or after the 1st day of July 2020.

The existing enterprises registered prior to 30th June 2020, shall continue to be valid till the 31st day of March 2021. An enterprise registered with any other organization under the Ministry of Micro, Small, and Medium Enterprises shall register itself under Udyam Registration.

As per office memorandum No. 5/2(2)/2021-E/P & G/Policy dated 02.07.2021, NIC codes No. 45,46,47 have been permitted to register on the Udyam portal. However, they will only be entitled to the benefit of Priority sector lending by banks after their registration. (wholesalers and retailers)

| NIC code | Activity |

| 45 | Wholesale and retail trade and repair of motor vehicle and motorcycles |

| 46 | Wholesale trade except for motor vehicles and motorcycles |

| 47 | Retail Trade Except of Motor Vehicles and motorcycles |

Table of Contents

Classification

Following is the classification of enterprises as per the latest guidelines:

| Classification | Investment in plant and machinery or equipment | Turnover |

| Micro | Less than 1 crore | Less than 5 crores |

| Small | Less than 10 crores | Less than 50 crores |

| Medium | Less than 50 crores | Less than 250 crores |

Note- Exports of goods or services or both, shall be excluded while calculating the turnover of any enterprise whether micro, small or medium, for the purposes of classification.

Benefits of registration

-

- MSME registration helps in getting government tenders under Atma Nirbhar Bharat Scheme

- Under bank loan, 15% import subsidy on fully automatic machinery.

- Becomes easy to get licenses, approvals, and registrations, irrespective of the field of business.

- Compensation of ISO certificate expenditure.

- Helps in getting low-interest rates on loans under priority sector

- Get the benefit of tariff subsidies, tax, and capital subsidies

- Gets exemption under Direct Tax Laws

- Concession in electricity Bills

- Protection against payments (Delayed payments) MSME Samadhan

- Technology and quality up-gradation support to MSMEs

- Become Eligible for various Loan Schemes

- Discounted IPR registration Fees

- Additional benefits in SEZ

- Get access to Government trade portals

- Applicability to get registered on TReDS Platform for ease of business and arrangement of funds

- Become a partner in the various programs started by the government for the growth of the MSMEs

CHAMPIONS

- MSME Samadhan

- MSME Sambandh

- MSME Sampark

- Entrepreneurship Skill Development Programme (ESDP)

Eligibility

Any enterprise which fulfills the above criteria can register accordingly on the portal. Enterprises in the manufacturing industry and in the service sector, both can register on the UDYAM portal. The constitution of the enterprise does not make any difference. The only criteria at present are based on investment and turnover. Recently wholesalers and retailers have also been included. The purpose to include all wide categories of enterprises for registration under this Act is to ensure that the benefits offered by the Government reach a large portion of the Society.

Documents Required

The user will only need to provide their 12-digit Aadhaar Number, Pan Card, GST No. of the enterprise, and Bank Account details of Business for the registration process.

Details to be filled

Some basics details required for registration under the Act are as follows:

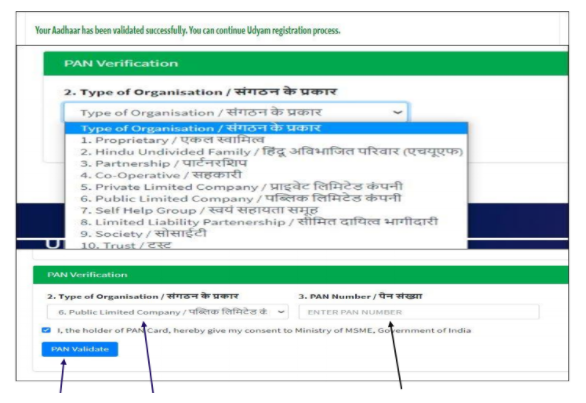

- PAN of Entity and its Authorised Signatory(ies);

- Aadhaar number of the following; [If your mobile & Aadhaar is not linked then first get it linked by visiting Aadhaar portal]

- Proprietor – Proprietorship firm;

- Managing partner – Partnership Firm

- Karta – Hindu Undivided Family (HUF)

- Authorized signatory – Company or a Limited Liability Partnership or a Cooperative Society or a Society or a Trust

- GST no. of the Enterprise

- E-mail ID and Mobile No. of Enterprise and person mentioned above

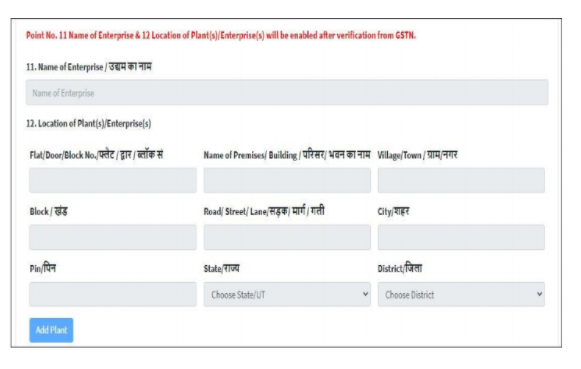

- Plant Address and Office Address.

