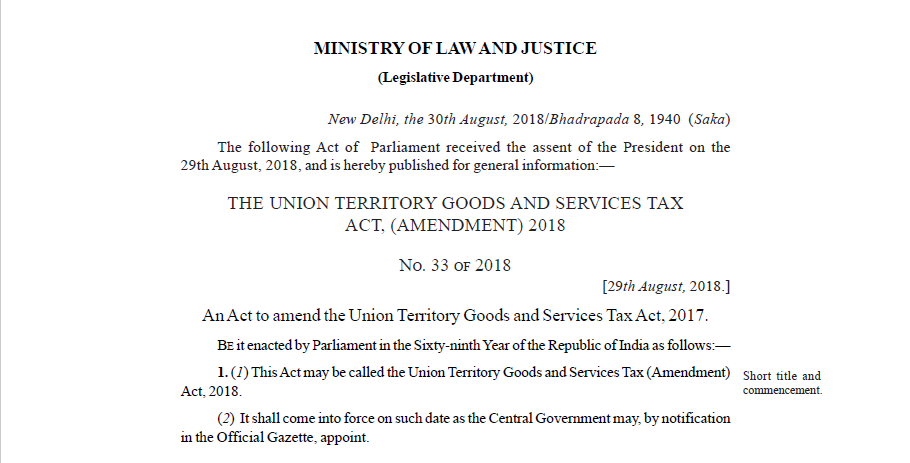

Union Territory Goods and Services Tax (Amendment) Act, 2018

The Union Territory Goods and Services Tax (Amendment) Act, 2018

Union Territory Goods and Services Tax (Amendment) Act, 2018 was pus published in The Gazette of India. The Union Territory Goods and Services Tax (Amendment) Act, 2018 of Parliament received the assent of the President on the 29th August 2018. After the assent, the act was published for the public.

The text of the Act:

1. (1) This Act may be called the Union Territory Goods and Services Tax (Amendment) Act, 2018.

(2) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint.

2. In section 7 of the Union Territory Goods and Services Tax Act, 2017 (hereinafter referred to as the principal Act), for sub-section (4), the following sub-section shall be substituted, namely:––

“(4) The Government may, on the recommendations of the Council, by notification, specify a class of registered persons who shall, in respect of supply of specified categories of goods or services or both received from an unregistered supplier, pay the tax on reverse charge basis as the recipient of such supply of goods or services or both, and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to such supply of goods or services or both.”.

3. In section 9 of the principal Act, in clause (b), the following proviso shall be inserted, namely:––

“Provided that the input tax credit on account of Union territory tax shall be utilized towards payment of integrated tax only where the balance of the input tax credit on account of central tax is not available for payment of integrated tax.”.

4. After section 9 of the principal Act, the following sections shall be inserted, namely:—

“9A. Notwithstanding anything contained in section 9, the input tax credit on account of Union territory tax shall be utilized towards payment of integrated tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilized towards such payment.

9B. Notwithstanding anything contained in this Chapter and subject to the provisions of clause (c) of section 9, the Government may, on the recommendations of the Council, prescribe the order and manner of utilisation of the input tax credit on account of integrated tax, Central tax, State tax or Union territory tax, as the case may be, towards payment of any such tax.”.

Download the full UTGST(Amendment) Act, 2018 by clicking the below image:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.