Whether Interest is payable for delay in filing of returns, if yes on net or gross?

Table of Contents

- Whether Interest is payable for delay in filing of returns? If interest is payable whether it should be on a gross basis or on a net basis?

- 1. Computation and deposit of interest

- 2. Interest is not payable:

- 2.1 Absence of Methodology:

- 2.2. Whether delay in filing of GSTR-3B can be the basis of calculation of interest:

- Download the copy:

Whether Interest is payable for delay in filing of returns? If interest is payable whether it should be on a gross basis or on a net basis?

Nowadays Revenue Authorities are issuing notices for collection of Interest u/s 50(1) on the gross amount of Tax. This is resulting in heavy demand though a major portion of the tax payment may have been done through ITC. There may be various grounds for not paying interest as demanded by notices. We have tried to compile the grounds and way to represent the case in the form of a letter, before authorities. Following are the few points for consideration:

1. Computation and deposit of interest

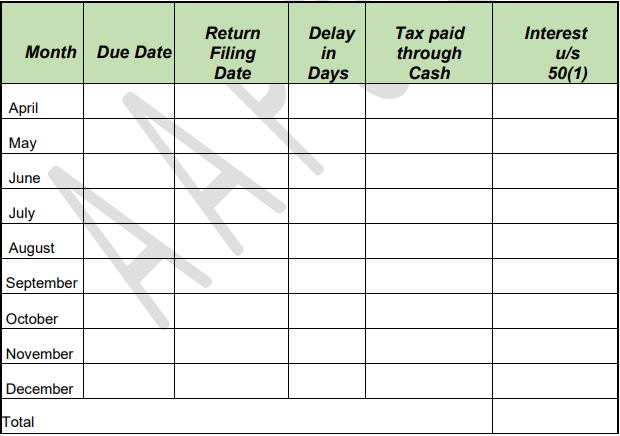

The liability of interest (if any) works out to Rs. __________________ as per the computation provided herein below:

Financial Year:

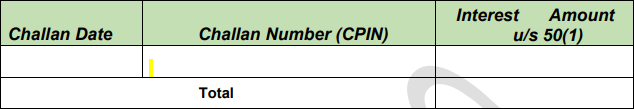

The above interest has already been deposited sue moto as per below given Challan details:

Financial Year:

Copy of Payment Challans is enclosed herewith as Annexure A.

Or

In case details of interest are not available in notice than the first calculation and details of interest should be asked from the dept.

2. Interest is not payable:

Being legal abide assessee, we have deposited sue-moto the interest as referred supra. In our considered view in the first instance, interest is not payable at all due to a delay in filing of GSTR 3B. Following are the grounds of our understanding:

2.1 Absence of Methodology:

Sec.50(2) of the CGST Act provides:

“The interest under sub-section (1) shall be calculated, in such manner as may be prescribed, from the day succeeding the day on which such tax was due to be paid.”

In terms of Sec.50(2), the method for calculation will be prescribed.

As per Sec.2(87) “prescribed” means prescribed by rules made under this Act on the recommendations of the Council.

We humbly submit that to date no such rules have been formulated to prescribe the manner for calculation the interest u/s. 50 (1) and in absence of methodology to calculate, interest cannot be charged. The same view is also supported by the following case laws:

• Apex Court decisions in Govind Saran Ganga Saran v. CST ( GIB/WB/GOVIND SARAN/26-04-1985/SC-3 )

• CIT v. B.C. Srinivasa Shetty (GIB/KN/B.C. SRINIVASA/19-02-1981/SC-5) &

• Suresh Kumar Bansal Vs. Union of India [GIB/DL/SURESH BANSAL/03-06- 2016/HC-48]

There is a failure to prescribe the method of calculation of interest by way of the suitable rule as mandated by section 50(2). Therefore, the demand of interest is not in accordance with Sec.50(2) in the absence of any rule for determination of interest.

2.2. Whether delay in filing of GSTR-3B can be the basis of calculation of interest:

We humbly submit GSTR-3B has been notified return under rule 61(5) retrospectively w.e.f 01-07-2017 vide Notification No.49/2019 CT Dated 09-10-2019.

Download the copy:

Ashu Dalmia

Ashu Dalmia

New Delhi, India

Ashu Dalmia is Managing Partner of the firm AAP and Co., having office in Connaught Place Delhi. He is rank holder in CA Inter and also at graduation level from Lucknow university. He is has been working extensively in GST training, Consultancy and litigation in India and also handled VAT implementation projects for mid and large corporates in Saudi Arabia. He was special Invitee to Indirect Tax Committee of ICAI for year 2018-19. He is faculty in ICAI to train professionals for GST in India and VAT for UAE. He has authored books on GST: “GST A Practical Approach” published by Taxman, “Audit and Annual Return in GST” published by Wolters Kluwer-CCH GST Referencer and Manual published by LMP. He has taken more than 300 workshops and trainings on various forums: like ICAI, ASSOCHAM, CII, PHD Chamber of commerce, trade associations in India, UAE and KSA.