Uttar Pradesh AAAR In M/s Ion Trading India Pvt Ltd

Case Covered:

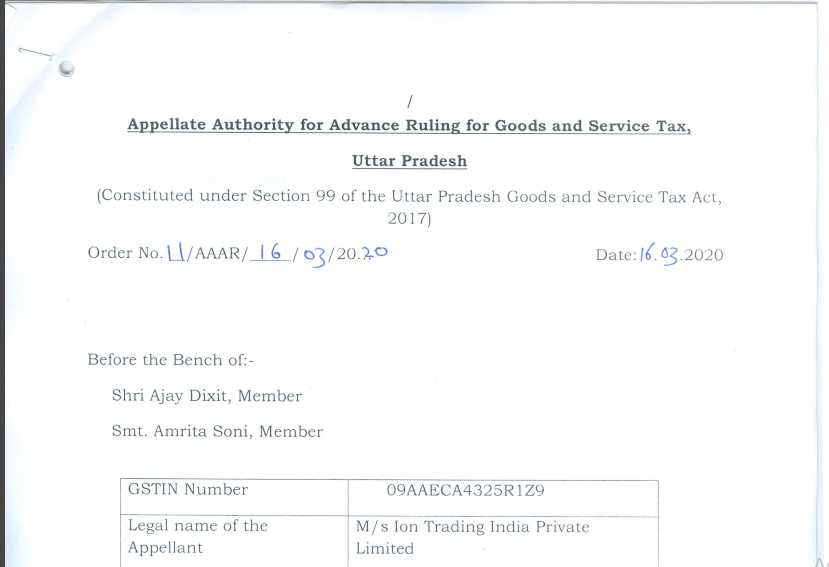

M/s Ion Trading India Pvt Ltd

Facts of the Case:

M/s ION Trading India Private Limited, Building No. 2, Infospace, 4-6th Floor, Block-B, Plot-2, Sector-62, Noida, Uttar Pradesh (here in after called the appellant) is a registered assessee under GST having GSTN: 09AAECA4325R1Z9.

The appellant is a private limited company, a wholly-owned subsidiary of M/s ION Trading UK Limited, and engaged in the business of software development which is exported to an overseas company. The appellant entered into a rent agreement with M/s Shantiniketan Properties Private Limited (Building Authority in short) for renting office premises including a certain number of free car parking spaces and a certain number of parking spaces on payment of agreed rent per parking space per month. As the aforesaid car parking spaces were not sufficient, and the employees are in need of more parking spaces, the appellant facilitates procurement of car parking spaces from the Building Authority and procures it on payment of agreed lease charges per car parking space per month.

The appellant bears part of the lease charges and the balance amount is equally recovered from all the employees using the parking space for four-wheeler parking or for two-wheeler parking. The appellant does not claim an input tax credit of the lease charges paid to the Building Authority. These lease charges are paid in advance on a monthly basis along with Goods and Service Tax Leviable thereon.

Related Topic:

Uttar Pradesh AAR in the case of M/s. Dwarikesh Sugar Industries Limited

Ruling:

Q 1- Whether the amount recovered from the employees towards the car parking charge payable to Shantiniketan properties private limited (building authorities), would be deemed as “Supply of Service” by the applicant to its employees?

Ans:- The question is answered in the affirmative.

Q2- If the first question is answered in the affirmative, whether the value of aforesaid supply would be NIL, being provided in the capacity of a “Pure Agent”? If the valuation is not accepted as NIL, what would be the value of such a supply?

Ans:- Value of the Supply would be nil, subject to the fulfillment of the conditions prescribed for a pure agent by the appellant.

Q3- If GST is payable on such amount recovered from the employees, whether the GST paid by the applicant to building authorities towards car parking charges would be admissible as an input tax credit against the supply of car parking services to employees?

Ans:- As the second question is answered in negative hence the question becomes redundant.

Read & Download the Full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.