Updated Due Dates Chart

Table of Contents

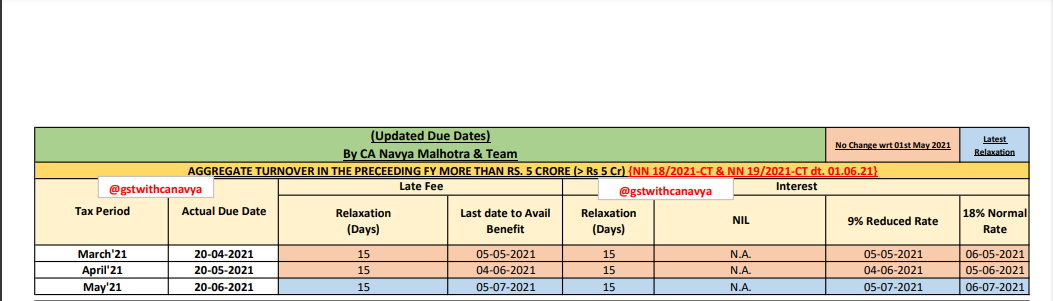

- Aggregate Turnover In The Preceding Fy More Than Rs. 5 Crore (> Rs 5 Cr) {NN 18/2021-CT & NN 19/2021-CT Dt. 01.06.21}

- Aggregate Turnover In The Preceding FY up to Rs. 5 Crore (Filling Monthly GSTR 3B) {NN 18/2021-CT & NN 19/2021-CT Dt. 01.06.21}

- Aggregate Turnover In The Preceding FY Upto Rs. 5 CRORE (Filling Quarterly GSTR 3B i.e. Opted QRMP) {NN 18/2021-CT & NN 19/2021-CT dt. 01.06.21}

- PMT-06 {NN 18/2021-CT & NN 19/2021-CT dt. 01.06.21}

Aggregate Turnover In The Preceding Fy More Than Rs. 5 Crore (> Rs 5 Cr) {NN 18/2021-CT & NN 19/2021-CT Dt. 01.06.21}

| Tax Period | Actual Due Date | Late Fee | Interest | ||||

| Relaxation (Days) | Last date to Avail Benefit | Relaxation (Days) | NIL | 9% Reduced Rate | 18% Normal Rate | ||

| March’21 | 20-04-2021 | 15 | 05-05-2021 | 15 | N.A. | 05-05-2021 | 06-05-2021 |

| April’21 | 20-05-2021 | 15 | 04-06-2021 | 15 | N.A. | 04-06-2021 | 05-06-2021 |

| May’21 | 20-06-2021 | 15 | 05-07-2021 | 15 | N.A. | 05-07-2021 | 06-07-2021 |

Aggregate Turnover In The Preceding FY up to Rs. 5 Crore (Filling Monthly GSTR 3B) {NN 18/2021-CT & NN 19/2021-CT Dt. 01.06.21}

| Tax Period | Actual Due Date | Late Fee | Interest | ||||

| Relaxation (Days) | Last date to Avail Benefit | Relaxation (Days) | NIL | 9% Reduced Rate | 18% Normal Rate | ||

| March’21 | 20-04-2021 | 60 | 19-06-2021 | 60 | 05-05-2021 | 19-06-2021 | 20-06-2021 |

| April’21 | 20-05-2021 | 45 | 04-07-2021 | 45 | 04-06-2021 | 04-07-2021 | 05-07-2021 |

| May’21 | 20-06-2021 | 30 | 20-07-2021 | 30 | 05-07-2021 | 20-07-2021 | 21-07-2021 |

Aggregate Turnover In The Preceding FY Upto Rs. 5 CRORE (Filling Quarterly GSTR 3B i.e. Opted QRMP) {NN 18/2021-CT & NN 19/2021-CT dt. 01.06.21}

| Tax Period | Actual Due Date | Late Fee | Interest | ||||

| Relaxation (Days) | Last date to Avail Benefit | Relaxation (Days) | NIL | 9% Reduced Rate | 18% Normal Rate | ||

| Jan – Mar’21 (Cat-I) | 22-04-2021 | 60 | 21-06-2021 | 60 | 07-05-2021 | 21-06-2021 | 22-06-2021 |

| Jan – Mar’21 (Cat-II) | 24-04-2021 | 60 | 23-06-2021 | 60 | 09-05-2021 | 23-06-2021 | 24-06-2021 |