- Bank Details viz. Account Number, IFSC code

- Miscellaneous Information viz. Social Category, Business Activity code, No. of employees, etc.

Your investment (Plant and machinery or equipment), turnover details are linked to your Permanent Account Number (PAN), and Goods and Services Tax (GST). This online portal is fully integrated with Income Tax and GSTIN systems. Hence, PAN and GSTIN are mandatory. In the case where an entrepreneur does not have PAN, then these figures have to be self-declared. Intentionally misrepresented self-declared facts and figures are liable to penalty under Section 27 of the CGST Act. Your self-declaration is valid only till the 31st of March 2021. From that day, GSTIN is a must. There is no registration fee for the process. A single enterprise is allowed to have only one Udyam registration.

Process

We are giving you the process for registration of a person for the first time on the Udyam portal

Step 1: Visit the official website URL HTTPS //: udyamregistrationdotgovdotin

Step 2: Click ‘New registration’ on the homepage. You will get the registration form

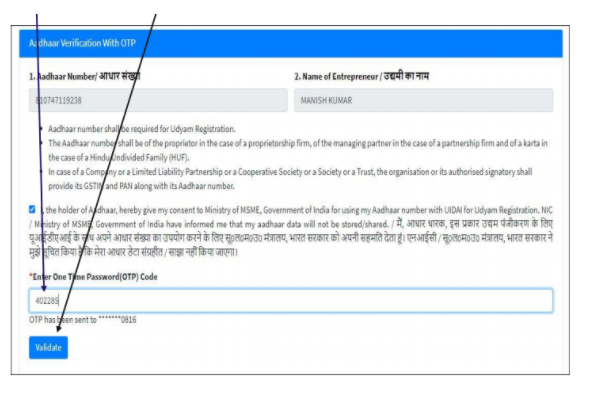

Step 3: Enter the concerned ‘Aadhaar Number’ and ‘Name of the Entrepreneur’ and click on ‘Validate & Generate OTP’

Step 4: Enter the required details on the PAN verification page

Step 5: Social Category

Provide the applicant’s caste: General/Scheduled Caste/Scheduled Tribe/ Other Backward Castes. You have to provide proof of your submission when asked by the authorities.

Step 6: Enter details for Correspondence

After filling in all the above-mentioned details, enter the full postal address of the enterprise, its pin code, the state, the email address, and the mobile number.

Step 7: Fill up all the Bank Details

Enter the firm’s bank account number along with the IFSC code of that branch in which the account is opened.

Step 8: Details of the Enterprise.

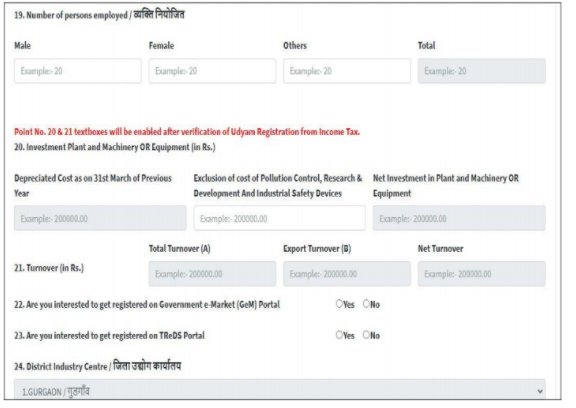

Mention the main activity of their enterprise, it can be “manufacturing” or “services”. Enter the number of persons that are employed. Provide the NIC or National Industry Classification Code for the activities undertaken by the enterprise. Post filling these details, enter the amount invested in the plant and machinery or equipment.

