Waiver of GSTR 3b late fees: Conditions apply

Table of Contents

What GST council recommended for the Waiver of GSTR 3b late fees

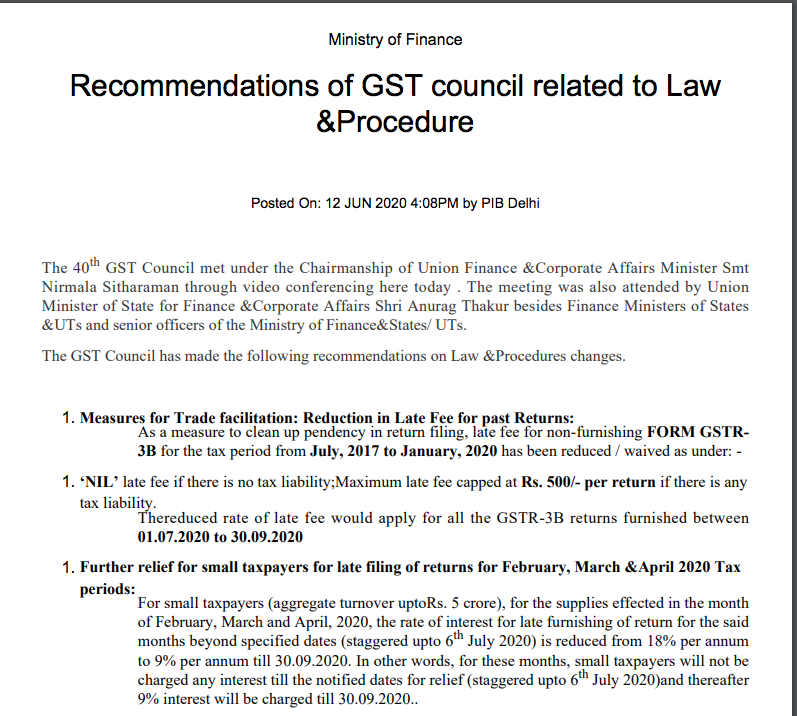

GST council agreed for a waiver of GSTR 3b late fees. Today GST council recommended for relief from GSTR 3b late fees. It is a long issue. Many taxpayers were aggrieved from the huge bundle of late fees on GSTR 3b. Last week it was decided to take up this issue in the current meeting of the GST council. There is a waiver but conditional. We need to look into it in detail to understand it properly. Following is the proposed structure of late fees:

- If the tax payable in the return is NIL then no late fee.

- If the tax payable if more than Zero than late fees is capped at Rs. 500 per month.

What period is covered for Waiver of GSTR 3b late fees?

The period covered for the waiver of late fee is from July 2017 to January 2020. You can file any return between this period.

Conditions to avail the Waiver of GSTR 3b late fees

The condition to avail of this waiver is that return should be filed from 1st July 2020 to 30th September 2020. Also, the return should be NIL. No tax payable should be there in return. If any tax is payable then it will be liable to late fees. Although the late fees are restricted to Rs. 500 (Aggregate amount). At present, the late fee is leviable @50 Rs. per day up to Rs. 10000 for return where tax is payable. In the case of NIL returns late fees are Rs. 20 per day which can go up to Rs. 10000 again. But now it is restricted to Nil & Rs. 500.

This Rs. 500 is for each month. Thus if your return is pending for 5 months. It can be leviable to a fee of Rs. 2500. (if the tax payable is there)

Can I get the refund of my GSTR 3b late fees already paid?

Unfortunately, the refund of tax already paid by the taxpayer will not be refunded. The waiver is only for the returns to be filed from 1st July 2020 to 30th September 2020. This is a hardship but that’s the real situation.

A taxpayer who already filed the return with a late fee has no respite.

Read the original press release:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.