DIY: How to file TDS return without the help of any expert/software

What you will learn here

- How to file TDS return

- How to file TDS return without help of expert.

- How to file TDS return without any software. Only the utility available on NSDL website will be used.

DIY: try to file your TDS return of this quarter by yourself

In my last article I told you how to file your ITR without the help of any expert or software. It was amazing to get the response from so many taxpayers who filed there ITR themselves. In this article I will guide you on how to file your TDS return without the help of any expert and use of any software. We will only use the utilities available on website of income tax department.

Let us start

There will be two forms for every TDS return. Form 24Q for details of TDS deducted and deposited on salaries. Form 26Q having details of TDS under all other heads.

First of all compile your data in the prescribed format. Once you will compile the entire data t will be very easy file TDS return. In TDS return utility you need to fill the following data. Basically there is two type of information.

First is the details related to challans

Second are the details of deductee against whose dues challan is consumed. You need to compile the details challan wise.

First of all compile the details of challan. We will have 2 kind of challans. Challans for TDS deposited u/s 192 i.e for salary. These challan will be used in filing 24Q which is for salary. All other challans will be filled in 26Q which for other than salary.

We will need following information related to challan.

| Amount of challan

|

BSR code of bank where challan is deposited | Date of challan deposited (mentioned on challan itself)

|

Amount of challan

|

Challan serial number (mentioned on challan itself)

|

Minor head of challan will be 200 in most of the cases (400 code will be in case of TDS demand is raised by Income tax department itself)

|

After compiling this data for all of the challan let us compile the deductewise details

Following fields will be required in deducteewise details

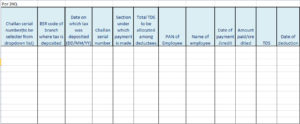

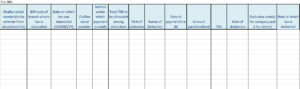

For form 24Q this format will be required

For form 26 Q following format will be used

Once your data is ready it is time to download the utility to file the return. Here we will have to download two files. One will be to feed the data and other one will be to file the return.

Download One:

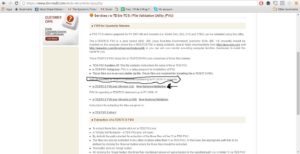

Now go to the following link and download this Return preparation utility in short it is called RPU.

https://www.tin-nsdl.com/etds-etcs/etds-rpu.php

Download Two:

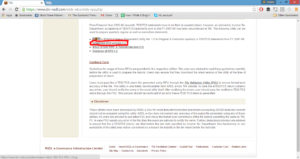

Also download the File validation utility ie FUV file .Click on this link (Highlighted in image below)

https://www.tin-nsdl.com/etds-etcs/etds-rpu.php

Download Three:

Now download the challan detail file from TIN website. Go to this link https://tin.tin.nsdl.com/oltas/servlet/TanSearch

You will find this form, fill you TAN, period and click on download challan file.

Save the file generated in the same folder as it will be used later.

Extract utilities:

Once you download both the utilities extract them. But first we will use the rpu file to fill data. FUV file will be used later when we will do with filling data in rpu. Now click on this exe file and start filing information.

Step-1: This is your utility and you need to fill entire data here. Let us start with this. When you will open this utility you will find a window like this (see image below)

Step-2: Here you need to choose the form you want to fill. We will show you both 24Q and 26Q one by one. Let us start with 24Q which is for salary deductee. Here chose 24Q from the dropdown list. You will get the following page. Here you need you fill your details. Your name, addresses, TAN, PAN, financial year, quarter, type of entity, Responsible person and his details. After filing this form you need to click on challan tab.

Step-3: Now fill details of all challan related to the quarter for which you are filing the return. You will need to fill Amount, challan no., Bank’s BSR no., and date. (See image below).

Once you fill all the challan details here you need to fill the deducteewise details against each and every challan. Now go to annexure and fill the details you already compiled. You can copy paste most of the fields.

Once you fill the entire data it is time to check it for errors. Now click on save and save this file. A file with name of form +qtr will be generated.(see image below)

You can open and edit it in future. Now to create file for filing you need to click on create. A dialogue box will open and will ask for csi file. Choose that file and chose a folder for error file.(you just click it will choose that path itself) and click on validate.

An fuv file will be created .Now extract the fuv utility and click on the jar file. You will get a small window like this.

Now upload the Challan input file and TDS input file and give a path to new error file to be generated. See images below.

When you will click on ok error file will open in your browser.

Correct the errors and try again. Once you are done without errors. A new file will be generate with form 27 A in a pdf. You can upload it directly or can send it for filing.

Now come back to for 26Q.In this form all other steps will be same. The only difference will be that some extra information will be required to be filled while filling the deducteewise details. We have already compiled them in our format we shared in this article. Rest of the process will be same for both forms.

Do try this yourself. First time you may face some problems but once your formats are completed it will be easy.

Develop this habit to compile all the details along with transactions to prevent the rush at last time. Whenever you make a new payment ask for their PAN copy and update your master. It will help you at the time of filing.

Hope this article will help you.

For more queries you can send me an e-mail at shaifaly.ca@gmail.com or whats app at 9953077844

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.