| Tax Period | Form | Due Date | NIL Interest | Interest 9% |

| Quarter Ending Mar’21 | CMP-08 | 18-04-2021 | 03-05-2021 | 17-06-2021 |

| Tax Period | Form | Due Date | Extended Date | |

| FY 2020-21 | GSTR-04 | 30th April’21 | 31st July’21 | NN 25/2021-CT |

| Jan-March’21 | ITC-04 | 25h April’21 | 30th June 21 | NN 26/2021-CT |

| April’21 | GSTR 1 | 11th May’21 | 26th May’21 | – |

| April’21 | IFF | 1st -13th May’21 | 1st to 28th May’21 | – |

| May’21 | GSTR 1 | 11th June’21 | 26th June 21 | NN 17/2021-CT |

| May’21 | IFF | 1 st -13th June’21 | 1 st to 28th June 21 | NN 27/2021-CT |

| Tax Period | Amendment in GST Rules | |||

| April’21, May’21 & June.21

{NN 27/2021-CT} |

Condition of Rule 36(4) shall apply cumulatively for April’21, May’21 & June;21. GSTR-3B for June’21 shall be furnished with the cumulative adjustment of ITC. | |||

[Wherever the timelines for actions have been extended by the Hon’ble Supreme Court, the same would apply]

| Tax Period | Due dates falling | Extended Due date | |

| The time limit for completion/compliance, by any authority or person | 15th April – 29th June’21 | 30th June 2021 | NN 24/2021-CT |

| The time limit for rule 9 (i.e. Verification & approval for Registration) | 1st May – 30th June’21 | 15th July’21 | NN 24/2021-CT |

| Time limit for issue of refund order in terms of the Sec 54(5)/(7) | 15th April – 29th June’21 | 15 days after the receipt of the reply to the notice from the registered person or the 30th June 2021, whichever is later. | NN 24/2021-CT |

PMT-06 {NN 18/2021-CT & NN 19/2021-CT dt. 01.06.21}

| Tax Period | Due Date | Next 15 Days | Next 30 Days | Thereafter |

| Apr-21 | 25-05-2021 | 09-06-2021 | 09-07-2021 | – |

| Interest | Nil | Nil | 9% | 18% |

| Late Fees | Nil | Nil | Nil | Fees Applicable |

| Tax Period | Due Date | Next 15 Days | Next 30 Days | Thereafter |

| May-21 | 25-06-2021 | 10-07-2021 | 25-07-2021 | – |

| Interest | Nil | Nil | 9% | 18% |

| Late Fees | Nil | Nil | Nil | Fees Applicable |

| Relief to small taxpayers in filing annual return and reconciliation statement for FY 2020-21 | The author remarks:

1. No Clarity as to what is “NIL Tax Liability”? 2. No Clarity for the assessee who have paid the late fee already at higher rates? |

Late Fee Rationalisation (Prospectively) {NN19/2021-CT} GSTR 3B and GSTR 1 {NN20/2021-CT} | ||||

| FORM | Turnover limits | Optional / Mandatory | S.No. | Tax Liability | Late Fees | |

| Annual return (GSTR-9/9A | Aggregate turnover <= Rs.2 crore | Optional | 1 | For taxpayers having NIL tax liability or No Outward Supplies | Rs 500 (Rs 250 CGST + Rs 250 SGST) | |

| Reconciliation (GSTR-9C) | Aggregate turnover > Rs.5 crore | Compulsory (Self Certification) | 2 | For taxpayers having Annual Aggregate Turnover (AATO) in preceding year up to Rs 1.5 crore | Rs 2000 (1000 CGST+1000 SGST) | |

| State Category I:- Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and the Nicobar Islands or Lakshadweep.

State Category II:- Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi |

3 | For taxpayers having AATO in the preceding year between Rs 1.5 crore to Rs 5 crore | Rs 5000 (2500 CGST+2500 SGST) | |||

| 4 | For taxpayers having AATO in preceding year above Rs 5 crores | Rs 10000 (5000 CGST+5000 SGST) | ||||

| FORM GSTR-4 | {NN21/2021-CT} | |||||

| 5 | For taxpayers having NIL tax liability | Rs 500 (Rs 250 CGST + Rs 250 SGST) per return | ||||

| For other taxpayers | Rs 2000 (Rs 1000 CGST + Rs 1000 SGST) return | |||||

| 6 | FORM GSTR-7 {NN22/2021-CT} | Rs 2000/- (Rs. 1,000 CGST + Rs 1,000 SGST) per return | ||||

Disclaimer: The use of the information is the sole discretion of the user. The chart prepared above is subject to changes without prior information to the users. Since the information is based on interpretation and analysis, there may be another view(s) possible. The author or his team shall not responsible for any of the use of the information above. The author’s permission is required to copy/ republish/retransmit the information in any form.

CA Navya Malhotra

CA Navya Malhotra