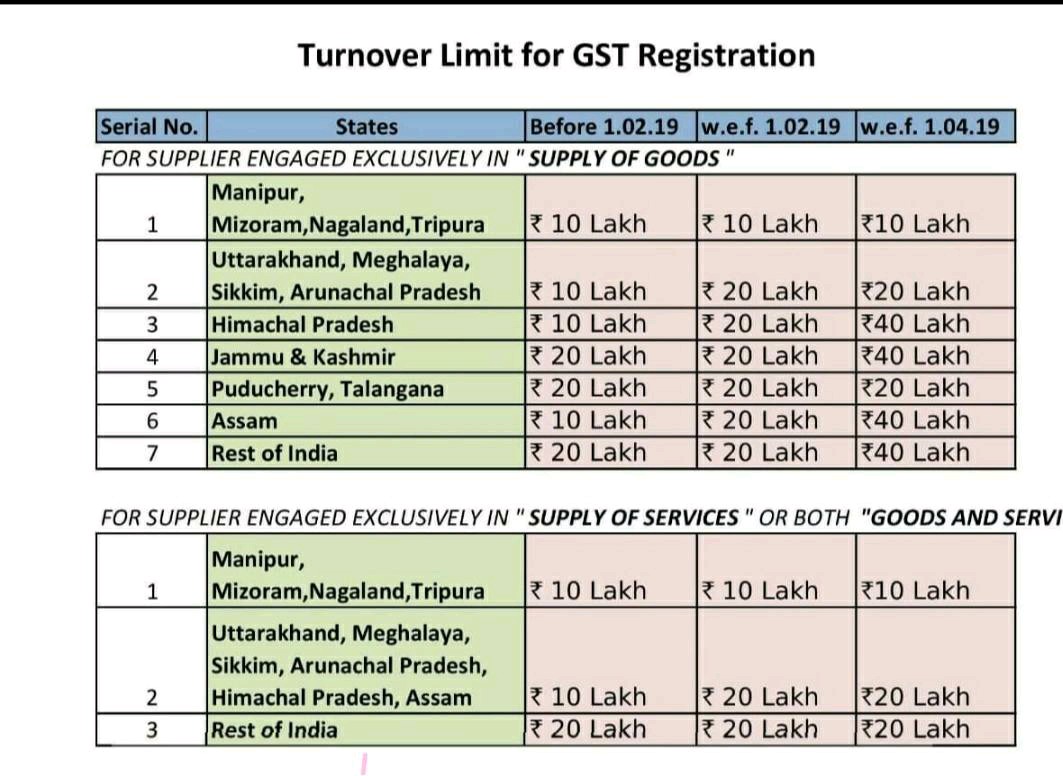

List for state-wise threshold for registration in GST

List for turnover limit for state-wise threshold for registration:

state-wise threshold for registration in GST. It is different for various states and taxpayers in the same state. The normal threshold is Rs. 20lac only. In this 20 lac, the following will be included. This is an aggregate turnover of GST.

- Interstate supply

- Intrastate supply

- Supply of alcoholic liquor for human consumption

- Exempted supply

- Zero-rated supply

- Petroleum products supply

Now three threshold is there for registration in GST:

- 20 lac when in normal state

- 10 lac when in specified state

- 40 lac when only supplying goods + interest

Following is the list for statewise threshold.

I hope it is helpful for you. It’s a quick list to check the threshold for registration in GST. Please check your state notification before taking a decision. It may change time to time.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.