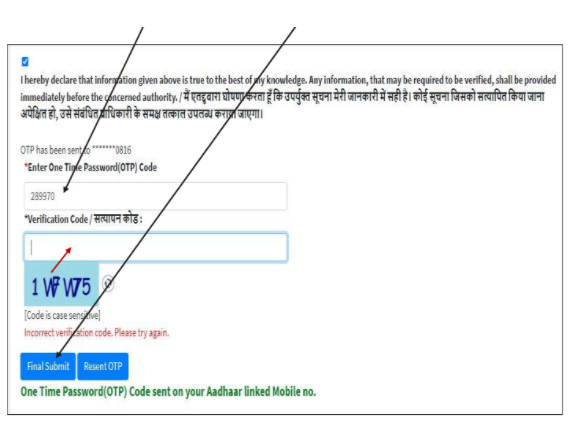

Step 9: Choose the DIC or District Industry Center and approve the Declaration Select the DIC or district industry center that is available from the drop-down list. Input the OTP which is sent on the registered mobile number and choose the “Final Submit” button.

Step 10: Then, the Udyam Registration box will appear where you will have to fill in all the details asked for.

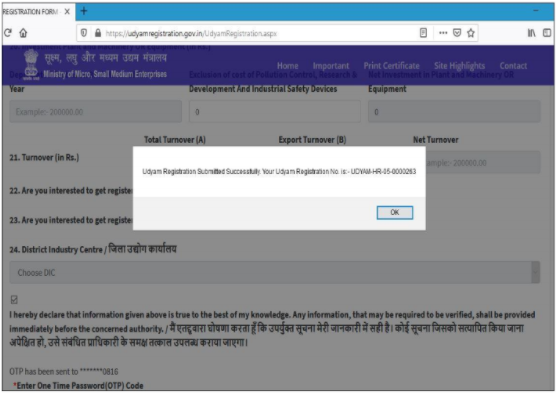

Upon clicking the ‘Submit and Get Final OTP’ button you would get a registration number.

When all the information is completely verified by the concerned authorities, you would get an E-registration document that is sent on your registered e-mail id.

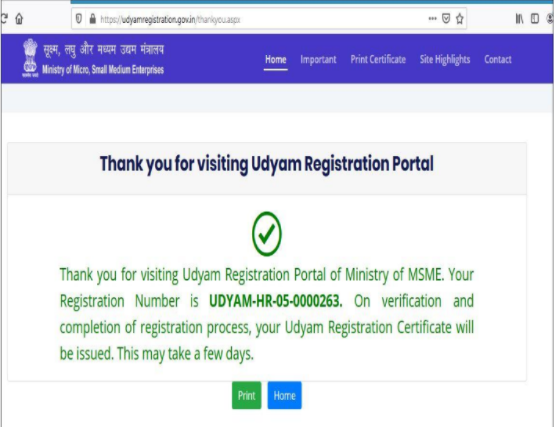

Step 11: After successful registration, you will get a ‘Thank You’ message with the Registration Number starting with ‘UDYAM’

On final submission, the system will generate your Udyam-MSME registration number

Certificate

- In the case of applicants who have not filed income tax returns and do not have GST registration

You will be issued the Certificate instantly on submission with self-declaration of investment and turnover. The turnover and investment-related figures of such enterprises which do not have PAN will be considered on a self-declaration basis only up to 31st March 2021, and

- In the case of applicants who have filed income tax returns and have GST registration

Upon submission, a registration number will be given and a certificate will be issued after verification of Investment details from Income Tax Portal & Turnover details from GST Portal.

Those Enterprises who are already registered under UAM (Udhyog Adhar memorandum) or EM (Entrepreneur Memorandum)

- All existing enterprises who are already registered under EM–Part-II or UAM have to register again on the Udyam Registration portal on or after the 1st day of July 2020.

- They have to register again by entering their Aadhaar, PAN, and previous registration number.

- All enterprises who have already registered till 30th June 2020, shall be re-classified in accordance with the information provided by them regarding investment and turnover.

- The existing enterprises registered prior to 30th June 2020, shall continue to be valid till the 31st day of March 2021, but after that their status shall be removed and they have to register afresh.

Some important Facts

- Previously, the process of registering on Udyog Aadhaar was quite time-consuming. Udyam registration is the new and simplified version for MSME registration.

- Udyam registration is mandatory even for existing businesses.

- Udyam registration is the same as MSME registration. Upon registration, you are issued a certificate of recognition and an identification number.

- Udyam registration is done using your Aadhaar number. Therefore you will get an OTP on the phone. Since you cannot verify your application without an Aadhaar-linked phone number, you should first get your mobile linked with Aadhaar.

- If an individual is a director of more than one company, he can use his Aadhaar number to apply for Udyam registration. Hence multiple registrations can be done on a single Aadhaar. But only one registration can be done against a single PAN number.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.