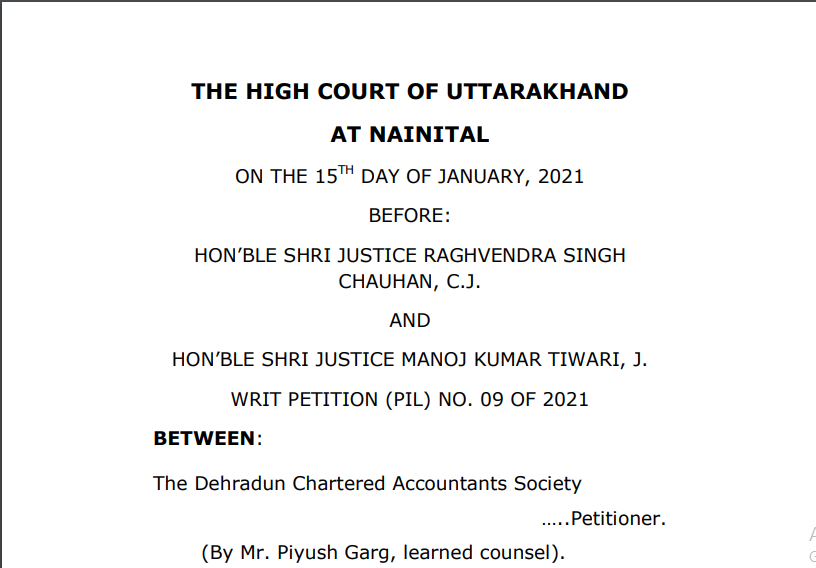

Uttarakhand HC in the case of The Dehradun Chartered Accountants Society Versus Union of India

Table of Contents

Case Covered:

The Dehradun Chartered Accountants Society

Versus

Union of India

Facts of the Case:

The Dehradun Chartered Accountants Society, the petitioner, has filed this Public Interest Litigation (PIL) with the following prayer:-

“(i) Issue a writ, order or direction in the nature of mandamus, directing the respondent no.1 and/or 2 to extend the due date of filing the Tax Audit Report and Income Tax Return for the assessment year 2021-21, both for tax audit assessee and for non-tax audit assessee for a reasonable time, at least till March 31, 2021”.

Observations:

In rejoinder, Mr. Piyush Garg, the learned counsel for the petitioner, submits that in the last para of the said judgment, the Hon’ble High Court of Gujarat has directed the Central Board of Direct Taxes (‘the CBDT’ for short) “to consider issuing an appropriate circular taking a lenient view as regards the consequences of late filing of the Tax Audit Reports as provided under Section 271B of the Income Tax Act (‘the Act’ for short)”. Moreover, the learned counsel for the petitioner submits that, while the said judgment is limited only to the consequences which would flow from Section 271B of the Act, there are other provisions that equally have consequences flowing in case the Income Tax Returns are not filed on time and, in case, the required steps are not taken by the Income Tax Assessee. Therefore, he prays that this Court should pass a similar order directing the CBDT to issue an appropriate circular while taking into account the said provisions of the Act. Thus, he seeks an opportunity to file a fresh representation before the CBDT and prays that the CBDT should be directed to consider the fresh representation, wherein the grievances of the petitioner would be voiced.

The Decision of the Court:

Admittedly, the country continues to suffer and to reel under the COVID-19 pandemic. A large number of assesses still find it difficult to even meet their Chartered Accountants and to file their Income Tax Audit Reports and the Income Tax Returns. Therefore, this Court permits the petitioner to submit a fresh representation, voicing all their grievances, with regard to the consequences which would flow from different provisions of the Act. The CBDT is directed to leniently consider the said representation after giving an opportunity of hearing to the petitioner and to pass a reasoned order thereupon.

With the above observations, the petition stands disposed of.

Let a certified copy of this order be issued to the learned counsel for the parties, today itself, on payment of the prescribed charges.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.