No extension in due date: 31/2020

No extension in due date: Notification 31/2020

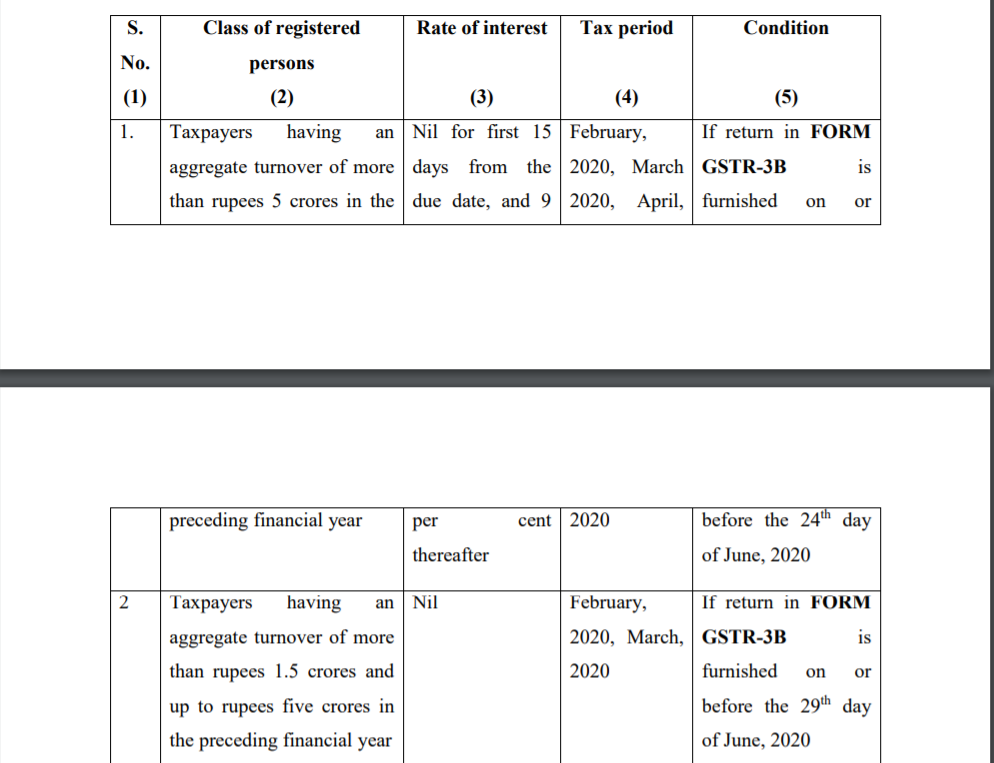

A reading of this notification is converted by many readers as an extension of the due date. But in reality, it is not an extension of the due date. The liability of interest is reduced/waived off in some of the cases. A careful reading of this notification is required.

| S. No. (1) | Class of registered persons (2) | Rate of interest (3) | Tax period (4) | Condition (5) |

| 1. | Taxpayers having an aggregate turnover of more than rupees 5 crores in the preceding financial year. | Nil for first 15 days from the due date, and 9 per cent thereafter | February, 2020, March 2020, April, 2020 | If return in FORM GSTR-3B is furnished on or before the 24th day of June, 2020 |

| 2. | Taxpayers having an aggregate turnover of more than rupees 1.5 crores and up to rupees five crores in the preceding financial year | NIL |

February, 2020, March, 2020

|

If return in FORM GSTR-3B is furnished on or before the 29th day of June, 2020 |

| April, 2020 | If return in FORM GSTR-3B is furnished on or before the 30th day of June, 2020 | |||

| 3. | Taxpayers having an aggregate turnover of up to rupees 1.5 crores in the preceding financial year | NIL | February, 2020 | If return in FORM GSTR-3B is furnished on or before the 30th day of June, 2020 |

| March, 2020 | If return in FORM GSTR-3B is furnished on or before the 3 rd day of July, 2020 | |||

| April, 2020 | If return in FORM GSTR-3B is furnished on or before the 6 th day of July, 2020.”. |

Download the full notification:

notfctn-31-central-tax-english-2020

Is this an extension of the due date?

First of all this notification is issued under section 50(1) which belongs to interest. It is not for the extension of due dates but for a waiver of interest. If the returns are not filed until the date prescribed in this notification. The taxpayer will be liable for full interest from the actual due date till the date of payment.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.