Validity of E-way bills further extended

The validity of E-way bills issues during COVID period:

The validity of E-way bills issued under the following dates is extended till 30th June 2020.

- The E-way bill was issued on or before 24th March 2020.

- Its validity was expired before 20th March 2020.

This amendment is made due to COVID 19 lockdown. Many vehicles couldn’t take off due to lockdown. Here mentioning of two other earlier notifications is important.

E-way bills are mandatory for the movement of goods. Rule 138 of CGST rules provide for E-way bills.

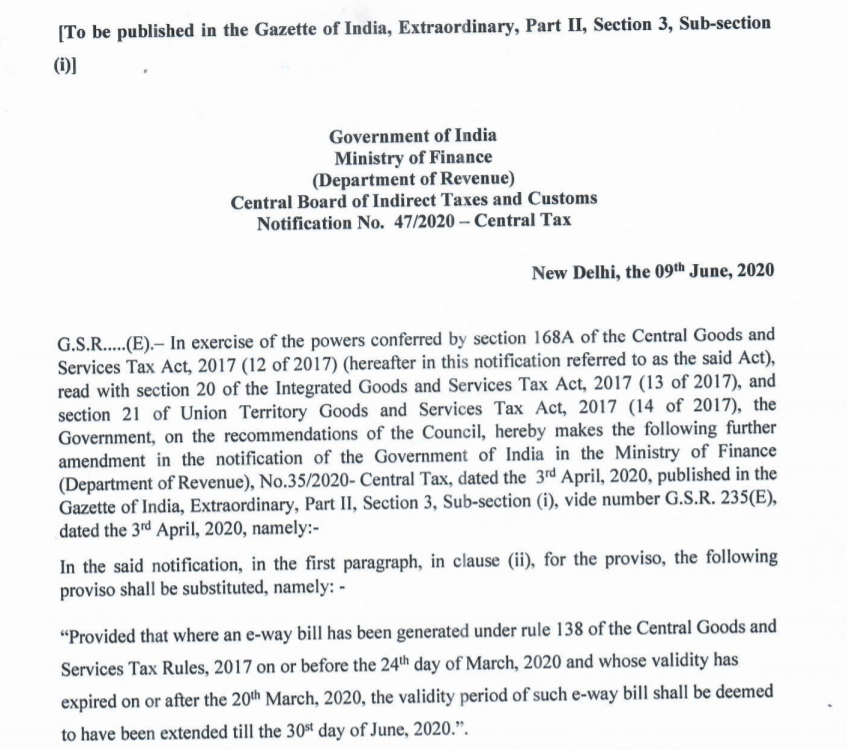

- Notification no. 35/2020 dated 3rd April 2020: Seeks to extend due date of compliance which falls during the period from “20.03.2020 to 29.06.2020” till 30.06.2020 and to extend the validity of e-way bills. It was first notification Ito extend the validity till 30th April 2020. It is for E-way bills issued from 20th March to 15th April 2020.

- Notification no 40/2020 dated 5th May 2020: Seeks to extend the validity of e-way bills till 31.05.2020 for those e-way bills which expire during the period from 20.03.2020 to 15.04.2020 and generated till 24.03.2020.

- But now the validity is extended till 30th June 2020.

Read the Original Notification no. 47/2020 CT dated 9th June 2020

notfctn-47-central-tax-english-2020 Consultease

It is important to see those old notifications also.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.