Section 143 of CGST Act : Job work procedure (Updated till on July 2024)

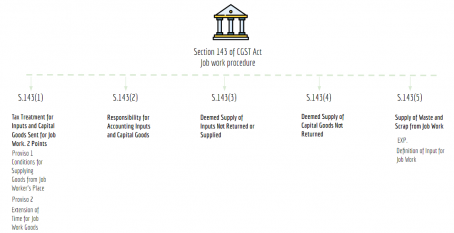

Section 143 Summary Chart :

Section 143 of CGST Act : Job work procedure

(1) A registered person (hereafter in this section referred to as the “principal”) may under intimation and subject to such conditions as may be prescribed, send any inputs or capital goods, without payment of tax, to a job worker for job work and from there subsequently send to another job worker and likewise, and shall,-

(a) bring back inputs, after completion of job work or otherwise, or capital goods, other than moulds and dies, jigs and fixtures, or tools, within one year and three years, respectively, of their being sent out, to any of his place of business, without payment of tax;

(b) supply such inputs, after completion of job work or otherwise, or capital goods, other than moulds and dies, jigs and fixtures, or tools, within one year and three years, respectively, of their being sent out from the place of business of a job worker on payment of tax within India, or with or without payment of tax for export, as the case may be:

Provided that the principal shall not supply the goods from the place of business of a job worker in accordance with the provisions of this clause unless the said principal declares the place of business of the job worker as his additional place of business except in a case-

(i) 1 where the job worker is registered under section 25; or

(ii) where the principal is engaged in the supply of such goods as may be notified by the Commissioner:

Note1[Provided further that the period of one year and three years may, on sufficient cause being shown, be extended by the Commissioner for a further period not exceeding one year and two years respectively.]

Note1- Inserted vide sec 29 of The CGST (Amendment) Act, 2018 (No. 31 of 2018), notified through Notification No. 2/2019 – CT dated 29.01.2019 – Brought into force w.e.f. 01.02.2019.

(2) The responsibility for keeping proper accounts for the inputs or capital goods shall lie with the principal.

(3) Where the inputs sent for job work are not received back by the principal after completion of job work or otherwise in accordance with the provisions of clause (a) of sub-section (1) or are not supplied from the place of business of the job worker in accordance with the provisions of clause (b) of sub-section (1) within a period of one year of their being sent out, it shall be deemed that such inputs had been supplied by the principal to the job worker on the day when the said inputs were sent out.

(4) Where the capital goods, other than moulds and dies, jigs and fixtures, or tools, sent for job work are not received back by the principal in accordance with the provisions of clause (a) of sub section (1) or are not supplied from the place of business of the job worker in accordance with the provisions of clause (b) of sub-section (1) within a period of three years of their being sent out, it shall be deemed that such capital goods had been supplied by the principal to the job worker on the day when the said capital goods were sent out.

(5) Notwithstanding anything contained in sub-sections (1) and (2), any waste and scrap generated during the job work may be supplied by the job worker directly from his place of business on payment of tax, if such job worker is registered, or by the principal, if the job worker is not registered.

Explanation.-For the purposes of job work, input includes intermediate goods arising from any treatment or process carried out on the inputs by the principal or the job worker.

Proposed by finance bill 2024 –

( No refund shall be made of all the tax paid or the input tax credit reversed, which would not have been so paid, or not reversed, had section 114 been in force at all material times. )

Prem

Prem

designer

Adilabad, India

gst taxation