Uploading supporting documents with the GST refund application

Table of Contents

- Introduction:

- Tips for Scanning Documents and Reducing File Size for uploading supporting documents with the GST refund application

- What is a document?

- Is there a limit on number of invoices, credit/debit notes etc. in a scanned document?

- How can multiple invoices/ debit/ credit notes be included in one document?

- How to find size of your document?

- How to scan the document at a lower resolution?

- How to save the file as a PDF and reduce the file size

Introduction:

As we are aware that a new refund module is live on GSTN portal from 26-10-2019. Now all refund applications will be filed online on GSTN portal. We need to upload all documents with the GST refund application online. This is a challenge and many taxpayers were facing issues. This advisory is issued by GSTIN for uploading the documents with the GST refund application.

Tips for Scanning Documents and Reducing File Size for uploading supporting documents with the GST refund application

Taxpayers are expected to upload the supporting documents while filing their refund application (Form GST RFD-01). The GST Common Portal allows taxpayers to upload 4 documents up to 5 MB each (total 20 MB).

What is a document?

The document here does not mean one invoice or one credit/debit note but a set of invoices or credit/debit notes scanned together so that the size of scanned document containing them is less than or equal to 5 MB.

Is there a limit on number of invoices, credit/debit notes etc. in a scanned document?

There is no limit to the number of invoices/credit notes etc. You can scan and upload, till size of the scanned document containing multiple pages is less than or equal to 5 MB.

How can multiple invoices/ debit/ credit notes be included in one document?

Some scanners can scan multiple documents and convert the images into a single pdf document. Whereas some scanners allow only one scan at a time. For such scanners, the taxpayers can scan the invoices/ debit/ credit notes, insert them sequentially in one word document and save the word document in PDF format. It is advised that the size of the scanned invoices/ debit/ credit notes be kept low.

How to find size of your document?

To find out the size of your scan/ document, right-click on the thumbnail of your scan in the Document Viewer and select “Properties.” Look for the number beside “File Size.” If your scan is too large (larger than 5MB), try one or more of the following to reduce the file size. How to scan the document to a lower quality file type: 1. When the window “Scanning From The Scan Picture/Document/Film” opens, select your preferred File Type like jpeg, pdf, png, tiff etc. PDF files are small in size

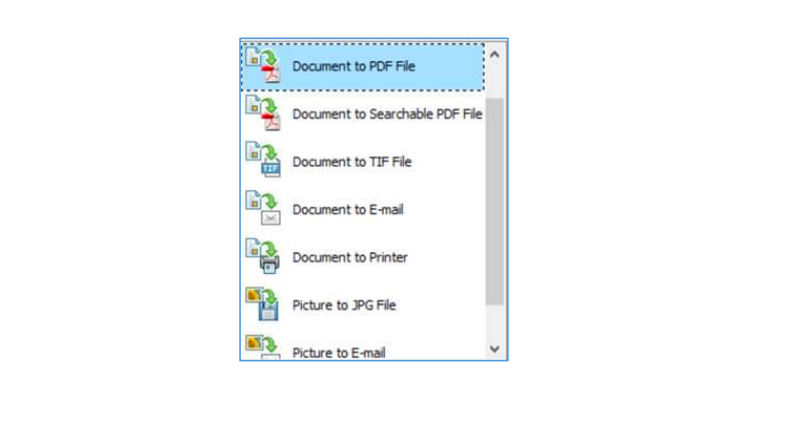

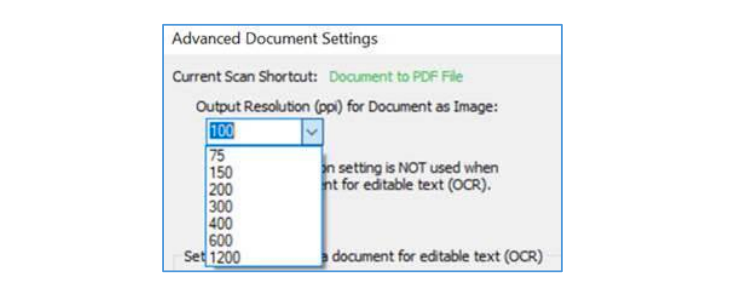

How to scan the document at a lower resolution?

1. When the window “Scanning From the Scan Picture/Document/Film” opens, click “Scan Document Settings.” 2. Adjust the number of the Resolution (dpi). We recommend a resolution of 100 dpi. Scanning in Line Art scan mode or Grayscale scan mode will also result in a lower resolution document. 3. Select “online publishing” option when saving as PDF since this will reduce the file size.

How to save the file as a PDF and reduce the file size

1. Open your scan (pdf)

2. Choose < “Advanced” > PDF Optimizer

3. Click on “OK” then name and save the file

4. The file size will automatically be reduced when saved

Please note, if the file size is already as small as possible, this command has no effect. Can mobile based scanning apps be used for scanning the invoices/ debit/ credit notes. Mobile phone based scanning apps like ‘Cam Scanner’ can also be used for scanning the invoices/ debit/ credit notes. The taxpayers can easily scan multiple invoices/ debit/ credit notes through such mobile applications and get the output in a consolidated PDF which can be uploaded with the refund application.

Notes:

If one uses 100 DPI in setting of scanner, an A-4 size paper can be scanned with 100 KB size and thus more than 50 A-4 documents can be scanned in one pdf document.

To facilitate scanning multi-page documents, we recommend using a scanner that can automatically scan multiple pages and save them as a single PDF file.

Order the supporting document by importance and relevance

In case of any doubt, please call our Helpdesk which can guide you on how to scan and upload multiple documents.

Thus you can file refund application easily with this advisory.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.