16 items a tax invoice in GST should have

16 items a tax invoice in GST should have

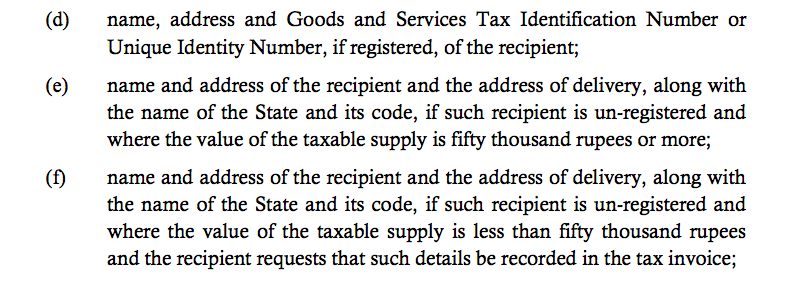

Rules for invoice are issued by the GSTIN. Format for a tax invoice in GST is also available here. Subject to rule 54, a tax invoice in GST referred to in section 31 shall be issued by the registered person containing the following particulars. In case you need to raise an invoice take care to include them.

(a) name, address and GSTIN of the supplier;

(b) a consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year;

(c) date of its issue;

(g) HSN code of goods or Accounting Code of services;

(h) description of goods or services;

(i) quantity in case of goods and unit or Unique Quantity Code thereof;

(j) total value of supply of goods or services or both;

(k) taxable value of supply of goods or services or both taking into account discount or abatement, if any;

(l) rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

(m) amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

(n) place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce;

(o) address of delivery where the same is different from the place of supply;

(p) whether the tax is payable on reverse charge basis; and

(q) signature or digital signature of the supplier or his authorized representative.

Importance:

In case of tax invoice in GST it is important to understand the items it should have. Supply without issue of an invoice is one of the offence attracting a penalty. Thus it is very important to change our format of invoice we are using in current regime.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.